Sale Tax Form St 330 2018

Understanding the Sale Tax Form ST-330

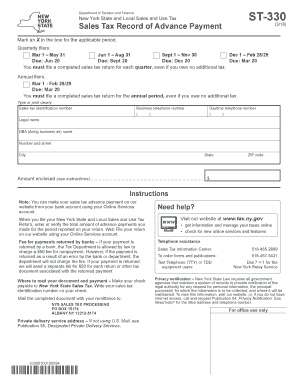

The Sale Tax Form ST-330 is a crucial document for businesses operating in New York State. This form is used to report sales tax collected from customers and is essential for compliance with state tax regulations. It helps businesses accurately calculate the amount of sales tax owed to the state, ensuring that they meet their tax obligations. The form is applicable to various types of sales transactions, making it a key component of financial reporting for businesses.

Steps to Complete the Sale Tax Form ST-330

Completing the Sale Tax Form ST-330 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary sales records and receipts for the reporting period.

- Calculate the total sales made during that period, including taxable and non-taxable sales.

- Determine the total amount of sales tax collected from customers.

- Complete the form by entering the total sales and sales tax amounts in the designated sections.

- Review the form for accuracy before submission.

Legal Use of the Sale Tax Form ST-330

The Sale Tax Form ST-330 is legally binding when filled out correctly and submitted on time. It must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. Compliance with these regulations ensures that the form is accepted by the state and can help avoid penalties for late or incorrect filings. Businesses should keep a copy of the submitted form for their records, as it may be required for future reference or audits.

Obtaining the Sale Tax Form ST-330

Businesses can obtain the Sale Tax Form ST-330 from the New York State Department of Taxation and Finance's official website. The form is available for download in a printable format, allowing businesses to fill it out by hand or electronically. Additionally, businesses may also request a physical copy through the mail if needed. It is important to ensure that the most current version of the form is used to comply with any recent changes in tax laws.

Filing Deadlines for the Sale Tax Form ST-330

Timely filing of the Sale Tax Form ST-330 is essential to avoid penalties. The form must be submitted according to the filing schedule established by the New York State Department of Taxation and Finance. Typically, businesses are required to file the form quarterly or annually, depending on their sales volume. It is advisable to mark the deadlines on a calendar to ensure compliance and maintain good standing with state tax authorities.

Key Elements of the Sale Tax Form ST-330

The Sale Tax Form ST-330 includes several key elements that businesses must complete accurately. These elements typically consist of:

- Business identification information, including name and address.

- Reporting period for the sales tax.

- Total sales amount and breakdown of taxable versus non-taxable sales.

- Total sales tax collected and owed.

- Signature of the authorized representative of the business.

Form Submission Methods for ST-330

The Sale Tax Form ST-330 can be submitted through various methods to accommodate different business needs. Options include:

- Online submission via the New York State Department of Taxation and Finance's e-file system.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at local tax offices, if necessary.

Quick guide on how to complete sale tax form st 330

Complete Sale Tax Form St 330 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Sale Tax Form St 330 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Sale Tax Form St 330 without stress

- Find Sale Tax Form St 330 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sale Tax Form St 330 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sale tax form st 330

Create this form in 5 minutes!

How to create an eSignature for the sale tax form st 330

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it facilitate ny sales payment?

airSlate SignNow is a versatile eSignature platform that simplifies the document signing process. With our solution, businesses can efficiently send and eSign documents related to ny sales payment, making transactions quicker and more secure.

-

How does airSlate SignNow help speed up ny sales payment processes?

By utilizing airSlate SignNow, businesses can streamline their ny sales payment processes, reducing turnaround time on contracts and agreements. Our platform enables instant notifications, allowing users to follow up promptly on pending signatures.

-

What pricing plans does airSlate SignNow offer for managing ny sales payment?

airSlate SignNow provides various pricing plans tailored to businesses of all sizes, ensuring affordability for managing ny sales payment. Each plan offers features that cater to different needs, allowing you to select the one that best fits your business model.

-

Are there specific features in airSlate SignNow that benefit ny sales payment?

Yes, airSlate SignNow includes features such as templates, customization options, and advanced tracking that enhance the management of ny sales payment. These tools help maintain accuracy and ensure compliance throughout your payment processes.

-

Can airSlate SignNow integrate with other tools to facilitate ny sales payment?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, providing a comprehensive solution for handling ny sales payment. This allows businesses to synchronize data across platforms and enhance their workflow efficiency.

-

What security measures does airSlate SignNow have for ny sales payment?

Security is a top priority at airSlate SignNow, especially for sensitive transactions like ny sales payment. Our platform employs encryption, multi-factor authentication, and secure storage to protect your documents and personal data.

-

Is airSlate SignNow suitable for businesses of all sizes when it comes to ny sales payment?

Yes, airSlate SignNow caters to businesses of all sizes, making it an ideal choice for handling ny sales payment. Whether you are a startup or a large enterprise, our solution adapts to your needs, providing flexibility and scalability.

Get more for Sale Tax Form St 330

Find out other Sale Tax Form St 330

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple