Bpt Ez Pa 2011-2026

What is the BPT EZ PA?

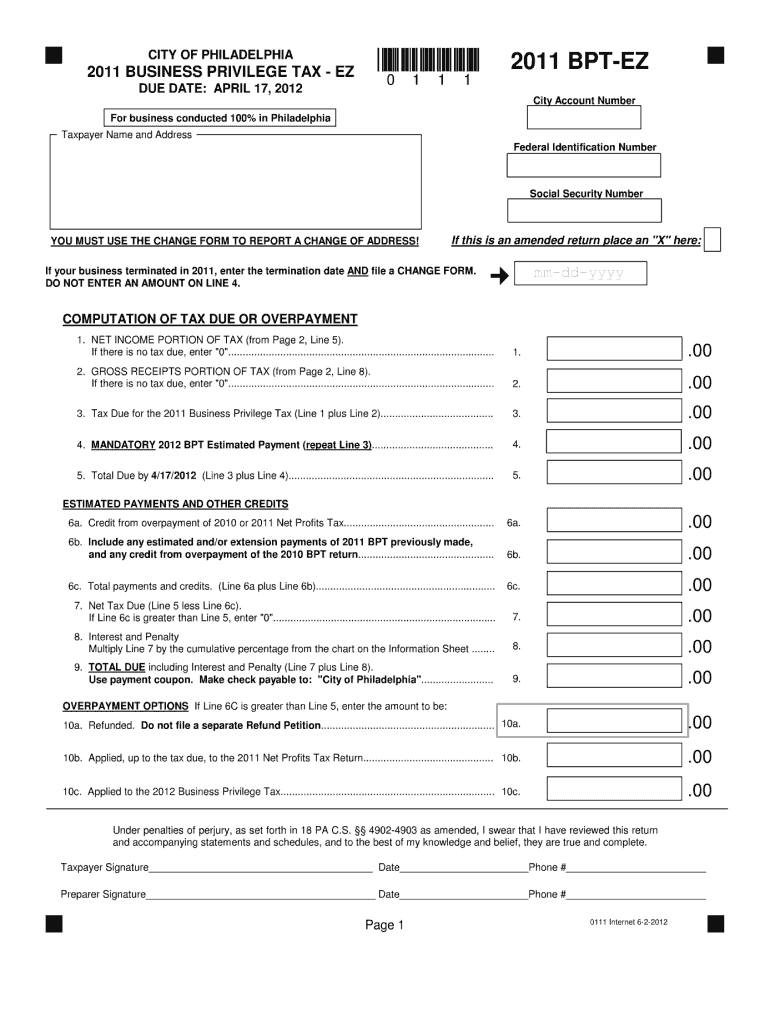

The BPT EZ PA, or Business Privilege Tax Easy Form, is a simplified tax form designed for businesses operating in Pennsylvania. This form allows eligible businesses to report their gross receipts and calculate their business privilege tax in a straightforward manner. It is particularly beneficial for small businesses and sole proprietors who may find more complex tax forms overwhelming. By using the BPT EZ PA, businesses can ensure compliance with local tax regulations while minimizing the time spent on tax preparation.

Steps to Complete the BPT EZ PA

Completing the BPT EZ PA involves several key steps to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather necessary information, including your business name, address, and federal employer identification number (EIN).

- Determine your gross receipts for the reporting period. This includes all income received from business activities.

- Fill out the BPT EZ PA form, entering your gross receipts and any applicable deductions.

- Calculate the total business privilege tax owed based on the provided tax rate.

- Review the form for accuracy, ensuring all information is complete and correct.

- Submit the completed form by the filing deadline, either online or by mail.

Required Documents

To complete the BPT EZ PA accurately, you will need several documents. These include:

- Your business's federal employer identification number (EIN).

- Records of gross receipts for the reporting period.

- Any previous tax returns or forms that may provide context for your current filing.

- Documentation of allowable deductions, if applicable.

Filing Deadlines / Important Dates

Timely filing of the BPT EZ PA is crucial to avoid penalties. Important dates to remember include:

- The annual filing deadline, typically set for March 15 of the following year.

- Quarterly estimated tax payment deadlines, which may vary based on your business structure.

Legal Use of the BPT EZ PA

The BPT EZ PA is legally recognized for businesses operating in Pennsylvania. To ensure its legal use, businesses must adhere to specific guidelines, including:

- Filing the form by the established deadlines.

- Providing accurate and truthful information regarding gross receipts and allowable deductions.

- Retaining copies of submitted forms and supporting documents for record-keeping and potential audits.

Who Issues the Form

The BPT EZ PA is issued by the local tax authority in Pennsylvania, typically the city or municipality where the business operates. It is essential for businesses to confirm they are using the correct form for their specific location, as different municipalities may have varying requirements and forms.

Quick guide on how to complete 2012 bpt ez pa

Effortlessly Prepare Bpt Ez Pa on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Bpt Ez Pa on any platform using the airSlate SignNow apps available for Android or iOS, and simplify your document-centric processes today.

The Easiest Way to Edit and Electronically Sign Bpt Ez Pa

- Find Bpt Ez Pa and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, taking mere seconds and holding the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or mistakes necessitating new printouts. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and eSign Bpt Ez Pa to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 bpt ez pa

Create this form in 5 minutes!

How to create an eSignature for the 2012 bpt ez pa

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

How can airSlate SignNow help with property tax documents?

airSlate SignNow streamlines the process of managing property tax documents by allowing users to easily send and eSign forms. This eliminates the hassle of printing, scanning, and sending physical documents. With our platform, you can ensure that all property tax submissions are quick, secure, and legally compliant.

-

What features does airSlate SignNow offer for property tax management?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage specifically for property tax documents. These tools enable users to manage their property tax workflows efficiently and reduce the risk of errors. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a free trial for airSlate SignNow related to property tax solutions?

Yes, airSlate SignNow offers a free trial that allows businesses to explore our property tax solutions without any commitment. During this trial, users can test all the features designed to simplify property tax management. This offers a great opportunity to see the benefits firsthand before making a purchase.

-

How does airSlate SignNow ensure security for property tax documents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive property tax documents. We use advanced encryption methods to protect data both in transit and at rest. Additionally, we comply with industry standards to ensure that your property tax information is safe and secure.

-

What integrations are available for managing property tax with airSlate SignNow?

airSlate SignNow integrates seamlessly with popular accounting and tax software to manage property tax documents efficiently. This integration allows for easy data transfer and reduces the manual input required for tax filings. Users can connect their existing tools to streamline property tax workflows effectively.

-

Can airSlate SignNow help with electronic signatures for property tax forms?

Absolutely! airSlate SignNow allows users to electronically sign property tax forms securely and legally. This feature is particularly beneficial for deadlines, as it facilitates quick approvals without the need for physical signatures, eliminating delays in property tax submissions.

-

What pricing plans does airSlate SignNow offer for property tax solutions?

airSlate SignNow offers various pricing plans designed to meet the needs of businesses managing property tax documents. These plans are tailored to different user requirements, ensuring that companies of all sizes can find a suitable option. Each plan includes features that facilitate efficient property tax management.

Get more for Bpt Ez Pa

- Sample letter to prosecutor to drop charges against my husband form

- Bppoku pindaan form

- Balcony inspection checklist form

- Dui certificate of completion form

- Boy scout service hours form

- The interior design handbook pdf download form

- Arizona residency documentation form

- Employee statement form 456251226

Find out other Bpt Ez Pa

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy