Denver Sales Tax Return Monthly Department of Finance Denvergov Form

What is the Denver Sales Tax Return Monthly?

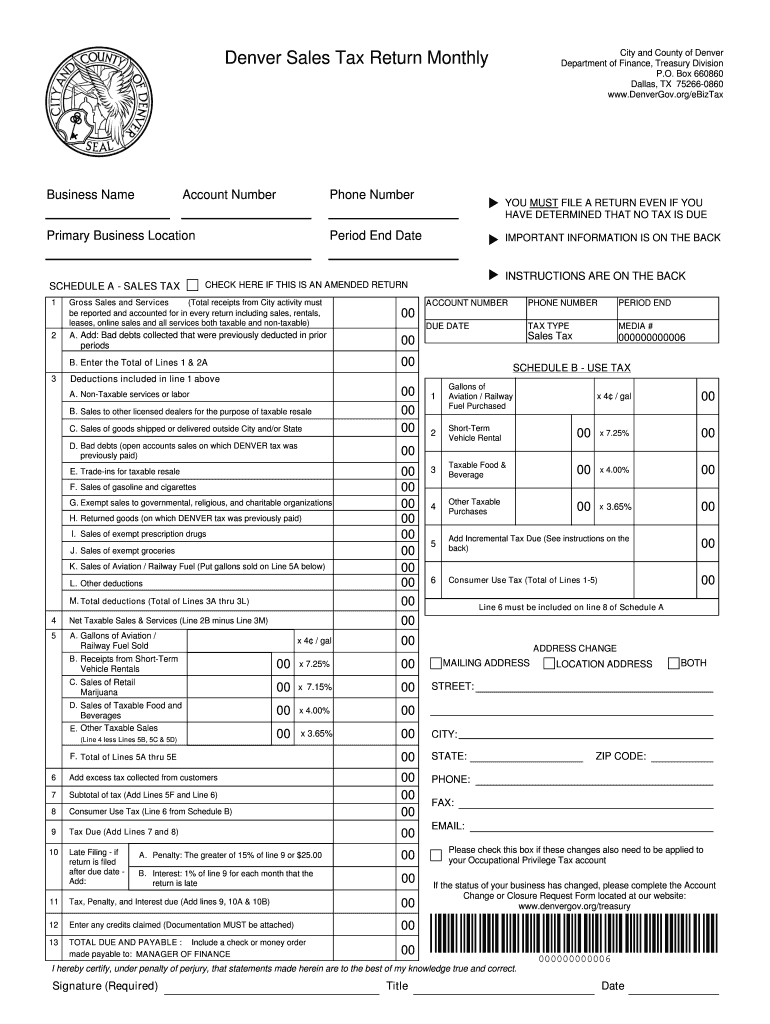

The Denver Sales Tax Return Monthly is a document required by the City and County of Denver for businesses that collect sales tax. This form enables businesses to report and remit sales tax collected during the month. It is essential for compliance with local tax regulations and helps ensure that the city receives the appropriate revenue to fund public services. Understanding this form is crucial for any business operating within Denver that is subject to sales tax obligations.

Steps to Complete the Denver Sales Tax Return Monthly

Completing the Denver Sales Tax Return Monthly involves several key steps:

- Gather necessary information, including total sales, exempt sales, and the amount of sales tax collected.

- Access the form, which can be downloaded in a fillable format for convenience.

- Fill out the required fields accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your chosen submission method.

Legal Use of the Denver Sales Tax Return Monthly

The Denver Sales Tax Return Monthly is legally binding when completed and submitted according to city regulations. Businesses must ensure that all information provided is truthful and accurate. Failure to comply with the requirements can lead to penalties or fines. Utilizing a reliable eSignature platform can enhance the legal validity of the form, ensuring that it meets all necessary electronic signature laws.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Denver Sales Tax Return Monthly. Typically, the form is due on the 20th of the month following the reporting period. For example, the return for sales made in January must be filed by February 20. Missing the deadline can result in late fees and interest on unpaid taxes, so timely submission is crucial for compliance.

Required Documents for Filing

When completing the Denver Sales Tax Return Monthly, businesses should have the following documents ready:

- Sales records for the reporting period.

- Invoices that detail sales transactions.

- Any documentation related to exempt sales.

- Previous sales tax returns for reference.

Form Submission Methods

Businesses have multiple options for submitting the Denver Sales Tax Return Monthly:

- Online submission through the Denver Department of Finance website, which allows for quick processing.

- Mailing a printed copy of the form to the designated address.

- In-person submission at the Department of Finance office, if preferred.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Denver Sales Tax Return Monthly can lead to significant penalties. These may include fines based on the amount of tax owed, interest on late payments, and potential legal action for repeated offenses. It is important for businesses to stay informed about their obligations to avoid these consequences.

Quick guide on how to complete denver sales tax return monthly department of finance denvergov

Effortlessly Prepare Denver Sales Tax Return Monthly Department Of Finance Denvergov on Any Device

Online document management has surged in popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage Denver Sales Tax Return Monthly Department Of Finance Denvergov on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Effortlessly Modify and eSign Denver Sales Tax Return Monthly Department Of Finance Denvergov

- Locate Denver Sales Tax Return Monthly Department Of Finance Denvergov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details thoroughly and click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Banish worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Denver Sales Tax Return Monthly Department Of Finance Denvergov to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the denver sales tax return monthly department of finance denvergov

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the denver sales tax form and why is it important?

The denver sales tax form is a document required by the City of Denver for reporting sales tax collected by businesses. Completing this form accurately is essential to comply with local tax regulations and avoid penalties. Using airSlate SignNow simplifies this process by allowing businesses to easily eSign and send completed forms.

-

How can I obtain the denver sales tax form using airSlate SignNow?

You can access the denver sales tax form by creating an account with airSlate SignNow. Once logged in, you can find templates for various tax forms, including the denver sales tax form, which you can fill out and eSign directly on the platform. This helps streamline your tax filing process.

-

What features does airSlate SignNow offer for managing the denver sales tax form?

airSlate SignNow provides several features for managing the denver sales tax form, including customizable templates, eSignature capabilities, and document tracking. You can easily collaborate with colleagues or accountants, ensuring that the form is prepared accurately and submitted on time.

-

Is airSlate SignNow a cost-effective solution for handling the denver sales tax form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using our platform to manage the denver sales tax form, you can reduce the time and resources spent on paperwork, helping you to cut costs while remaining compliant with Denver's tax regulations.

-

Can I integrate airSlate SignNow with other software for managing the denver sales tax form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, such as accounting and CRM tools. This integration ensures that you can manage the denver sales tax form without disrupting your existing workflows, enhancing efficiency across your business.

-

What are the benefits of using airSlate SignNow for the denver sales tax form?

Using airSlate SignNow for your denver sales tax form provides numerous benefits, including faster processing times, improved accuracy, and reduced paperwork. The platform's user-friendly interface allows for quick submission and tracking of your forms, ensuring you stay compliant with Denver's tax laws effortlessly.

-

Can I track the status of my denver sales tax form submissions?

Yes, airSlate SignNow allows you to track the status of your denver sales tax form submissions in real time. You will receive notifications when the forms are viewed and signed, providing peace of mind and accountability throughout the submission process.

Get more for Denver Sales Tax Return Monthly Department Of Finance Denvergov

Find out other Denver Sales Tax Return Monthly Department Of Finance Denvergov

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF