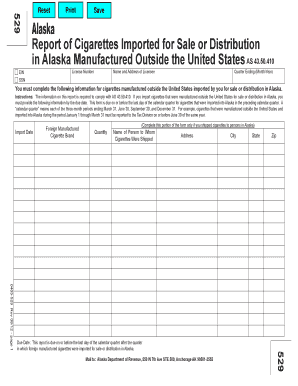

Taxs in Alaska Form

What is the Taxs in Alaska

The taxs in Alaska primarily refer to the various tax obligations that residents and businesses must adhere to within the state. Unlike many other states, Alaska does not impose a state income tax, which can be beneficial for individuals and families. However, there are other forms of taxation, such as property tax and sales tax, that are essential for funding local services and infrastructure. Understanding these tax obligations is crucial for compliance and effective financial planning.

How to Use the Taxs in Alaska

Utilizing the taxs in Alaska involves understanding the specific requirements and processes associated with each type of tax. Residents and businesses should familiarize themselves with local regulations to ensure they meet all tax obligations. For example, property owners must file property tax assessments annually, while businesses may need to collect and remit sales tax. It is advisable to consult with tax professionals or utilize reliable software solutions to navigate these requirements effectively.

Steps to Complete the Taxs in Alaska

Completing the taxs in Alaska involves several key steps:

- Gather necessary documents, such as income statements, property deeds, and sales records.

- Determine which taxes apply to your situation, including property tax and any applicable sales tax.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit your tax forms by the designated deadlines to avoid penalties.

- Keep copies of all submitted documents for your records.

Legal Use of the Taxs in Alaska

The legal use of taxs in Alaska requires adherence to state laws and regulations. Taxpayers must ensure they are compliant with all filing requirements and deadlines to avoid penalties. Additionally, understanding the legal implications of property ownership and business operations is essential. Engaging with a tax professional can provide clarity on legal obligations and help navigate any complexities associated with tax compliance.

Required Documents

When dealing with taxs in Alaska, certain documents are essential for accurate filing and compliance. Commonly required documents include:

- Income statements, such as W-2s or 1099s for individuals.

- Property deeds and tax assessments for property tax filings.

- Sales records for businesses that collect sales tax.

- Any relevant deductions or credits documentation.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for tax compliance in Alaska. Typically, property tax assessments are due annually, while sales tax filings may have quarterly deadlines. It is important to check with local tax authorities for specific dates, as these can vary by municipality. Marking these deadlines on a calendar can help ensure timely submissions and avoid any late fees.

Quick guide on how to complete taxs in alaska

Complete Taxs In Alaska effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Taxs In Alaska on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Taxs In Alaska with ease

- Find Taxs In Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Taxs In Alaska and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxs in alaska

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it help with taxs?

airSlate SignNow is a user-friendly platform that enables businesses to send and electronically sign documents efficiently. This tool is particularly beneficial during tax season, as it allows you to manage tax-related documents quickly and securely, ensuring compliance and accuracy.

-

How much does airSlate SignNow cost for businesses dealing with taxs?

Pricing for airSlate SignNow varies based on the plan you choose, catering to different business sizes. For businesses managing taxs, the pricing is designed to be cost-effective, offering essential features without breaking the budget, making it accessible for tax filing needs.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow provides several features that streamline tax documentation, such as customizable templates, unlimited electronic signatures, and real-time status tracking. These features allow users to efficiently manage taxs, ensuring that all necessary documents are signed and submitted on time.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow takes security seriously by employing encryption and compliance with industry standards to protect sensitive taxs. With secure storage and a robust authentication process, businesses can confidently handle their tax documents without the risk of data bsignNowes.

-

Can airSlate SignNow integrate with other tools for managing taxs?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business applications, including accounting software and CRM tools. This integration allows businesses to streamline their workflow in managing taxs, making it easier to gather and share necessary documentation.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced organization. Businesses can handle taxs more quickly with electronic signatures, which signNowly cuts down on processing time and minimizes the possibility of errors.

-

Does airSlate SignNow support multiple users for team tax management?

Yes, airSlate SignNow supports multiple users, making it perfect for teams working on taxs collaboratively. This feature allows team members to access shared documents, track changes, and ensure that everyone is on the same page when managing tax-related tasks.

Get more for Taxs In Alaska

Find out other Taxs In Alaska

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed