Tax Alaska Form

What is the Tax Alaska

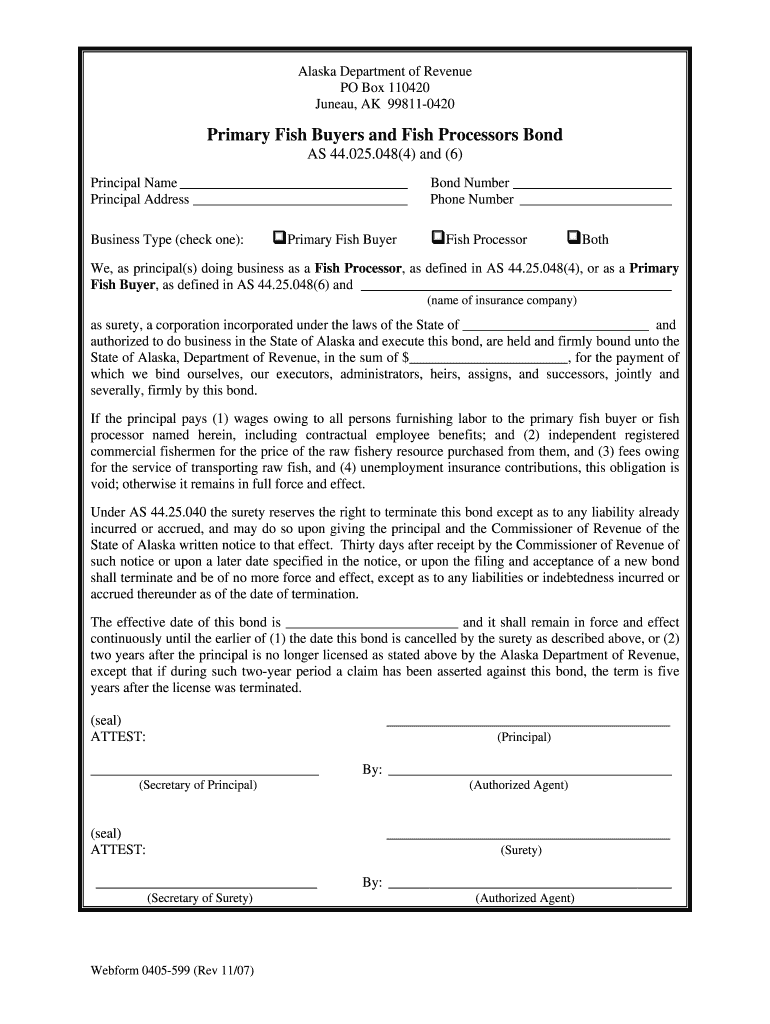

The Tax Alaska refers to specific tax obligations and forms related to the state of Alaska, particularly concerning the fishing industry and primary processors. This tax is crucial for maintaining compliance with state regulations and ensuring that businesses operating in Alaska adhere to the financial responsibilities imposed by local laws. Understanding the Tax Alaska is essential for both new and established businesses in the fishing sector.

How to use the Tax Alaska

Using the Tax Alaska involves several steps, including understanding the specific requirements for your business type. Businesses must first determine their eligibility for the tax and gather all necessary documentation. This may include financial records, proof of operations, and other relevant data. Properly filling out the required forms is vital to ensure compliance and avoid penalties.

Steps to complete the Tax Alaska

Completing the Tax Alaska requires a systematic approach:

- Gather all required documentation, including financial statements and operational records.

- Determine the correct forms needed for your business type.

- Fill out the forms accurately, ensuring all information is complete and correct.

- Review the completed forms for any errors or omissions.

- Submit the forms by the specified deadlines to avoid late fees.

Legal use of the Tax Alaska

Legal use of the Tax Alaska involves adhering to state regulations and ensuring that all submissions are compliant with local laws. This includes understanding the legal implications of the forms and ensuring that all information provided is truthful and accurate. Non-compliance can lead to penalties, including fines and potential legal action.

Required Documents

When filing the Tax Alaska, specific documents are required to ensure a complete submission. These may include:

- Financial statements detailing income and expenses.

- Proof of business operations, such as licenses and permits.

- Any previous tax filings related to the fishing industry.

Having these documents ready will streamline the filing process and help in maintaining compliance.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Tax Alaska. Typically, these deadlines align with the end of the fiscal year or specific dates set by the state. Missing these deadlines can result in penalties, so businesses should mark these dates on their calendars and prepare their submissions in advance.

Quick guide on how to complete tax alaska 6967250

Complete Tax Alaska effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Tax Alaska with ease

- Locate Tax Alaska and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Alaska and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967250

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is an Alaska primary bond?

An Alaska primary bond is a financial instrument issued by the state of Alaska, typically used to fund public projects. Investors purchase these bonds to support local initiatives, and in return, they receive interest payments. This investment option can be attractive for those looking to support Alaska's economy while earning a return.

-

How can airSlate SignNow assist with managing Alaska primary bonds?

airSlate SignNow streamlines the process of managing Alaska primary bonds by providing an efficient platform for document signing and eSigning. With our solution, businesses can effortlessly send contracts related to bond transactions, ensuring compliance and enhancing document security. This eliminates the hassles of traditional paperwork associated with Alaska primary bonds.

-

What are the pricing options for airSlate SignNow when dealing with Alaska primary bonds?

airSlate SignNow offers flexible pricing plans that cater to various business needs when managing Alaska primary bonds. Customers can choose from monthly or annual subscriptions, ensuring they find an option that fits their budget. Additionally, a free trial is available so you can experience the features specifically designed for handling Alaska primary bonds without any initial costs.

-

What features does airSlate SignNow provide for Alaska primary bond transactions?

airSlate SignNow includes features tailored for Alaska primary bond transactions, such as customizable templates, in-person signing, and document tracking. These features enhance the efficiency of bond-related contracts and ensure that all parties involved are kept in the loop. The platform also complies with legal requirements, making it safe for use with Alaska primary bonds.

-

What are the benefits of using airSlate SignNow for Alaska primary bond management?

Using airSlate SignNow for Alaska primary bond management provides numerous benefits, including increased efficiency, security, and the ability to store documents digitally. Our easy-to-use interface simplifies the signing process for both businesses and investors. Additionally, it reduces the time and costs typically associated with managing Alaska primary bonds manually.

-

Can airSlate SignNow integrate with other tools for Alaska primary bond documentation?

Yes, airSlate SignNow can seamlessly integrate with various tools and platforms to enhance documentation for Alaska primary bonds. Users can connect to CRM systems, cloud storage services, and document management systems. This integration capability ensures that all your bond-related documents are easily accessible and well-organized.

-

Is airSlate SignNow compliant with regulations related to Alaska primary bonds?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations regarding the handling of Alaska primary bonds. Our platform adheres to stringent security standards and provides audit trails for all eSignatures. This compliance ensures that your processes are legally binding and that you are protected during your bond transactions.

Get more for Tax Alaska

Find out other Tax Alaska

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe