Tax Alaska Form

What is the Alaska Form 531?

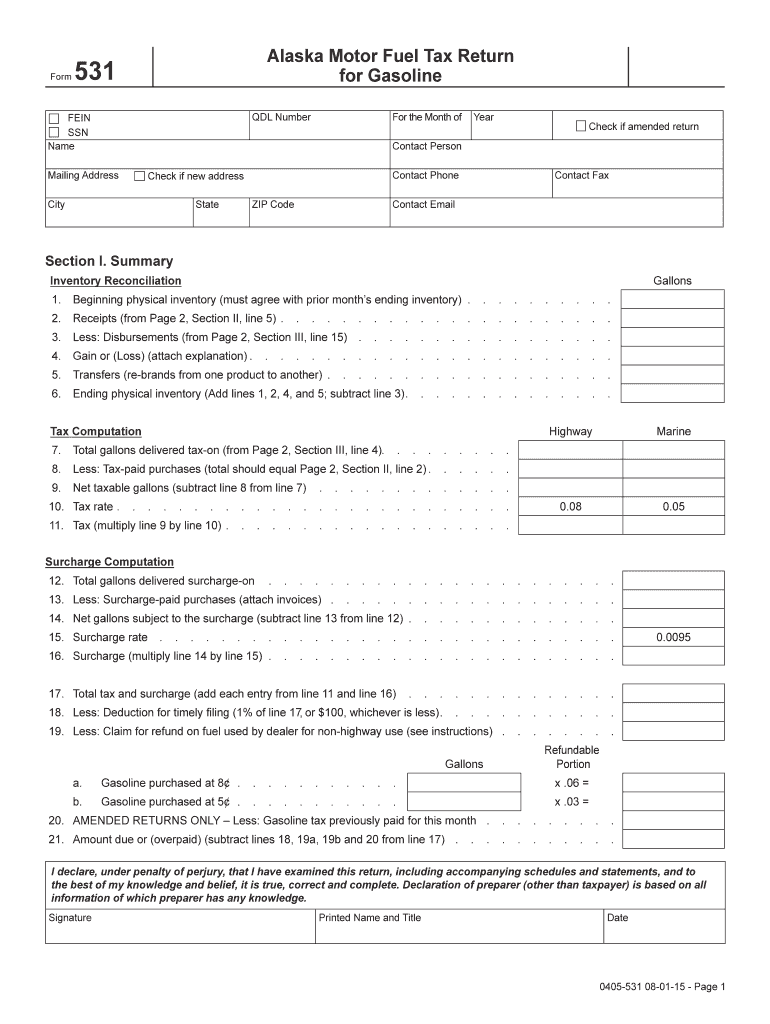

The Alaska Form 531 is a tax document specifically designed for reporting certain financial activities related to gasoline tax. This form is essential for businesses and individuals engaged in the sale or distribution of gasoline within Alaska. It captures critical information regarding the amount of gasoline sold, the applicable tax rates, and any exemptions that may apply. Understanding this form is vital for ensuring compliance with state tax regulations and for accurate financial reporting.

Steps to Complete the Alaska Form 531

Completing the Alaska Form 531 involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather all necessary documentation, including sales records and any relevant invoices.

- Fill in your business information, including your name, address, and tax identification number.

- Report the total gallons of gasoline sold during the reporting period.

- Calculate the total tax owed based on the applicable tax rates for the gasoline sold.

- Include any exemptions or deductions that apply to your sales.

- Review the completed form for accuracy before submission.

Legal Use of the Alaska Form 531

The Alaska Form 531 is legally binding when completed and submitted according to state regulations. It is essential to adhere to the guidelines established by the Alaska Department of Revenue to ensure that the form is accepted without issues. Properly filling out this form not only helps in fulfilling tax obligations but also protects against potential legal repercussions associated with tax fraud or misreporting.

Filing Deadlines / Important Dates

Timely filing of the Alaska Form 531 is crucial to avoid penalties. The specific deadlines may vary based on the reporting period, but typically, the form must be submitted quarterly. It is important to keep track of these dates to ensure compliance. Missing a deadline can result in late fees or other penalties, impacting your business's financial health.

Required Documents

To complete the Alaska Form 531 accurately, several documents are required. These may include:

- Sales records detailing the quantity of gasoline sold.

- Invoices related to gasoline purchases and sales.

- Documentation of any exemptions claimed.

- Previous tax filings for reference.

Having these documents readily available will streamline the completion process and help ensure that all information reported is accurate and compliant with state regulations.

Who Issues the Form?

The Alaska Form 531 is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Alaska. It is advisable to refer to the department's official resources for the most current version of the form and any updates to filing requirements.

Quick guide on how to complete tax alaska 6967281

Effortlessly Prepare Tax Alaska on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Tax Alaska with Ease

- Locate Tax Alaska and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your edits.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Alaska to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967281

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the alaska form 531 and who needs it?

The alaska form 531 is a document required for certain administrative processes in Alaska. It is designed for individuals or businesses that need to submit specific data to state agencies. Understanding this form is crucial for avoiding delays or issues with compliance.

-

How can airSlate SignNow help with alaska form 531?

airSlate SignNow simplifies the process of filling out and eSigning the alaska form 531. Our platform allows users to easily upload the form, fill it out electronically, and send it for signatures. This not only saves time but also enhances accuracy in document submission.

-

Is there a cost associated with using airSlate SignNow for alaska form 531?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. While the use of our platform to manage forms like the alaska form 531 comes at an affordable cost, we provide exceptional value with features designed to streamline your document workflow.

-

What features does airSlate SignNow offer for managing alaska form 531?

airSlate SignNow provides several features that make handling the alaska form 531 efficient. Users can enjoy customizable templates, secure eSigning options, and real-time tracking. These tools contribute to a smoother document management experience.

-

Can I integrate airSlate SignNow with other software for handling alaska form 531?

Absolutely! airSlate SignNow can seamlessly integrate with various software applications. This means you can easily manage the alaska form 531 alongside other important business tools, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the alaska form 531?

Using airSlate SignNow for the alaska form 531 offers numerous benefits, including reduced processing time and improved accuracy. Additionally, the platform’s user-friendly interface allows for quick eSigning, making it an ideal choice for busy professionals.

-

How secure is airSlate SignNow when processing the alaska form 531?

Security is a top priority at airSlate SignNow. When processing the alaska form 531, all documents are encrypted and stored securely. Our compliance with industry standards ensures that your information remains confidential and protected.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy