Tax Alaska Form

What is the Tax Alaska?

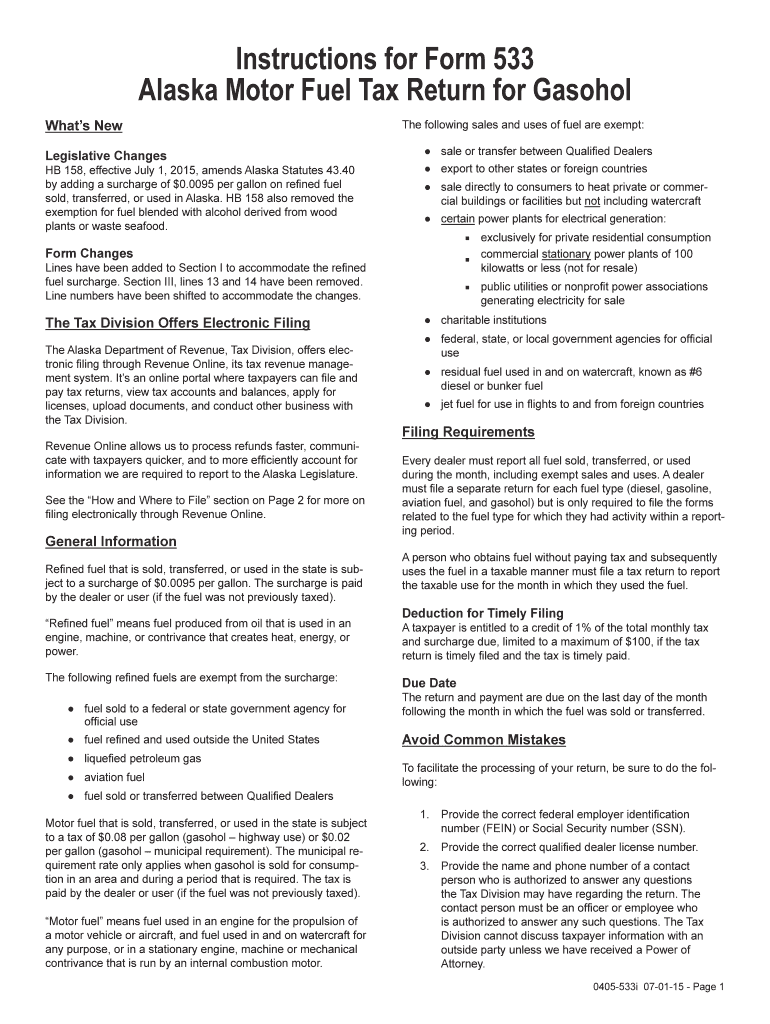

The Tax Alaska refers to specific forms and instructions related to the taxation of motor fuel in the state of Alaska. This tax is imposed on the sale and use of motor fuel within the state and is designed to generate revenue for various state projects and initiatives. Understanding the Tax Alaska is crucial for businesses and individuals who engage in activities involving motor fuel, as it ensures compliance with state regulations and helps avoid potential penalties.

Steps to complete the Tax Alaska

Completing the Tax Alaska involves several key steps to ensure accuracy and compliance. Here’s a brief outline of the process:

- Gather necessary information, including your business details and fuel usage records.

- Obtain the appropriate Tax Alaska form, which may vary depending on your specific situation.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail, as per the instructions provided.

Legal use of the Tax Alaska

The legal use of the Tax Alaska is governed by state laws and regulations. It is essential for filers to adhere to these legal requirements to avoid issues with compliance. This includes understanding the eligibility criteria for exemptions, the proper calculation of tax owed, and the submission of forms within the designated timeframes. Non-compliance can lead to penalties, including fines or interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska are critical for taxpayers to meet to avoid penalties. Typically, these deadlines align with quarterly or annual tax periods. It is advisable to check the official state resources for the most accurate and current deadlines. Marking these dates on your calendar can help ensure timely submissions and maintain compliance with state tax laws.

Required Documents

To complete the Tax Alaska, certain documents are required. These may include:

- Proof of fuel purchases, such as invoices or receipts.

- Records of fuel usage, detailing how much fuel was consumed and for what purposes.

- Previous tax returns, if applicable, to provide context for current filings.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Tax Alaska can be done through various methods, depending on the preferences of the filer and the requirements set by the state. Common submission methods include:

- Online Submission: Many states offer an online portal for electronic filing, which can expedite the process.

- Mail: Completed forms can be sent via postal service to the designated tax office.

- In-Person: Some filers may choose to submit their forms in person at local tax offices.

Each method has its own advantages, and filers should choose the one that best suits their needs.

Quick guide on how to complete tax alaska 6967283

Effortlessly prepare Tax Alaska on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to acquire the correct form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage Tax Alaska on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and electronically sign Tax Alaska effortlessly

- Find Tax Alaska and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that require reprinting document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Tax Alaska and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967283

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are Alaska instructions for motor fuel return?

Alaska instructions for motor fuel return refer to the specific guidelines and procedures set by the state for reporting and returning motor fuel taxes. These instructions help ensure compliance with state regulations and can vary based on the type of fuel and usage. Understanding these guidelines is crucial for businesses operating in Alaska to avoid penalties.

-

How can airSlate SignNow simplify the process of submitting Alaska motor fuel return forms?

airSlate SignNow simplifies the submission of Alaska motor fuel return forms by providing an easy-to-use platform for e-signing and managing documents. With automated workflows, businesses can efficiently gather signatures and submit required forms without hassle. This not only saves time but also reduces the chance of errors.

-

What features does airSlate SignNow offer that are beneficial for handling Alaska motor fuel returns?

airSlate SignNow offers features such as template creation, automated reminders, and secure cloud storage, which are beneficial for managing Alaska motor fuel returns. These tools streamline the document preparation process and ensure compliance with state requirements. Additionally, users can track the status of their submissions in real time.

-

Is there a cost associated with using airSlate SignNow for Alaska motor fuel return submissions?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Pricing depends on the plan selected, which varies based on factors like the number of users and features needed. The investment is worthwhile compared to the potential savings in time and compliance issues related to Alaska motor fuel return.

-

Can airSlate SignNow integrate with other software used for Alaska motor fuel returns?

Yes, airSlate SignNow offers integrations with various software solutions frequently used for Alaska motor fuel returns. This includes accounting software, document management systems, and more. Such integrations enhance workflow efficiency, making it easier for businesses to manage their obligations in compliance with Alaska instructions for motor fuel return.

-

What benefits can I expect from using airSlate SignNow for my Alaska motor fuel return?

Using airSlate SignNow for your Alaska motor fuel return can provide numerous benefits including increased efficiency, reduced paperwork, and enhanced compliance. The platform ensures that all necessary signatures and documentation are gathered swiftly. As a result, businesses can focus on their core activities while confidently meeting their reporting obligations.

-

How secure is airSlate SignNow for submitting sensitive information related to Alaska motor fuel returns?

airSlate SignNow employs robust security measures to protect sensitive information related to Alaska motor fuel returns. With features like data encryption and secure cloud storage, businesses can trust that their documents are safe. This commitment to security allows users to submit their information confidently while adhering to state regulations.

Get more for Tax Alaska

- Opwdd training requirements guide form

- Non refundable deposit agreement pdf form

- Prize claim form template

- Broward schools seperation of employment iform

- Beta club service hours form

- Ergonomic assessment checklist form

- Seating chart form 6 by 5 blank seating chart 6 by 5 with form field for teachers to type in the names of the students

- Immunization forms department of public health environment

Find out other Tax Alaska

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template