Tax Alaska Form

What is the Tax Alaska?

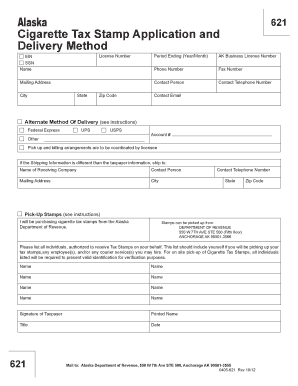

The Tax Alaska form, specifically the Alaska 621, is designed for individuals and businesses to report certain tax information to the state of Alaska. This form is essential for ensuring compliance with state tax regulations. It serves various purposes, including the declaration of income, deductions, and credits. Understanding the specifics of this form is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the Tax Alaska

Completing the Alaska 621 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including income statements and any relevant deductions. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income as specified, ensuring all figures are accurate.

- Apply any deductions or credits you qualify for, following the guidelines.

- Double-check all entries for accuracy before submission.

Legal use of the Tax Alaska

The legal validity of the Alaska 621 form hinges on compliance with state tax laws and regulations. It is important to ensure that the form is filled out accurately and submitted on time. Electronic submissions are recognized as legally binding when they adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Using a reliable eSignature platform can enhance the legal standing of your submission.

Required Documents

To complete the Alaska 621, you will need several documents to support your claims. These typically include:

- W-2 forms from employers for reported income.

- 1099 forms for any freelance or contract work.

- Documentation for deductions, such as receipts for business expenses.

- Any prior year tax returns for reference.

Having these documents ready will streamline the completion process and help ensure accuracy.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties. The Alaska 621 form typically has a deadline aligned with the federal tax filing date. It is advisable to check the Alaska Department of Revenue website for specific dates each tax year. Marking these dates on your calendar can help you stay organized and compliant.

Who Issues the Form

The Alaska 621 form is issued by the Alaska Department of Revenue. This department is responsible for overseeing tax collection and ensuring compliance with state tax laws. For any updates or changes to the form, it is essential to refer to the official state resources to obtain the most current version and instructions.

Quick guide on how to complete tax alaska 6967176

Effortlessly Prepare Tax Alaska on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without unnecessary delays. Handle Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Tax Alaska with Ease

- Locate Tax Alaska and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize crucial sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, such as email, text message (SMS), invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or errors that require new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign Tax Alaska to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967176

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Alaska 621 and how does it work with airSlate SignNow?

Alaska 621 refers to a specific document format that airSlate SignNow supports for eSigning and document handling. This format allows users to easily send, sign, and manage documents electronically, streamlining your workflow and enhancing productivity. With airSlate SignNow, you can handle Alaska 621 documents efficiently and securely.

-

What are the pricing plans for using airSlate SignNow with Alaska 621?

airSlate SignNow offers competitive pricing plans that accommodate various business needs for handling Alaska 621 documents. Our plans are designed to provide cost-effective solutions to companies of all sizes, ensuring you only pay for the features you need. Visit our pricing page to find the best plan that fits your requirements.

-

What features does airSlate SignNow offer for Alaska 621 document management?

airSlate SignNow provides a suite of features tailored for Alaska 621 document management, including customizable templates, advanced security options, and real-time collaboration tools. These features enable users to create, send, and sign documents efficiently, ensuring compliance and enhancing team productivity. Experience seamless document workflows with our intuitive platform.

-

Can airSlate SignNow integrate with other software for Alaska 621 use?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications, enhancing your ability to manage Alaska 621 documents. Integration options include popular CRM, ERP, and productivity tools that help streamline your workflows. Explore our integration options to maximize your efficiency.

-

What are the security measures in place for Alaska 621 documents when using airSlate SignNow?

When handling Alaska 621 documents with airSlate SignNow, you can rest assured knowing that we prioritize security. Our platform implements advanced encryption, two-factor authentication, and compliance with industry standards to protect your data. This commitment to security ensures that your sensitive documents remain safe at all times.

-

How does airSlate SignNow improve the signing process for Alaska 621 documents?

AirSlate SignNow enhances the signing process for Alaska 621 documents by providing a user-friendly interface and fast, efficient eSigning capabilities. With our platform, you can sign documents electronically from anywhere, on any device, eliminating the need for print, scan, and mail. This efficient process speeds up contract execution and reduces turnaround times.

-

Is there a mobile app for managing Alaska 621 documents with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage Alaska 621 documents conveniently from your smartphone or tablet. The app provides full functionality for sending, signing, and tracking documents on the go. Stay productive and manage your important documents anytime, anywhere with our mobile solution.

Get more for Tax Alaska

Find out other Tax Alaska

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation