TPP Exemption Application and Return for Previous Filers with Total Bb Bcpa Form

What is the personal exemption application?

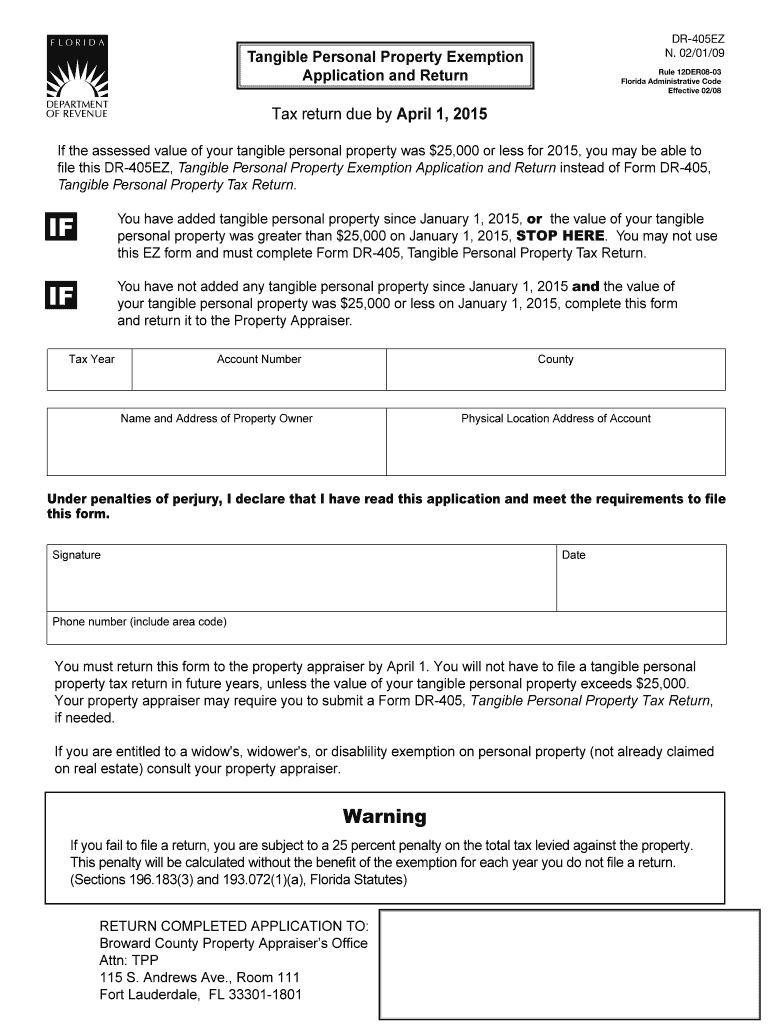

The personal exemption application is a formal request submitted by individuals or businesses to claim exemptions on their personal property taxes. This application is essential for those seeking to reduce their taxable personal property value, which can lead to significant savings. The application typically requires detailed information about the property, its use, and the applicant's eligibility for the exemption. Understanding the specifics of this application is crucial for ensuring compliance with local tax regulations.

Steps to complete the personal exemption application

Completing the personal exemption application involves several key steps:

- Gather necessary documents, including proof of ownership and any relevant financial records.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide supporting documentation that verifies your eligibility for the exemption.

- Review the application for accuracy and completeness before submission.

- Submit the application by the specified deadline, either online or via mail.

Eligibility criteria for the personal exemption application

Determining eligibility for the personal exemption application is essential for successful approval. Generally, applicants must meet specific criteria, which may include:

- Ownership of the property being claimed for exemption.

- Use of the property for qualifying purposes, such as residential or charitable activities.

- Meeting local residency requirements, if applicable.

- Filing the application within the designated timeframe set by local tax authorities.

Required documents for the personal exemption application

To support your personal exemption application, you will need to provide various documents. Commonly required documents include:

- Proof of ownership, such as a deed or title.

- Financial statements that demonstrate the property's value and use.

- Identification documents to verify the applicant's identity.

- Any additional documentation that may be requested by the local tax authority.

Form submission methods for the personal exemption application

The personal exemption application can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing a physical copy of the application to the designated tax office.

- In-person submission at local tax offices or designated locations.

Penalties for non-compliance with the personal exemption application

Failure to comply with the requirements of the personal exemption application can result in penalties. These may include:

- Denial of the exemption, leading to higher property tax liabilities.

- Potential fines or interest on unpaid taxes.

- Legal action for failure to adhere to local tax laws.

Quick guide on how to complete tpp exemption application and return for previous filers with total bb bcpa

Prepare TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa effortlessly on any gadget

Web-based document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to adjust and eSign TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa without hassle

- Find TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes a few seconds and has the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa and ensure optimal communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpp exemption application and return for previous filers with total bb bcpa

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a personal exemption application?

A personal exemption application is a formal request that individuals can submit to claim tax exemptions based on personal circumstances. This application is crucial for ensuring that individuals aren't overtaxed and can take advantage of any available benefits regarding their financial situation.

-

How can airSlate SignNow help with the personal exemption application process?

airSlate SignNow streamlines the personal exemption application process by allowing users to easily create, send, and eSign necessary documents. With its user-friendly platform, you can ensure that your application is completed accurately and submitted efficiently, saving you time and hassle.

-

What features does airSlate SignNow offer for managing personal exemption applications?

airSlate SignNow offers features like document templates, bulk sending, and real-time tracking that help in managing personal exemption applications. These tools ensure that your paperwork is organized, easy to access, and completed in a timely manner.

-

Is there a cost to using airSlate SignNow for personal exemption applications?

Yes, airSlate SignNow has a pricing model that provides various tiers based on the features you need. Depending on your business requirements, you can choose a plan that best fits your budget while still being cost-effective for processing personal exemption applications.

-

Can I integrate airSlate SignNow with other applications for personal exemption management?

Absolutely! airSlate SignNow offers integrations with popular applications like CRM systems and cloud storage platforms. This capability allows you to manage your personal exemption applications alongside other workflow tools you already use, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for personal exemption applications?

Using airSlate SignNow for your personal exemption applications provides signNow benefits, including enhanced security, ease of use, and accelerated turnaround times. These advantages help ensure that you can focus on what matters while handling your exemption applications effectively.

-

Is airSlate SignNow secure for personal exemption applications?

Yes, airSlate SignNow prioritizes the security of your documents, including personal exemption applications. With features like encryption and secure data storage, you can rest assured that your sensitive information is protected throughout the eSigning process.

Get more for TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa

Find out other TPP Exemption Application And Return For Previous Filers With Total Bb Bcpa

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice