M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A and M4T 2020

What is the M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T

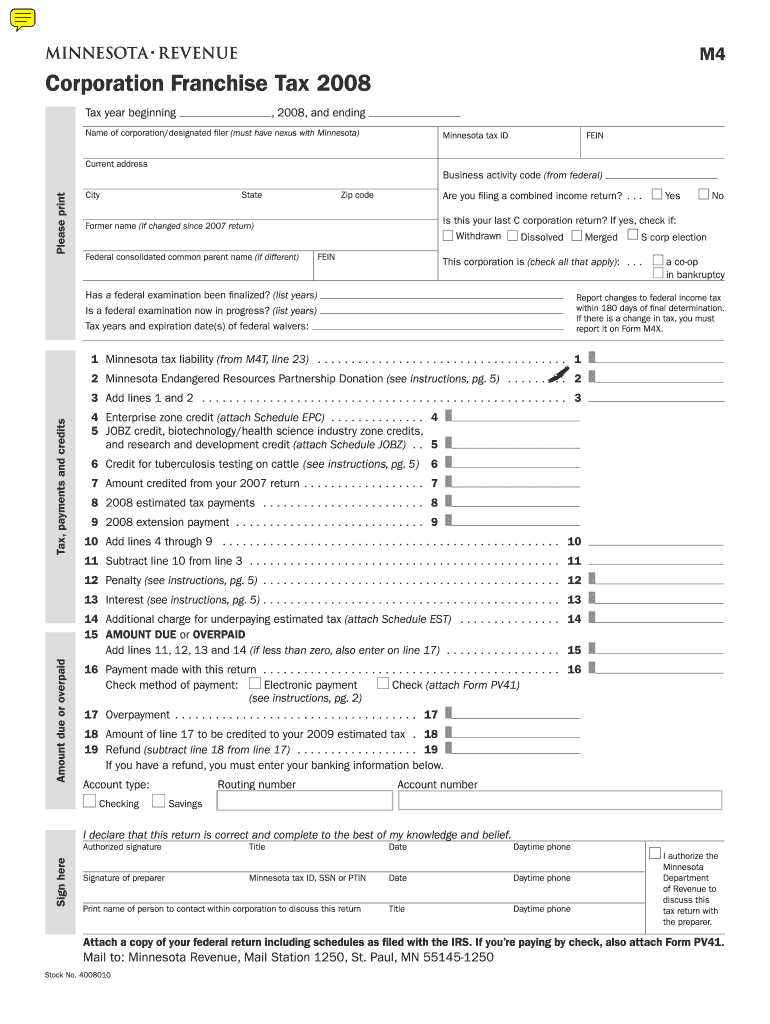

The M4, Corporation Franchise Tax Return is a crucial document for corporations operating in the United States. It includes several forms: M4, M4I, M4A, and M4T, each serving a specific purpose in the tax filing process. The M4 form is the primary tax return, while the M4I form is used for additional information regarding income. The M4A form allows for adjustments, and the M4T form is specifically for tax credits. Together, these forms ensure that corporations comply with state tax regulations and accurately report their financial activities.

Steps to complete the M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T

Completing the M4, Corporation Franchise Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the M4 form, ensuring all income and deductions are accurately reported.

- Complete the M4I form if additional income details are required.

- Use the M4A form to make any necessary adjustments to your reported income.

- Fill out the M4T form to claim any applicable tax credits.

- Review all forms for accuracy and completeness.

- Submit the completed forms by the designated filing deadline.

Legal use of the M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T

The legal use of the M4, Corporation Franchise Tax Return is essential for compliance with state tax laws. Each form included in the M4 return must be filled out accurately to avoid penalties. Electronic signatures can be used to validate the submission of these forms, provided they meet the requirements set by the ESIGN Act and UETA. Ensuring that all information is truthful and complete is vital, as discrepancies can lead to audits or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the M4, Corporation Franchise Tax Return vary by state, but generally, corporations must submit their returns by the fifteenth day of the fourth month following the end of their fiscal year. It is important to check specific state regulations for any variations. Missing the deadline can result in penalties, interest on unpaid taxes, and additional scrutiny from tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The M4, Corporation Franchise Tax Return can typically be submitted through various methods:

- Online: Many states offer electronic filing options, allowing for quicker processing and confirmation.

- Mail: Corporations can send completed forms via postal service to the appropriate tax office.

- In-Person: Some states allow for in-person submissions at designated tax offices, providing immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the requirements of the M4, Corporation Franchise Tax Return can result in significant penalties. Common consequences include late filing fees, interest on unpaid taxes, and potential legal action. Corporations may also face increased scrutiny from tax authorities, leading to audits. It is crucial to adhere to all filing requirements and deadlines to avoid these penalties.

Quick guide on how to complete 2008 m4 corporation franchise tax return includes 2008 forms m4 m4i m4a and m4t

Effortlessly Prepare M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

Edit and Electronically Sign M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T with Ease

- Find M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a handwritten signature.

- Review all the details and then click Done to save your changes.

- Select your preferred method for delivering your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 m4 corporation franchise tax return includes 2008 forms m4 m4i m4a and m4t

Create this form in 5 minutes!

How to create an eSignature for the 2008 m4 corporation franchise tax return includes 2008 forms m4 m4i m4a and m4t

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the M4, Corporation Franchise Tax Return?

The M4, Corporation Franchise Tax Return is a vital tax document that businesses must file in Massachusetts. It includes essential forms such as M4, M4I, M4A, and M4T, which help corporations report their income and meet state tax obligations effectively.

-

What forms are included in the M4, Corporation Franchise Tax Return?

The M4, Corporation Franchise Tax Return includes several important forms: M4, M4I, M4A, and M4T. Each form serves a specific purpose, with M4 for the main corporation reporting, M4I for income tax credits, M4A addressing tax disclosures, and M4T for estimated taxes.

-

How can airSlate SignNow help with filing the M4, Corporation Franchise Tax Return?

With airSlate SignNow, businesses can easily prepare, send, and eSign their M4, Corporation Franchise Tax Return and included forms. Our user-friendly platform ensures that filing is not only efficient but also compliant with all tax regulations.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to various business needs. Users can choose from different subscription tiers, ensuring access to features that streamline the process of completing the M4, Corporation Franchise Tax Return, including forms M4, M4I, M4A, and M4T.

-

Are there integrations available for managing the M4, Corporation Franchise Tax Return?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software. These integrations allow users to efficiently manage their M4, Corporation Franchise Tax Return and related forms, such as M4, M4I, M4A, and M4T, directly within their existing systems.

-

What benefits does airSlate SignNow offer for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents provides numerous benefits, including faster turnaround times and enhanced security. Businesses can easily eSign their M4, Corporation Franchise Tax Return and associated forms, ensuring compliance and peace of mind.

-

Is customer support available for questions about the M4 forms?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any inquiries regarding the M4, Corporation Franchise Tax Return and its forms, including M4, M4I, M4A, and M4T. Our team is dedicated to ensuring you have the help you need for successful filing.

Get more for M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T

- Dodgeball packet 24 answers form

- Ohio dental board complaints form

- Employee commitment letter sample pdf form

- Horse breeding contract template form

- Wigan mental maths form

- Agl 149 withholding election non periodic ampamp taxpayer identification number 3 14 doc form

- Form f88 rule 21 41

- Federal drug testing custody and control form federal drug testing custody and control form

Find out other M4, Corporation Franchise Tax Return Includes Forms M4, M4I, M4A And M4T

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple