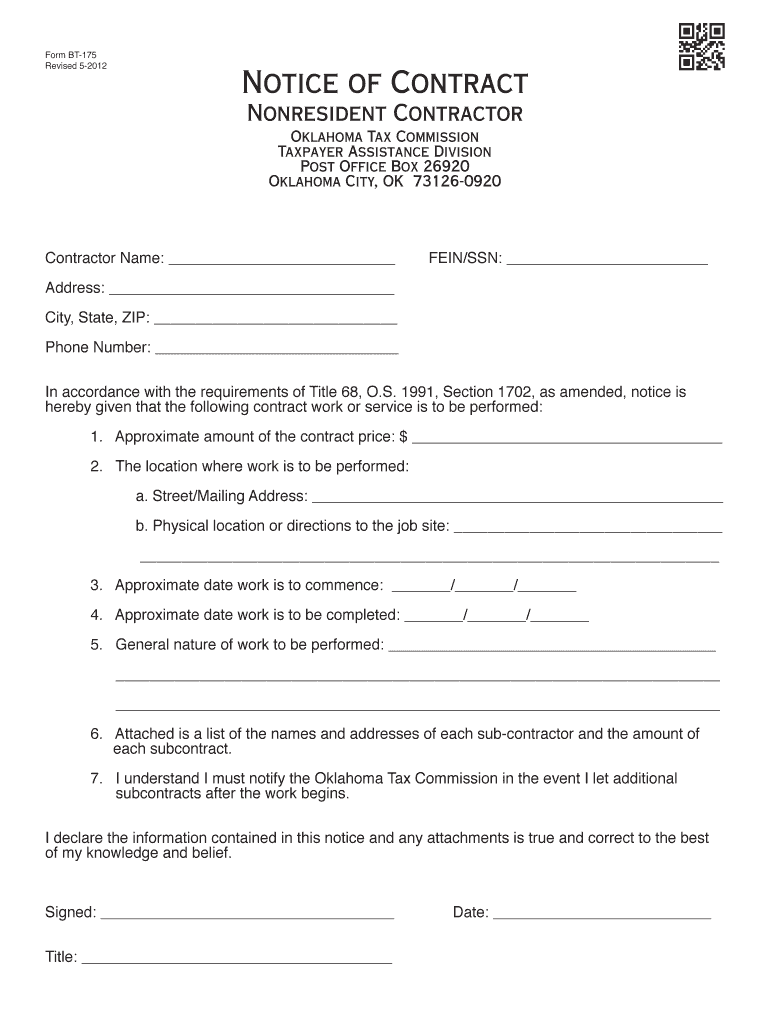

Oklahoma Form Bt 175 2012

What is the Oklahoma Form Bt 175

The Oklahoma Form Bt 175 is a tax-related document used by businesses and individuals in the state of Oklahoma. This form is primarily associated with the reporting of various tax obligations, including sales tax and use tax. It serves as a crucial tool for ensuring compliance with state tax laws and regulations. Understanding the purpose and requirements of this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the Oklahoma Form Bt 175

Using the Oklahoma Form Bt 175 involves several key steps. First, gather all necessary financial information related to sales and purchases that may be subject to taxation. This includes invoices, receipts, and any relevant documentation. Next, accurately fill out the form by entering the required details, such as the total sales amount, tax rates, and any exemptions that may apply. It is important to review the completed form for accuracy before submission to ensure compliance with state tax regulations.

Steps to complete the Oklahoma Form Bt 175

Completing the Oklahoma Form Bt 175 involves a systematic approach:

- Collect all relevant financial records, including sales and purchase documentation.

- Access the latest version of the form, which can be obtained from the Oklahoma Tax Commission website or other official sources.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Calculate the total amount of tax owed based on the information provided.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal use of the Oklahoma Form Bt 175

The Oklahoma Form Bt 175 is legally binding when completed and submitted according to state regulations. It must be filled out accurately to reflect true financial information. Failure to comply with the legal requirements associated with this form can result in penalties, including fines or interest on unpaid taxes. Therefore, it is crucial to understand the legal implications and ensure that all entries are truthful and substantiated by proper documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form Bt 175 vary depending on the specific tax obligations being reported. Generally, businesses must submit this form on a monthly or quarterly basis, depending on their sales volume. It is essential to stay informed about these deadlines to avoid late fees or penalties. Checking the Oklahoma Tax Commission's official website can provide the most current information regarding important dates and filing requirements.

Who Issues the Form

The Oklahoma Form Bt 175 is issued by the Oklahoma Tax Commission, the state agency responsible for administering tax laws and regulations in Oklahoma. This agency provides resources and guidance for individuals and businesses to ensure compliance with state tax obligations. For any questions regarding the form or its requirements, contacting the Oklahoma Tax Commission directly is advisable.

Quick guide on how to complete oklahoma form bt 175

Prepare Oklahoma Form Bt 175 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious replacement for traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Oklahoma Form Bt 175 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to amend and eSign Oklahoma Form Bt 175 effortlessly

- Locate Oklahoma Form Bt 175 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Oklahoma Form Bt 175 and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma form bt 175

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form bt 175

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is Oklahoma Form Bt 175?

Oklahoma Form Bt 175 is a tax exemption form used by businesses to claim exemption from sales and use taxes in Oklahoma. This form is essential for companies that qualify for tax exemptions under specific circumstances. By using airSlate SignNow, you can efficiently eSign this document and ensure proper submission.

-

How do I fill out Oklahoma Form Bt 175?

To fill out Oklahoma Form Bt 175, you need to provide information about your business, including your tax identification number and the reason for the exemption. airSlate SignNow offers pre-filled templates to streamline the process, allowing you to complete the form with ease and accuracy.

-

What are the benefits of using airSlate SignNow for Oklahoma Form Bt 175?

Using airSlate SignNow for Oklahoma Form Bt 175 provides a seamless eSigning experience, reducing time and paperwork. The platform is designed to ensure secure document storage and easy retrieval, which is crucial for compliance. Additionally, features like customizable templates can help users manage their forms effortlessly.

-

Is there a cost associated with using airSlate SignNow for Oklahoma Form Bt 175?

Yes, airSlate SignNow provides a range of pricing plans to fit different business needs. These plans include features that can help you manage your Oklahoma Form Bt 175 efficiently, from eSigning to organization. With its cost-effective solutions, businesses can save time and reduce administrative costs.

-

Can I integrate airSlate SignNow with other apps for Oklahoma Form Bt 175?

Absolutely! airSlate SignNow offers integrations with a variety of business applications, allowing you to streamline your workflow when handling Oklahoma Form Bt 175 and other documents. This connectivity enhances productivity by enabling users to access and manage their forms from within their preferred platforms.

-

How does airSlate SignNow ensure the security of Oklahoma Form Bt 175?

AirSlate SignNow prioritizes security by employing advanced encryption and secure data storage measures for Oklahoma Form Bt 175 and all other documents. This ensures that your sensitive information remains protected throughout the eSigning process. You can confidently manage your forms without compromising security.

-

How quickly can I get my Oklahoma Form Bt 175 processed using airSlate SignNow?

One of the advantages of using airSlate SignNow is the speed of the eSigning process. Documents like Oklahoma Form Bt 175 can be signed and sent for processing within minutes, reducing waiting times signNowly. This swift processing helps businesses meet deadlines more effectively.

Get more for Oklahoma Form Bt 175

Find out other Oklahoma Form Bt 175

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document