Form or STT 2, Statewide Transit Tax Employee Detail Report 2018

What is the Form OR STT 2, Statewide Transit Tax Employee Detail Report

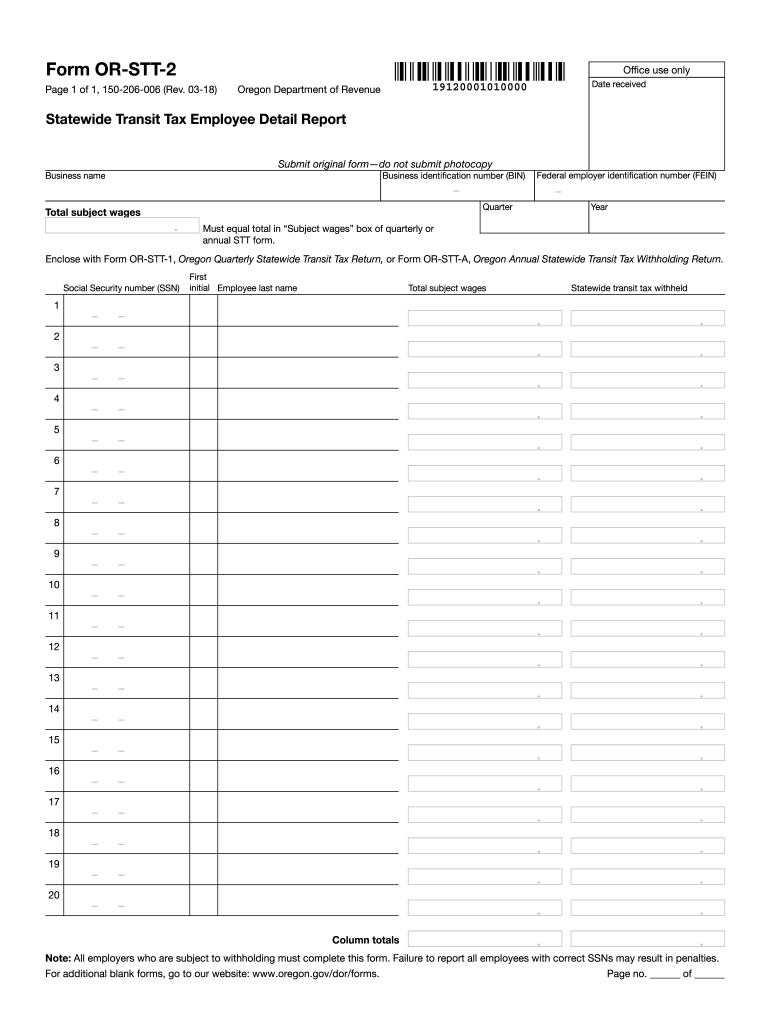

The Form OR STT 2, Statewide Transit Tax Employee Detail Report, is a crucial document used by employers in the United States to report employee information related to the statewide transit tax. This form collects essential data regarding employees' earnings, hours worked, and other relevant details that contribute to the calculation of transit taxes owed. Accurate completion of this form ensures compliance with state regulations and helps facilitate proper funding for public transit systems.

How to use the Form OR STT 2, Statewide Transit Tax Employee Detail Report

Using the Form OR STT 2 involves several steps to ensure that all required information is accurately reported. Employers should first gather necessary employee data, including names, Social Security numbers, and earnings. Once the information is compiled, it should be entered into the form's designated fields. After completing the form, employers must review it for accuracy before submission to avoid penalties and ensure compliance with state transit tax laws.

Steps to complete the Form OR STT 2, Statewide Transit Tax Employee Detail Report

Completing the Form OR STT 2 requires attention to detail. Follow these steps:

- Collect employee information, including full names and Social Security numbers.

- Document each employee's total earnings and hours worked during the reporting period.

- Fill in the form accurately, ensuring all information is complete.

- Double-check for any errors or omissions.

- Submit the completed form to the appropriate state agency by the deadline.

Key elements of the Form OR STT 2, Statewide Transit Tax Employee Detail Report

The Form OR STT 2 includes several key elements that are vital for accurate reporting. These elements typically consist of:

- Employer identification details, including name and address.

- Employee identification, such as names and Social Security numbers.

- Details of earnings and hours worked for each employee.

- Calculation of the total transit tax owed based on the reported data.

Legal use of the Form OR STT 2, Statewide Transit Tax Employee Detail Report

The legal use of the Form OR STT 2 is governed by state laws regarding transit taxes. Employers are required to file this form accurately and on time to comply with legal obligations. Failure to do so can result in penalties, including fines or additional tax liabilities. Ensuring that the form is filled out correctly and submitted by the deadline is essential for maintaining compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form OR STT 2 can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s tax portal.

- Mailing a physical copy of the completed form to the designated state agency.

- In-person submission at local government offices or tax agencies.

Quick guide on how to complete form or stt 2 statewide transit tax employee detail report

Effortlessly Complete Form OR STT 2, Statewide Transit Tax Employee Detail Report on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Form OR STT 2, Statewide Transit Tax Employee Detail Report on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The Easiest Way to Modify and eSign Form OR STT 2, Statewide Transit Tax Employee Detail Report Effortlessly

- Obtain Form OR STT 2, Statewide Transit Tax Employee Detail Report and click Get Form to begin.

- Utilize the provided tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring the reprinting of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Form OR STT 2, Statewide Transit Tax Employee Detail Report and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or stt 2 statewide transit tax employee detail report

Create this form in 5 minutes!

How to create an eSignature for the form or stt 2 statewide transit tax employee detail report

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

The Form OR STT 2, Statewide Transit Tax Employee Detail Report is a mandatory document that employers must submit to report wages and transit taxes for their employees. It helps maintain compliance with statewide transit tax requirements, ensuring accurate reporting and payment. airSlate SignNow simplifies this process by allowing users to easily eSign and submit this form online.

-

How can airSlate SignNow assist with the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

With airSlate SignNow, you can quickly create, eSign, and manage the Form OR STT 2, Statewide Transit Tax Employee Detail Report. Our platform ensures that your forms are securely stored, easily accessible, and can be sent for signatures in minutes. This streamlines your tax reporting process, saving valuable time and resources.

-

What are the costs associated with using airSlate SignNow for the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

airSlate SignNow offers various pricing plans tailored to meet different business needs, making it cost-effective for managing the Form OR STT 2, Statewide Transit Tax Employee Detail Report. Each plan includes features that facilitate eSigning and form management, with options for scaling as your business grows. Contact our sales team for detailed pricing information and potential discounts.

-

Are there any integration options for using airSlate SignNow with tax software related to the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

Yes, airSlate SignNow integrates seamlessly with popular accounting and tax software, allowing for efficient management of the Form OR STT 2, Statewide Transit Tax Employee Detail Report. This integration ensures that your employee details and transit tax information are synced, minimizing errors and reducing manual entry time. Explore our integration options to enhance your workflow.

-

What features does airSlate SignNow offer for managing the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

airSlate SignNow provides features such as drag-and-drop form creation, automated reminders, and secure storage that are perfect for managing the Form OR STT 2, Statewide Transit Tax Employee Detail Report. Additionally, the platform allows users to track the status of signatures in real-time, ensuring timely submission and compliance. These features enhance your productivity and streamline the documentation process.

-

How does airSlate SignNow enhance the security of the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols to protect the integrity of the Form OR STT 2, Statewide Transit Tax Employee Detail Report and any sensitive employee data. With features like audit trails and user authentication, you can trust that your documents and data remain secure.

-

Can I collaborate with my team using airSlate SignNow for the Form OR STT 2, Statewide Transit Tax Employee Detail Report?

Absolutely! airSlate SignNow offers collaboration tools that allow team members to work together on the Form OR STT 2, Statewide Transit Tax Employee Detail Report efficiently. You can easily share documents, assign roles for signing, and communicate within the platform to ensure everyone is aligned. This collaborative approach improves accuracy and speeds up the filing process.

Get more for Form OR STT 2, Statewide Transit Tax Employee Detail Report

- Foundation basics icivics answer key form

- Form 433 f mailing address

- Memorandum and articles of association sample form

- Online marriage certificate form

- 40 mcq answer sheet pdf form

- Handicap placard application pennsylvania form

- Eic table form

- In the iowa district court for county upon the petition of affidavit for form

Find out other Form OR STT 2, Statewide Transit Tax Employee Detail Report

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors