Form or STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 2018-2026

What is the Form OR STT 2?

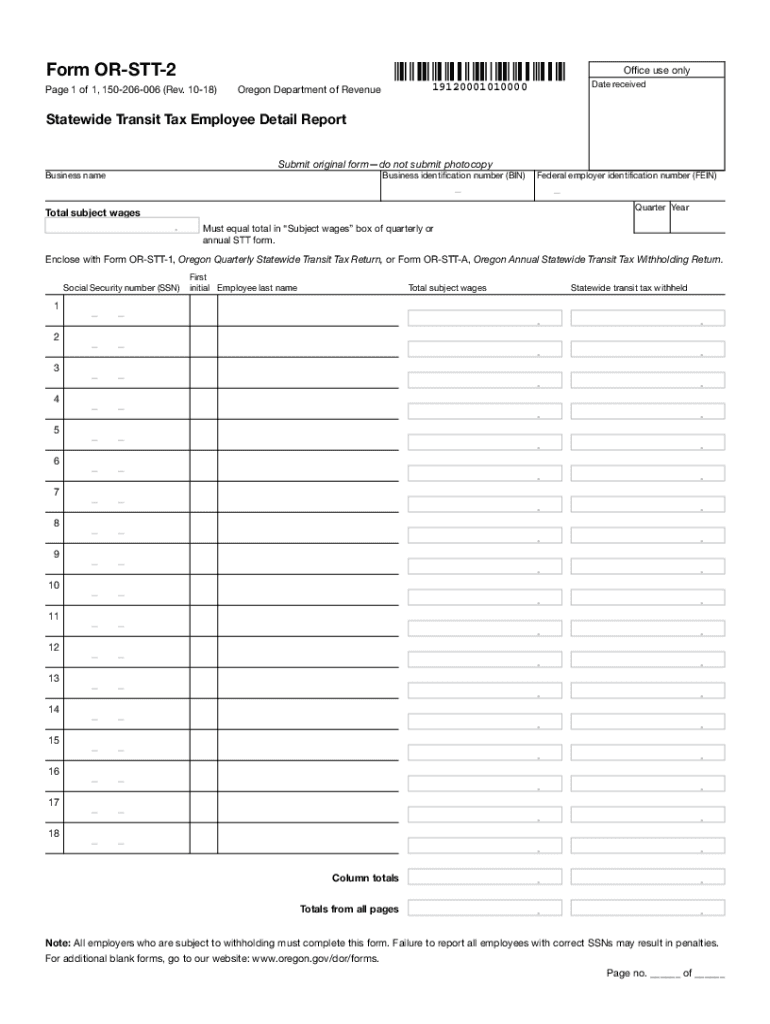

The Form OR STT 2, also known as the Statewide Transit Tax Employee Detail Report, is a document used in Oregon to report employee wages and calculate the statewide transit tax. This form is essential for employers to fulfill their tax obligations under Oregon's transit tax law. It collects detailed information about employees, including their wages and the transit tax withheld, ensuring compliance with state regulations.

How to use the Form OR STT 2

To use the Form OR STT 2 effectively, employers must accurately fill out the required fields, including employee names, Social Security numbers, and total wages paid. Each employee's transit tax withholding must also be documented. Once completed, the form must be submitted to the appropriate state agency, either electronically or through traditional mail, depending on the employer's preference and capabilities.

Steps to complete the Form OR STT 2

Completing the Form OR STT 2 involves several key steps:

- Gather employee information, including names, Social Security numbers, and total wages.

- Calculate the total transit tax withheld for each employee based on their wages.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form to the designated state agency by the deadline.

Legal use of the Form OR STT 2

The legal use of the Form OR STT 2 is crucial for employers in Oregon. This form must be completed in compliance with state tax laws to avoid penalties. Accurate reporting of employee wages and transit tax withholding is necessary to maintain legal standing and ensure that employees are correctly accounted for in the state's transit tax system.

Key elements of the Form OR STT 2

The Form OR STT 2 includes several key elements that are vital for accurate reporting:

- Employee identification details, including name and Social Security number.

- Total wages paid to each employee during the reporting period.

- Amount of transit tax withheld from each employee's wages.

- Employer identification information to ensure proper attribution of the report.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Form OR STT 2 to avoid late penalties. Typically, the form must be submitted annually, with the deadline aligning with the state’s tax reporting schedule. It is important for employers to stay informed about any changes in deadlines to ensure timely compliance.

Quick guide on how to complete form or stt 2 statewide transit tax employee detail report 150 206 006

Effortlessly Prepare Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it on the internet. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 with Ease

- Find Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or stt 2 statewide transit tax employee detail report 150 206 006

Create this form in 5 minutes!

How to create an eSignature for the form or stt 2 statewide transit tax employee detail report 150 206 006

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is stt paperwork and how can airSlate SignNow help?

STT paperwork refers to standardized transactional documents that require signatures for validation. airSlate SignNow streamlines this process by allowing users to easily create, edit, and eSign these documents, ensuring a faster and more efficient workflow for businesses.

-

How does airSlate SignNow ensure the security of stt paperwork?

airSlate SignNow prioritizes the security of stt paperwork by utilizing advanced encryption methods and secure cloud storage. This ensures that your documents are protected from unauthorized access while still remaining accessible to authorized users.

-

What features does airSlate SignNow offer for managing stt paperwork?

airSlate SignNow provides a range of features for managing stt paperwork, including document templates, customizable workflows, and real-time tracking of signatures. These tools allow businesses to optimize their document management processes efficiently.

-

Is there a mobile app for airSlate SignNow to handle stt paperwork on the go?

Yes, airSlate SignNow offers a mobile app that enables users to handle stt paperwork on the go. This app provides full functionality for sending, signing, and managing documents, ensuring your business stays productive from anywhere.

-

What pricing plans are available for airSlate SignNow for stt paperwork processing?

airSlate SignNow offers flexible pricing plans that cater to various business needs for stt paperwork processing. You can choose from different tiers depending on features and user limits, ensuring you find a plan that fits your budget and requirements.

-

Can airSlate SignNow integrate with other tools for managing stt paperwork?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications like Salesforce, Google Drive, and Microsoft 365, making it easy to manage stt paperwork alongside your other business tools. This integration boosts productivity and simplifies document management.

-

What are the benefits of using airSlate SignNow for stt paperwork?

Using airSlate SignNow for stt paperwork offers numerous benefits, including time savings, increased accuracy, and enhanced collaboration. With its intuitive interface and advanced features, businesses can ensure documents are processed quickly and reliably.

Get more for Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006

Find out other Form OR STT 2, Statewide Transit Tax Employee Detail Report, 150 206 006

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later