Form Pt 2018-2026

What is the Form PT?

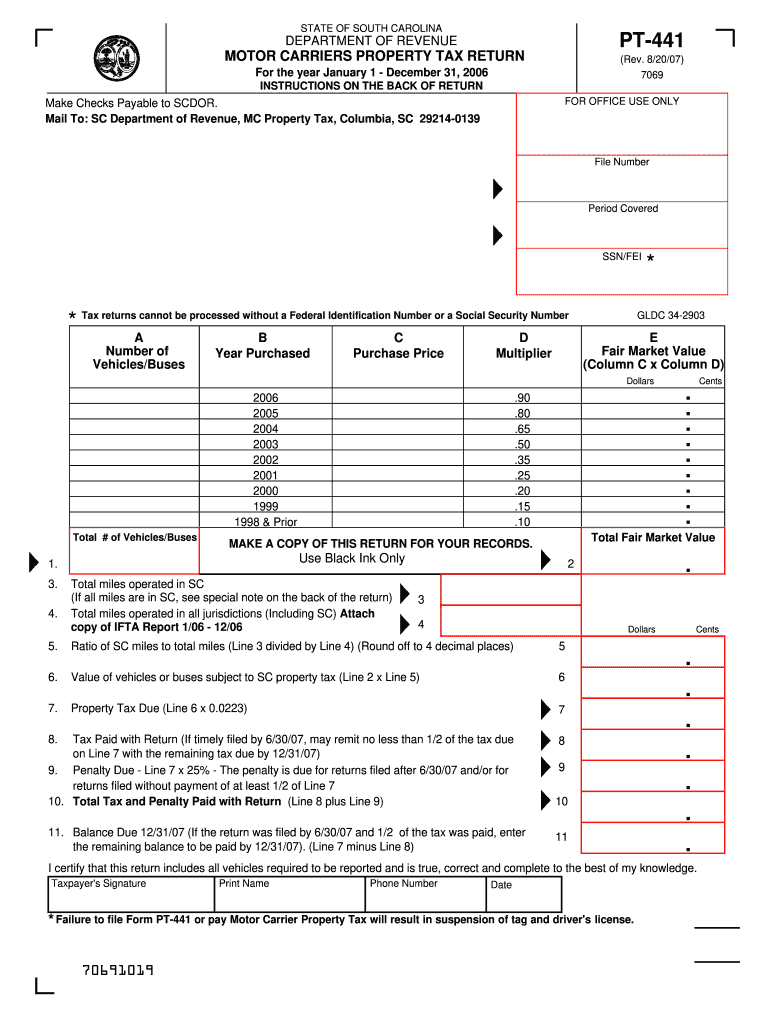

The Form PT, specifically the SC Motor Property tax form, is utilized in South Carolina to report property owned by motor carriers. This form is essential for businesses operating vehicles that transport goods or services within the state. It helps assess the property tax obligations for motor vehicles, ensuring compliance with state regulations.

How to Use the Form PT

Using the Form PT involves accurately reporting the details of motor vehicles owned by a business. This includes providing information such as the vehicle identification number (VIN), make, model, and year of manufacture. Additionally, businesses must declare the total number of vehicles and their assessed value. Proper completion of this form is crucial for determining tax liabilities.

Steps to Complete the Form PT

Completing the Form PT requires several steps:

- Gather necessary information about each vehicle, including the VIN, make, model, and year.

- Calculate the total assessed value of all motor vehicles owned by the business.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness before submission.

Legal Use of the Form PT

The Form PT is legally binding once it is signed and submitted. It must comply with state regulations governing property taxes for motor carriers. Failure to accurately report or submit this form can lead to penalties or legal repercussions, emphasizing the importance of understanding the legal implications of the information provided.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form PT to avoid penalties. Typically, the form must be submitted annually by a specific date set by the South Carolina Department of Revenue. Missing this deadline can result in fines or interest on unpaid taxes, making timely submission critical for compliance.

Form Submission Methods

The Form PT can be submitted through various methods, including:

- Online submission via the South Carolina Department of Revenue's website.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices for direct assistance.

Penalties for Non-Compliance

Non-compliance with the Form PT requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to ensure accurate and timely submission to avoid these consequences and maintain good standing with state tax authorities.

Quick guide on how to complete form pt 2007

Effortlessly Complete Form Pt on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form Pt on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form Pt with Ease

- Obtain Form Pt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in a few clicks from any device you select. Edit and eSign Form Pt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form pt 2007

Create this form in 5 minutes!

How to create an eSignature for the form pt 2007

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is SC motor property and how can airSlate SignNow help with it?

SC motor property refers to the property related to motor vehicles that are registered in South Carolina. airSlate SignNow simplifies the management and signing of documents related to SC motor property by providing an easy-to-use, efficient eSigning solution that streamlines paperwork and helps prevent delays.

-

What features does airSlate SignNow offer for managing SC motor property documents?

airSlate SignNow offers features such as secure eSignatures, customizable templates, and document sharing to streamline the processing of SC motor property documents. With these tools, you can ensure compliance with state regulations while saving time on paperwork.

-

Is airSlate SignNow affordable for managing SC motor property tasks?

Yes, airSlate SignNow offers a cost-effective solution for businesses handling SC motor property tasks. Our pricing plans are designed to provide value and flexibility, ensuring that you can efficiently manage your document needs without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for SC motor property management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage SC motor property documents alongside your existing tools. Whether you use a CRM or project management software, our integrations help streamline your workflow.

-

How secure is airSlate SignNow when handling SC motor property documents?

Security is a top priority at airSlate SignNow. When managing SC motor property documents, you can trust that your information is protected with industry-standard encryption and compliance measures, ensuring that sensitive data remains confidential throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for SC motor property transactions?

Using airSlate SignNow for SC motor property transactions offers several benefits, including reduced processing times, improved accuracy, and enhanced collaboration among stakeholders. This results in a more efficient workflow, helping you close deals faster and with confidence.

-

Can I use airSlate SignNow for mobile SC motor property document signing?

Yes, airSlate SignNow is designed to work seamlessly on mobile devices, allowing you to sign SC motor property documents from anywhere, at any time. This mobility ensures that you can stay productive, even while on the go.

Get more for Form Pt

- Bi form cgaf 001 rev 2

- Prwhe pdf form

- Uc5a form

- Chapter 1 test form 1 precalculus answer key

- Advisory committee membership background information advisory committee membership background information

- Are dog breeder contracts enforceable breeding business form

- Tn visa regulations form

- First report of injury questions umes form

Find out other Form Pt

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter