DOR Home State of Wisconsin Revenue Wi 2018

What is the DOR Home State Of Wisconsin Revenue Wi

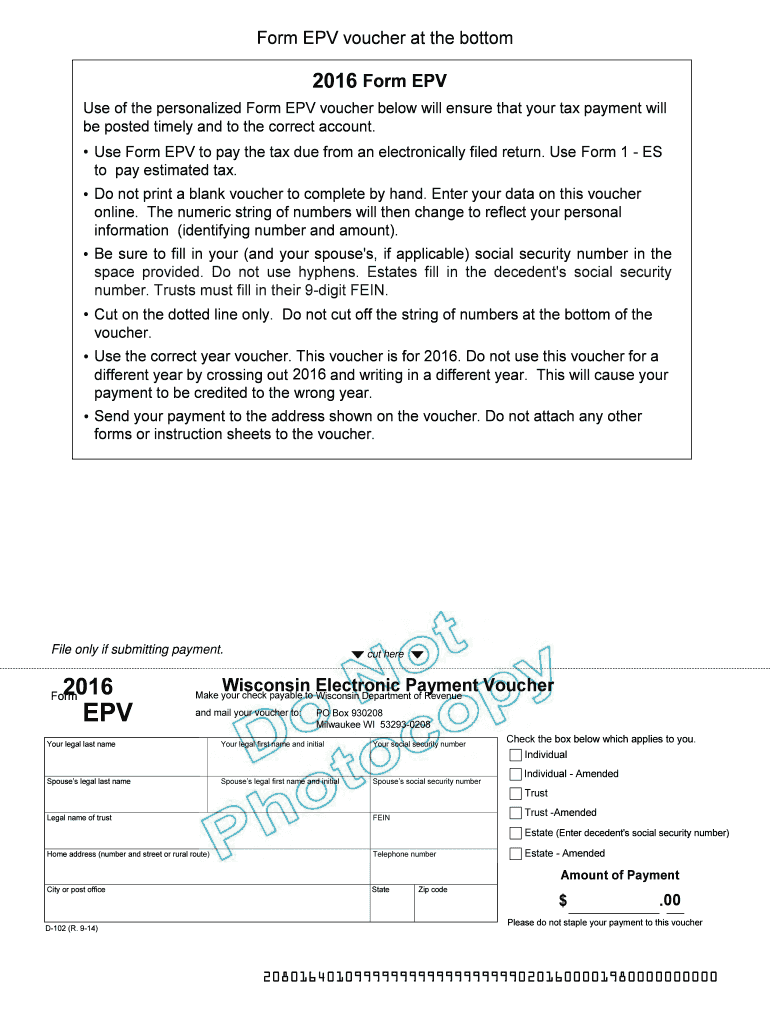

The DOR Home State Of Wisconsin Revenue Wi form is a crucial document used for various tax-related purposes within the state of Wisconsin. This form is primarily utilized by individuals and businesses to report income, claim deductions, and ensure compliance with state tax regulations. Understanding its purpose is essential for accurate tax reporting and avoiding potential penalties.

How to use the DOR Home State Of Wisconsin Revenue Wi

Using the DOR Home State Of Wisconsin Revenue Wi form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form accurately, ensuring that all information is current and correctly reflects your financial situation. Finally, submit the completed form through the appropriate channels, which may include online submission, mailing, or in-person delivery to a designated office.

Steps to complete the DOR Home State Of Wisconsin Revenue Wi

Completing the DOR Home State Of Wisconsin Revenue Wi form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Download or obtain a copy of the form from the Wisconsin Department of Revenue website.

- Fill out the form, ensuring that you provide accurate information in each section.

- Review the completed form for any errors or omissions.

- Submit the form through your chosen method: online, by mail, or in person.

Legal use of the DOR Home State Of Wisconsin Revenue Wi

The legal use of the DOR Home State Of Wisconsin Revenue Wi form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the specified deadlines. Additionally, electronic signatures are accepted, provided they comply with the relevant eSignature laws. This ensures that the document holds legal weight and can be used in any necessary legal or administrative proceedings.

State-specific rules for the DOR Home State Of Wisconsin Revenue Wi

Wisconsin has specific rules and regulations regarding the use of the DOR Home State Of Wisconsin Revenue Wi form. Taxpayers must adhere to state tax laws, including income thresholds, allowable deductions, and filing deadlines. It is essential to stay informed about any changes in state tax legislation that may affect the completion and submission of this form.

Required Documents

To successfully complete the DOR Home State Of Wisconsin Revenue Wi form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

The DOR Home State Of Wisconsin Revenue Wi form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Submit the form electronically through the Wisconsin Department of Revenue website.

- Mail: Send the completed form to the designated address provided on the form.

- In-Person: Deliver the form directly to a local Department of Revenue office.

Quick guide on how to complete dor home state of wisconsin revenue wi

Prepare DOR Home State Of Wisconsin Revenue Wi seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools essential for quickly creating, editing, and electronically signing your documents without delays. Handle DOR Home State Of Wisconsin Revenue Wi on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to alter and eSign DOR Home State Of Wisconsin Revenue Wi without hassle

- Locate DOR Home State Of Wisconsin Revenue Wi and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or black out sensitive details with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, time-consuming form searches, or errors that require freshly printed document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign DOR Home State Of Wisconsin Revenue Wi to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor home state of wisconsin revenue wi

Create this form in 5 minutes!

How to create an eSignature for the dor home state of wisconsin revenue wi

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the DOR Home State Of Wisconsin Revenue Wi?

The DOR Home State Of Wisconsin Revenue Wi is a vital resource for understanding tax obligations and compliance in Wisconsin. It provides residents with access to essential tax forms, guidelines, and updates necessary for meeting state tax requirements. Utilizing airSlate SignNow can streamline your document processes while ensuring adherence to these guidelines.

-

How does airSlate SignNow help with DOR Home State Of Wisconsin Revenue Wi forms?

airSlate SignNow allows users to easily eSign and send DOR Home State Of Wisconsin Revenue Wi forms electronically. This ensures that your submissions are timely and secure, saving you time while reducing the risk of errors. With user-friendly templates, managing tax-related documents becomes signNowly more efficient.

-

Are there any costs associated with using airSlate SignNow for DOR Home State Of Wisconsin Revenue Wi?

Yes, airSlate SignNow offers a cost-effective solution for handling DOR Home State Of Wisconsin Revenue Wi documents. Plans vary based on features and usage, ensuring there’s an option that fits your budget. Investing in such a solution can lead to more streamlined operations and potentially reduce costly errors.

-

What features does airSlate SignNow offer for managing DOR Home State Of Wisconsin Revenue Wi documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows specifically for DOR Home State Of Wisconsin Revenue Wi documents. These features enhance document accuracy and efficiency, making it easier to handle tax obligations without the hassle of paper-based methods.

-

Can I integrate airSlate SignNow with other tools related to DOR Home State Of Wisconsin Revenue Wi?

Yes, airSlate SignNow offers integrations with various software that can assist with managing DOR Home State Of Wisconsin Revenue Wi documents. Integrating with tools like CRM systems or accounting software ensures greater efficiency and data accuracy. This seamless connection allows you to stay organized while managing all relevant processes.

-

How secure is airSlate SignNow for handling DOR Home State Of Wisconsin Revenue Wi documents?

Security is a top priority for airSlate SignNow when handling DOR Home State Of Wisconsin Revenue Wi documents. The platform uses advanced encryption protocols to protect your data, ensuring that your sensitive tax information remains safe from unauthorized access. You can sign and send documents with peace of mind.

-

What benefits can businesses gain from using airSlate SignNow for DOR Home State Of Wisconsin Revenue Wi?

By using airSlate SignNow for DOR Home State Of Wisconsin Revenue Wi, businesses can achieve faster document turnaround and improved compliance with tax-related requirements. The ability to eSign documents reduces delays and enhances productivity. Overall, it contributes to a more organized approach to tax management.

Get more for DOR Home State Of Wisconsin Revenue Wi

Find out other DOR Home State Of Wisconsin Revenue Wi

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form