Form EPV, Wisconsin Electronic Payment Voucher 2014

What is the Form EPV, Wisconsin Electronic Payment Voucher

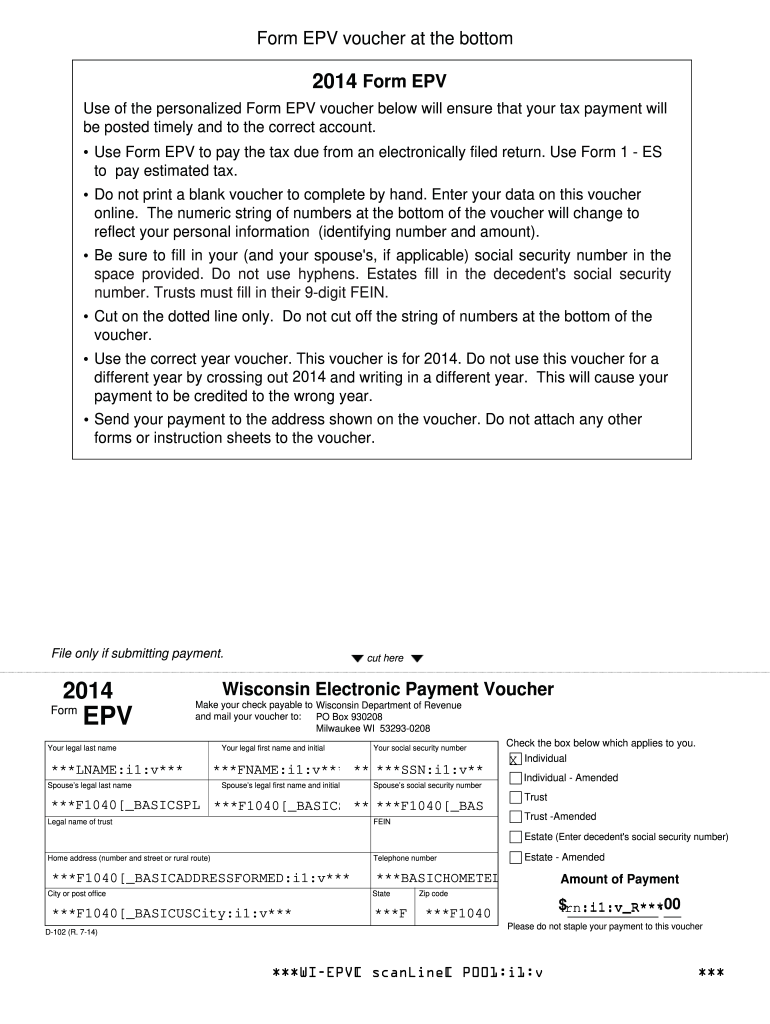

The Form EPV, or Wisconsin Electronic Payment Voucher, is a document used by taxpayers in Wisconsin to facilitate electronic payments for their state taxes. This form is essential for individuals and businesses who prefer to make payments online rather than through traditional paper methods. By using the Form EPV, taxpayers can ensure that their payments are processed swiftly and securely, aligning with state requirements for tax submissions.

How to use the Form EPV, Wisconsin Electronic Payment Voucher

Using the Form EPV involves several straightforward steps. First, taxpayers need to access the form online through the Wisconsin Department of Revenue website or other authorized platforms. Once the form is obtained, users should fill in the required fields, including personal identification information and payment details. After completing the form, taxpayers can submit it electronically, ensuring they follow any specific guidelines provided by the state to validate their payment.

Steps to complete the Form EPV, Wisconsin Electronic Payment Voucher

Completing the Form EPV requires careful attention to detail. Here are the steps to ensure accurate submission:

- Access the Form EPV from a reliable source.

- Fill in your name, address, and Social Security number or Employer Identification Number.

- Indicate the tax type and the amount you are paying.

- Review all information for accuracy.

- Submit the form electronically through the designated portal.

Key elements of the Form EPV, Wisconsin Electronic Payment Voucher

The Form EPV contains several key elements that are crucial for its validity. These include:

- Taxpayer Information: Personal details such as name, address, and identification number.

- Payment Amount: The total amount being paid for state taxes.

- Tax Type: Specification of the tax category for which the payment is being made.

- Signature: An electronic signature is required to validate the submission.

Legal use of the Form EPV, Wisconsin Electronic Payment Voucher

The legal use of the Form EPV is governed by Wisconsin state tax laws. Taxpayers must ensure that they comply with all regulations regarding electronic payments. The form is designed to meet the requirements set forth by the Wisconsin Department of Revenue, making it a legally binding document when completed and submitted correctly. It is advisable to keep a copy of the submitted form for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Form EPV align with Wisconsin's tax payment schedules. Taxpayers should be aware of the due dates for their specific tax obligations to avoid penalties. Typically, electronic payments must be submitted by the due date of the tax return to ensure timely processing. It is essential to check the Wisconsin Department of Revenue website for any updates or changes to these deadlines.

Quick guide on how to complete 2014 form epv wisconsin electronic payment voucher

Your assistance manual on how to prepare your Form EPV, Wisconsin Electronic Payment Voucher

If you’re wondering how to finalize and submit your Form EPV, Wisconsin Electronic Payment Voucher, here are a few straightforward tips to simplify the tax filing process.

First, you only need to create your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, generate, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust information as needed. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Form EPV, Wisconsin Electronic Payment Voucher in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to open your Form EPV, Wisconsin Electronic Payment Voucher in our editor.

- Fill in the necessary fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Check your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and delayed refunds. Also, before e-filing your taxes, verify the filing regulations on the IRS website specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form epv wisconsin electronic payment voucher

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the 2014 form epv wisconsin electronic payment voucher

How to make an electronic signature for your 2014 Form Epv Wisconsin Electronic Payment Voucher in the online mode

How to create an electronic signature for the 2014 Form Epv Wisconsin Electronic Payment Voucher in Chrome

How to make an electronic signature for signing the 2014 Form Epv Wisconsin Electronic Payment Voucher in Gmail

How to create an electronic signature for the 2014 Form Epv Wisconsin Electronic Payment Voucher straight from your smart phone

How to generate an electronic signature for the 2014 Form Epv Wisconsin Electronic Payment Voucher on iOS devices

How to make an electronic signature for the 2014 Form Epv Wisconsin Electronic Payment Voucher on Android

People also ask

-

What is the Form EPV, Wisconsin Electronic Payment Voucher?

The Form EPV, Wisconsin Electronic Payment Voucher, is a form used by individuals and businesses to submit payment for state taxes electronically. It simplifies the payment process and ensures timely payments to the Wisconsin Department of Revenue.

-

How does airSlate SignNow support the Form EPV, Wisconsin Electronic Payment Voucher?

airSlate SignNow streamlines the signing process for the Form EPV, Wisconsin Electronic Payment Voucher, making it easy to complete and submit your documents electronically. With our platform, you can quickly add signatures and finalize documents without leaving your desk.

-

Can I track my submissions of the Form EPV, Wisconsin Electronic Payment Voucher?

Yes, with airSlate SignNow, you can track all your submissions of the Form EPV, Wisconsin Electronic Payment Voucher. Our software provides real-time updates and notifications, ensuring you stay informed about the status of your submissions.

-

What are the pricing options for using airSlate SignNow for the Form EPV, Wisconsin Electronic Payment Voucher?

airSlate SignNow offers several pricing plans suitable for businesses of all sizes. Each plan includes features that support the completion and management of the Form EPV, Wisconsin Electronic Payment Voucher, ensuring you find a solution that meets your budget.

-

What features does airSlate SignNow provide for the Form EPV, Wisconsin Electronic Payment Voucher?

Key features of airSlate SignNow for the Form EPV, Wisconsin Electronic Payment Voucher include customizable templates, secure electronic signatures, and integration with various cloud storage systems. These tools enhance efficiency and reduce the likelihood of errors.

-

Is airSlate SignNow compliant with the requirements for the Form EPV, Wisconsin Electronic Payment Voucher?

Yes, airSlate SignNow complies with all relevant electronic signature laws and regulations, ensuring that your use of the Form EPV, Wisconsin Electronic Payment Voucher is legally binding and secure. You can trust our platform to meet state compliance standards.

-

Can airSlate SignNow integrate with other software for managing the Form EPV, Wisconsin Electronic Payment Voucher?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to manage the Form EPV, Wisconsin Electronic Payment Voucher seamlessly with your existing software tools. This connectivity enhances your workflow and productivity.

Get more for Form EPV, Wisconsin Electronic Payment Voucher

- Divorce minor children form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497430469 form

- Wi corporation 497430470 form

- Wisconsin pre incorporation agreement shareholders agreement and confidentiality agreement wisconsin form

- Wi bylaws corporation form

- Corporate records maintenance package for existing corporations wisconsin form

- Wi articles form

- Wi formation 497430475

Find out other Form EPV, Wisconsin Electronic Payment Voucher

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document