Payment Voucher WV State Tax Department 2009

What is the Payment Voucher WV State Tax Department

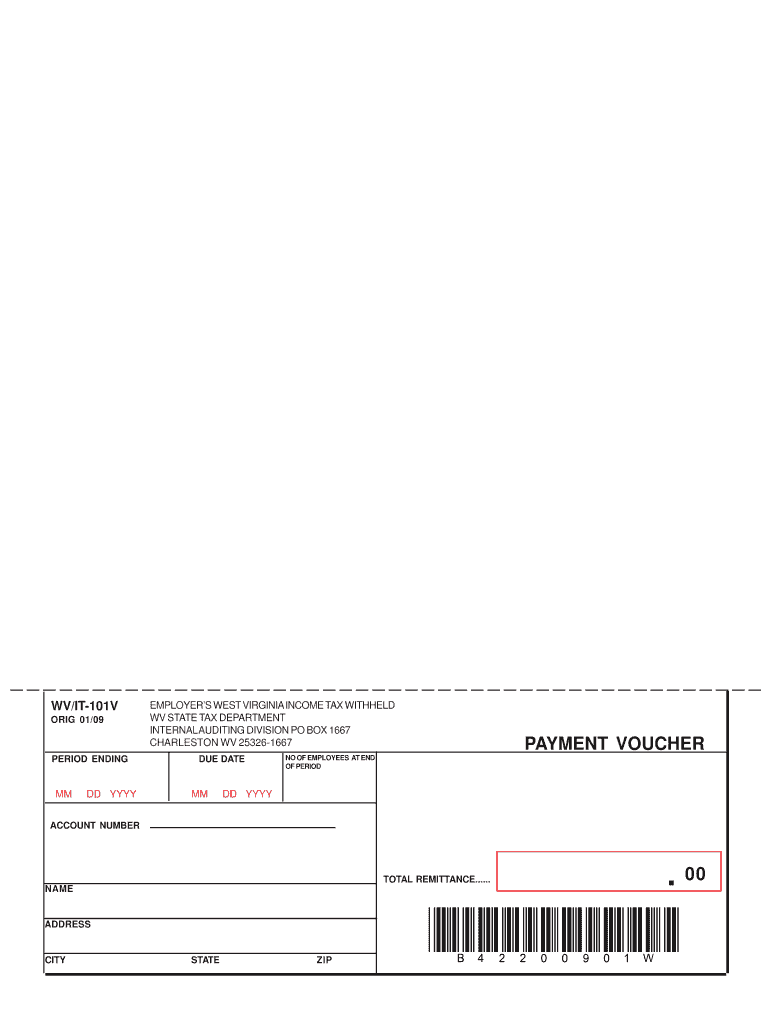

The Payment Voucher for the West Virginia State Tax Department is a crucial document used by individuals and businesses to remit tax payments. This form serves as a record of payment and ensures that the state receives the appropriate funds for taxes owed. It is typically used for various tax obligations, including income tax, corporate tax, and other state-specific taxes. Understanding the purpose and function of this voucher is essential for compliance with state tax regulations.

How to use the Payment Voucher WV State Tax Department

Using the Payment Voucher involves a few straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the West Virginia State Tax Department's official website or other authorized sources. Once you have the form, fill in the required information, including your name, address, tax identification number, and the amount being paid. It is important to double-check all entries for accuracy to avoid delays in processing. After completing the form, submit it along with your payment via the chosen method, whether online, by mail, or in person.

Steps to complete the Payment Voucher WV State Tax Department

Completing the Payment Voucher requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Payment Voucher from the West Virginia State Tax Department.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the tax type and the amount you are remitting.

- Review all information for accuracy to prevent any potential issues.

- Sign and date the voucher, if required.

- Choose your submission method: online, by mail, or in person.

Legal use of the Payment Voucher WV State Tax Department

The Payment Voucher is legally recognized as a valid method for submitting tax payments to the West Virginia State Tax Department. To ensure its legal standing, it must be filled out correctly and submitted according to state regulations. Compliance with eSignature laws is also essential when submitting electronically. Utilizing a trusted eSignature solution can enhance the legal validity of the document, ensuring that it meets the necessary requirements for acceptance by the state.

Key elements of the Payment Voucher WV State Tax Department

Several key elements must be included in the Payment Voucher to ensure it is processed correctly. These elements typically include:

- Your full name and contact information.

- Your taxpayer identification number or Social Security number.

- The type of tax payment being made.

- The amount of payment.

- A signature, if required, to validate the submission.

Accurate completion of these elements will facilitate timely processing and help avoid any complications with your tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Payment Voucher are critical to avoid penalties and interest. Generally, the due dates align with the tax year and specific tax obligations. For instance, individual income tax payments are typically due on April fifteenth, while corporate tax deadlines may vary. It is essential to check the West Virginia State Tax Department's official schedule for any updates or changes to these deadlines to ensure compliance.

Quick guide on how to complete payment voucher wv state tax department

Prepare Payment Voucher WV State Tax Department with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents swiftly and without hassles. Manage Payment Voucher WV State Tax Department on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Payment Voucher WV State Tax Department effortlessly

- Obtain Payment Voucher WV State Tax Department and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with specific tools offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Payment Voucher WV State Tax Department to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payment voucher wv state tax department

Create this form in 5 minutes!

How to create an eSignature for the payment voucher wv state tax department

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is a Payment Voucher for WV State Tax Department?

A Payment Voucher for the WV State Tax Department is a document used by taxpayers to submit tax payments to the state. It helps ensure that the payment is properly credited to the correct account and is often required for various types of tax filings.

-

How can airSlate SignNow help me manage my Payment Voucher for WV State Tax Department?

airSlate SignNow simplifies the process of creating and eSigning your Payment Voucher for the WV State Tax Department. With our easy-to-use platform, you can generate vouchers quickly, ensuring compliance and reducing the likelihood of errors.

-

Are there any fees associated with using airSlate SignNow for my Payment Voucher WV State Tax Department?

While airSlate SignNow offers a cost-effective solution for document signing, specific fees may apply depending on your usage and selected plan. We provide transparent pricing that allows you to choose the best option for managing your Payment Voucher for the WV State Tax Department.

-

Is airSlate SignNow compliant with WV State Tax Department regulations?

Yes, airSlate SignNow is compliant with all relevant regulations regarding the submission of documents, such as the Payment Voucher for the WV State Tax Department. Our platform is designed to ensure that all signed documents meet legal standards.

-

Can I integrate airSlate SignNow with my accounting software for Payment Voucher submission?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to manage your Payment Voucher for WV State Tax Department along with other financial documents in one place.

-

What are the benefits of using airSlate SignNow for my Payment Voucher?

Using airSlate SignNow for your Payment Voucher for the WV State Tax Department offers several benefits, including increased efficiency, reduced manual errors, and the convenience of electronic signing. This streamlines the process and helps ensure timely payments.

-

How secure is the data when using airSlate SignNow for Payment Voucher transactions?

Security is a top priority at airSlate SignNow. When using our platform for your Payment Voucher for the WV State Tax Department, you can rest assured that your data is protected with advanced encryption methods and secure storage.

Get more for Payment Voucher WV State Tax Department

- Barilla pasta donation request form

- Hunting agreement form

- Safeguard cancellation form

- 4 license form 30795671

- Offer to purchase real estate form

- Graefes archive for clinical and experimental ophthalmology form

- Evacuation code no form

- Ration card application form pdf ration card application form pdf cg ration card application form pdf ampampnbspration card

Find out other Payment Voucher WV State Tax Department

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter