540nr Efile 2018

What is the 540nr efile

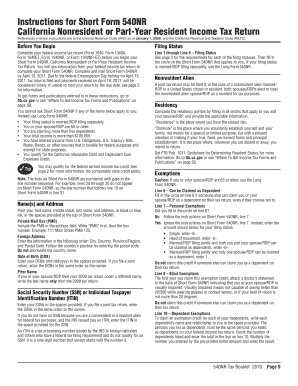

The 540nr efile form is a California state income tax return designed specifically for non-residents. This form allows individuals who earn income in California but do not reside in the state to report their earnings and fulfill their tax obligations. By using the 540nr efile, taxpayers can efficiently submit their returns electronically, ensuring a quicker processing time and reducing the likelihood of errors compared to paper submissions.

How to use the 540nr efile

Using the 540nr efile is straightforward. Taxpayers must gather their income information, including W-2s and 1099s, and any deductions or credits they may qualify for. Once the necessary documents are ready, individuals can access the 540nr efile through authorized e-filing software or platforms. After completing the form, users can electronically sign and submit it, receiving immediate confirmation of their submission. This method not only streamlines the process but also enhances the security of sensitive information.

Steps to complete the 540nr efile

Completing the 540nr efile involves several key steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and any other income statements.

- Determine your filing status and any applicable deductions or credits.

- Access the 540nr efile through a trusted e-filing platform.

- Fill out the form accurately, ensuring all information matches your financial documents.

- Review the completed form for any errors or omissions.

- Electronically sign the form and submit it through the e-filing system.

- Keep a copy of the submitted form and confirmation for your records.

Legal use of the 540nr efile

The 540nr efile is legally binding when completed and submitted according to California state tax laws. To ensure its validity, taxpayers must adhere to the regulations governing e-signatures, which require that the electronic signature be secure and verifiable. Utilizing a platform that complies with the ESIGN Act and UETA ensures that the efile is recognized as a legitimate document by tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 540nr efile to avoid penalties. Typically, the deadline for submitting the 540nr efile aligns with the federal tax filing date, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to check for any specific updates or changes to these dates each tax season.

Required Documents

To successfully complete the 540nr efile, taxpayers need to gather several essential documents, including:

- W-2 forms from employers showing income earned.

- 1099 forms for any additional income sources.

- Records of any deductions or credits claimed.

- Identification information, such as Social Security numbers.

- Any other relevant tax documents that support your income and deductions.

Quick guide on how to complete 540nr efile

Accomplish 540nr Efile effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage 540nr Efile on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign 540nr Efile with ease

- Find 540nr Efile and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form: by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, and errors that require new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign 540nr Efile and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 540nr efile

Create this form in 5 minutes!

How to create an eSignature for the 540nr efile

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 540nr form and why is it important?

The 540nr form is a California Nonresident Income Tax Return used by nonresidents to report income earned in California. Understanding the 540nr is essential for accurately filing taxes and avoiding penalties. By using airSlate SignNow to electronically sign and send your 540nr forms, you streamline the process, ensuring timely submissions.

-

How can airSlate SignNow help with the 540nr filing process?

airSlate SignNow allows you to easily manage and eSign your 540nr forms digitally. With its user-friendly platform, you can complete and send your tax documents securely from any device. This not only saves time but also enhances the accuracy of your filings by reducing manual errors.

-

Is the airSlate SignNow service affordable for small businesses handling 540nr forms?

Yes, airSlate SignNow offers a cost-effective solution that is particularly beneficial for small businesses managing multiple 540nr forms. With various pricing plans, it ensures that you only pay for the features you need. This scalability makes it an ideal choice for businesses of all sizes looking to efficiently handle their document signing.

-

What features does airSlate SignNow offer for enhancing the 540nr signing process?

airSlate SignNow comes with features such as customizable templates, automated workflows, and real-time tracking for document status. These tools ensure that your 540nr forms are completed swiftly and correctly. Additionally, the platform provides secure storage, allowing easy access to your signed documents whenever you need them.

-

Can I integrate airSlate SignNow with other software to manage my 540nr forms?

Absolutely! airSlate SignNow integrates seamlessly with various software such as CRM systems, cloud storage, and productivity tools. This ensures that your workflow remains uninterrupted when handling your 540nr forms. With these integrations, you can centralize your document management for increased efficiency.

-

What are the benefits of using airSlate SignNow for eSigning 540nr forms?

Using airSlate SignNow for eSigning your 540nr forms offers numerous benefits, including faster turnaround times, enhanced security, and improved accessibility. You can execute important documents from anywhere without the need for printing or scanning. This not only improves efficiency but also contributes to a more environmentally friendly process.

-

How does airSlate SignNow ensure the security of my 540nr documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure storage protocols. This protects your sensitive 540nr information from unauthorized access. Additionally, the platform complies with industry standards to ensure that your data remains safe throughout the signing process.

Get more for 540nr Efile

- Hsbc com mx account opening forms

- Application form for the grant of interest loan

- Career paths physiotherapy pdf download form

- Provation anesthesia quality metrics form

- Iht411 form

- 1778av a private american bankcourt voucherlwarrant i i 20 form

- Cape cod national seashore advisory commission notice form

- Consular outreach in las vegas form

Find out other 540nr Efile

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF