Ca 540nr Instructions Form 2015

What is the Ca 540nr Instructions Form

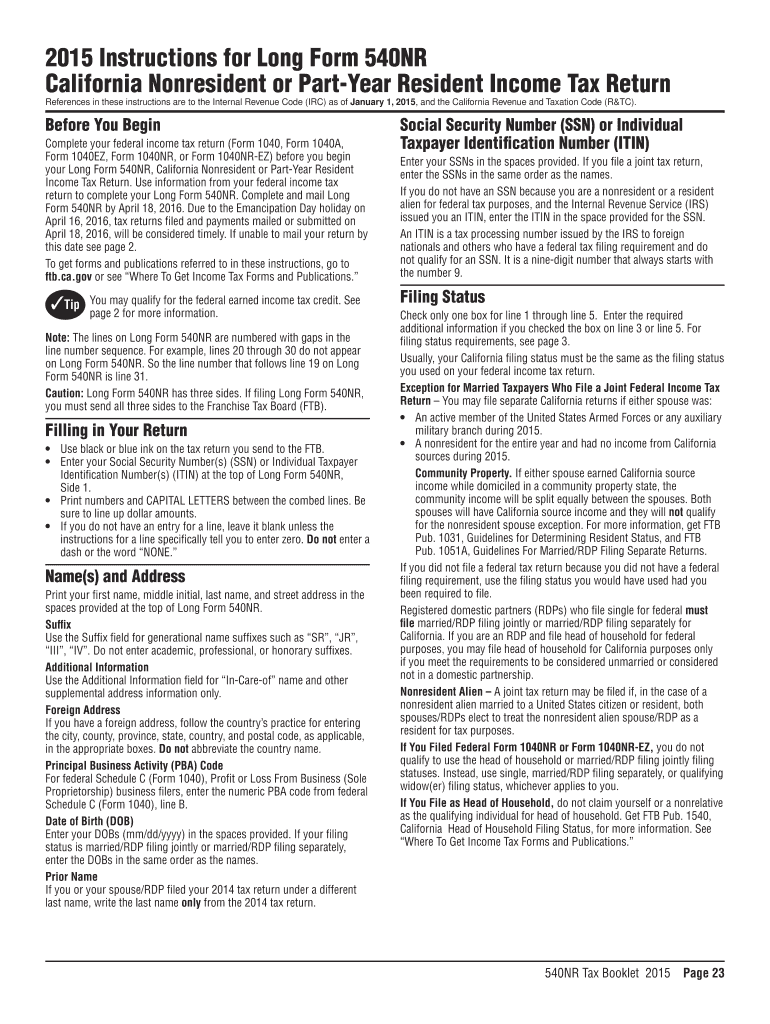

The Ca 540nr Instructions Form is a tax document specifically designed for non-residents who earn income in California. This form provides essential guidelines for completing the California Non-Resident Income Tax Return. It helps taxpayers understand their obligations and ensure compliance with state tax laws. The form outlines the necessary steps to report income, deductions, and credits applicable to non-residents, making it a crucial resource for accurate tax filing.

Steps to complete the Ca 540nr Instructions Form

Completing the Ca 540nr Instructions Form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Review the form's instructions carefully to understand the required information.

- Fill in your personal details, including your name, address, and Social Security number.

- Report your total income earned in California, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax rates.

- Sign and date the form before submitting it.

How to obtain the Ca 540nr Instructions Form

The Ca 540nr Instructions Form can be easily obtained online through the California Franchise Tax Board (FTB) website. Alternatively, taxpayers can request a physical copy by contacting the FTB directly. It is advisable to ensure that you are using the most current version of the form to comply with any recent tax law changes.

Legal use of the Ca 540nr Instructions Form

The Ca 540nr Instructions Form is legally recognized for filing state income taxes in California. It must be completed accurately to ensure compliance with California tax laws. Taxpayers are responsible for providing truthful information, and any discrepancies may result in penalties or audits. Utilizing this form correctly helps maintain legal standing and avoid potential legal issues with the California tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ca 540nr Instructions Form typically align with the federal tax filing schedule. Generally, the deadline for submitting your California non-resident tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions or changes announced by the California Franchise Tax Board, especially in light of recent events that may affect filing schedules.

Required Documents

To complete the Ca 540nr Instructions Form accurately, several documents are required. These include:

- W-2 forms from employers for income earned in California.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation of any deductions or credits being claimed.

- Proof of residency status, if applicable.

Having these documents ready will streamline the process and help ensure that the form is filled out correctly.

Quick guide on how to complete ca 540nr instructions 2015 form

Your assistance manual on how to prepare your Ca 540nr Instructions Form

If you’re uncertain about how to finalize and send your Ca 540nr Instructions Form, below are some brief guidelines on how to simplify tax declarations.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, create, and complete your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to amend responses where necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to finalize your Ca 540nr Instructions Form in a few minutes:

- Establish your account and start working on PDFs in moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Ca 540nr Instructions Form in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Please bear in mind that filing on paper can lead to return errors and delay refunds. It is advisable to review the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct ca 540nr instructions 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

What is the link for filling out the CAT 2015 form?

CAT 2014

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the CA CPT form offline?

To apply for CA CPT offline you need to grow through the following procedure:Download CPT Registration Form from the pdf link above.CPT registration fee is to be paid in the form of Demand Draft drawn in favor of “The Secretary, The Institute of Chartered Accountants of India, payable at concerned Regional Office i.e. Mumbai, Chennai, Kolkata, Kanpur or New Delhi”. If Registration Form is downloaded from the Institute’s website, add Rs. 100/- or US $10 along with Common Proficiency Course (CPC) Registration fee for supply of a copy of the Prospectus along with the study package. For fees related details you check this excellent article CA CPT Registration fees.You should fill following details Name in full (As per SSC X certificates)Sex Date of Birth Mother’s Name and Father’s Name Address Category: General, ST / SC, OBC, Backward Class or Disabled Nationality: Indian or Foreign National Medium of study: English or Hindi Educational Qualifications Details: 10th and 12th Annual income of Parents Demand draft details Affix recent passport size photoPrint out your registration form, attached the documents required and send it to ICAI. Check here for CA CPT Registration required document.For full details on CA CPT registration form offline check here: CA CPT registraiton form offline

Create this form in 5 minutes!

How to create an eSignature for the ca 540nr instructions 2015 form

How to generate an eSignature for your Ca 540nr Instructions 2015 Form online

How to create an eSignature for your Ca 540nr Instructions 2015 Form in Google Chrome

How to make an electronic signature for signing the Ca 540nr Instructions 2015 Form in Gmail

How to make an electronic signature for the Ca 540nr Instructions 2015 Form right from your mobile device

How to make an eSignature for the Ca 540nr Instructions 2015 Form on iOS

How to generate an eSignature for the Ca 540nr Instructions 2015 Form on Android

People also ask

-

What is the Ca 540nr Instructions Form and why is it important?

The Ca 540nr Instructions Form is a crucial document for non-resident taxpayers in California, providing detailed guidelines on how to file your state income tax. Understanding this form helps ensure accurate filing and compliance with California tax regulations, potentially saving you from penalties.

-

How can airSlate SignNow help with the Ca 540nr Instructions Form?

airSlate SignNow streamlines the process of completing and signing the Ca 540nr Instructions Form by providing an intuitive eSignature solution. Users can easily fill out the form online, add digital signatures, and send it securely, making tax filing more efficient.

-

Is there a cost associated with using airSlate SignNow for the Ca 540nr Instructions Form?

Yes, airSlate SignNow offers a range of pricing plans that cater to different needs. The cost-effective solution allows users to access features for managing the Ca 540nr Instructions Form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the Ca 540nr Instructions Form?

airSlate SignNow provides essential features such as customizable templates, in-app document editing, and secure cloud storage, specifically for forms like the Ca 540nr Instructions Form. These features enhance user experience and simplify the tax filing process.

-

Can I integrate airSlate SignNow with other applications for handling the Ca 540nr Instructions Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to manage the Ca 540nr Instructions Form alongside their existing workflows. This integration helps streamline document management and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the Ca 540nr Instructions Form?

Using airSlate SignNow for the Ca 540nr Instructions Form offers numerous benefits, including time-saving automation, secure document handling, and easy collaboration. These advantages ensure that your tax filing process is efficient and stress-free.

-

How secure is airSlate SignNow when handling the Ca 540nr Instructions Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information within the Ca 540nr Instructions Form. Users can confidently sign and share documents knowing their data is secure.

Get more for Ca 540nr Instructions Form

Find out other Ca 540nr Instructions Form

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free