Ftb 3538 2019

What is the FTB 3538

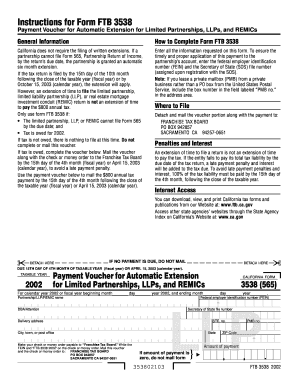

The FTB 3538 form, officially known as the California Nonresident or Part-Year Resident Income Tax Return, is a crucial document for individuals who earn income in California but do not reside there full-time. This form allows nonresidents to report their California-source income, ensuring compliance with state tax laws. It is essential for accurately calculating the tax owed on income generated within the state, which may include wages, rental income, or business earnings.

How to use the FTB 3538

Using the FTB 3538 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements relevant to your earnings in California. Next, complete the form by accurately reporting your income, deductions, and credits. It is important to follow the instructions provided with the form to ensure all information is correctly filled out. Once completed, you can submit the form either online, by mail, or in person, depending on your preference and the guidelines set by the California Franchise Tax Board.

Steps to complete the FTB 3538

Completing the FTB 3538 requires a systematic approach:

- Collect all income documentation, including any relevant tax forms.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your California-source income accurately in the designated sections.

- Claim any applicable deductions or credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the FTB 3538

The FTB 3538 is legally binding when completed accurately and submitted on time. It is essential to ensure that all information provided is truthful and reflects your actual income and tax situation. Filing this form correctly helps avoid legal issues with the California Franchise Tax Board, including potential audits or penalties. Compliance with state tax laws not only protects you legally but also contributes to the proper funding of public services within California.

Form Submission Methods

The FTB 3538 can be submitted through various methods, offering flexibility to taxpayers:

- Online: Submit your form electronically through the California Franchise Tax Board's website, which may expedite processing times.

- By Mail: Print the completed form and send it to the appropriate address provided in the instructions.

- In Person: Deliver the form directly to a local California Franchise Tax Board office, if preferred.

Who Issues the Form

The FTB 3538 is issued by the California Franchise Tax Board, the state agency responsible for administering California's income tax laws. This agency oversees the collection of taxes and ensures compliance with state regulations. The FTB provides resources and assistance for taxpayers to understand and complete their tax obligations accurately.

Quick guide on how to complete ftb 3538

Complete Ftb 3538 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Ftb 3538 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Ftb 3538 with ease

- Locate Ftb 3538 and select Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ftb 3538 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 3538

Create this form in 5 minutes!

How to create an eSignature for the ftb 3538

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the ftb 3538 form and why is it important?

The ftb 3538 form, used for California taxpayers, is critical for reporting certain tax-related information. Understanding how to complete this form correctly can help businesses avoid penalties and ensure compliance with state tax regulations. airSlate SignNow can simplify the process of signing and submitting your ftb 3538.

-

How does airSlate SignNow facilitate the signing of the ftb 3538?

airSlate SignNow provides a straightforward platform to eSign documents, including the ftb 3538 form. Its user-friendly interface allows users to manage their documents efficiently, ensuring that the signing process is quick and secure. This enhances the overall experience for businesses dealing with tax documentation.

-

Are there any costs associated with using airSlate SignNow for the ftb 3538?

airSlate SignNow offers competitive pricing options that cater to various business needs when handling the ftb 3538. While basic features may be available for free, premium plans provide advanced functionalities, ensuring a cost-effective solution for all your signing and document management needs.

-

What features does airSlate SignNow offer for managing the ftb 3538?

airSlate SignNow includes several features that benefit users dealing with the ftb 3538, such as document templates, customizable workflows, and reminders for signing deadlines. These tools help streamline the document signing process, making it easier to manage and organize important tax forms efficiently.

-

Can I integrate airSlate SignNow with other tools for my ftb 3538 filings?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage the ftb 3538 form effectively. By connecting with tools like CRM systems or accounting software, you can automate workflows and ensure that your tax documents are in sync with your overall business operations.

-

What are the benefits of eSigning the ftb 3538 with airSlate SignNow?

eSigning the ftb 3538 with airSlate SignNow provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. With digital signatures, you can ensure that your documents are signed quickly and securely, while also maintaining a digital record for future reference.

-

Is airSlate SignNow user-friendly for first-time users of the ftb 3538?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it easy for first-time users to navigate the platform while completing the ftb 3538. With comprehensive support resources and a straightforward interface, users can quickly learn how to manage their documents effectively.

Get more for Ftb 3538

Find out other Ftb 3538

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free