Instructions for Form FTB 3538 E Form RS Login 2019

Understanding Form FTB 3538 Instructions

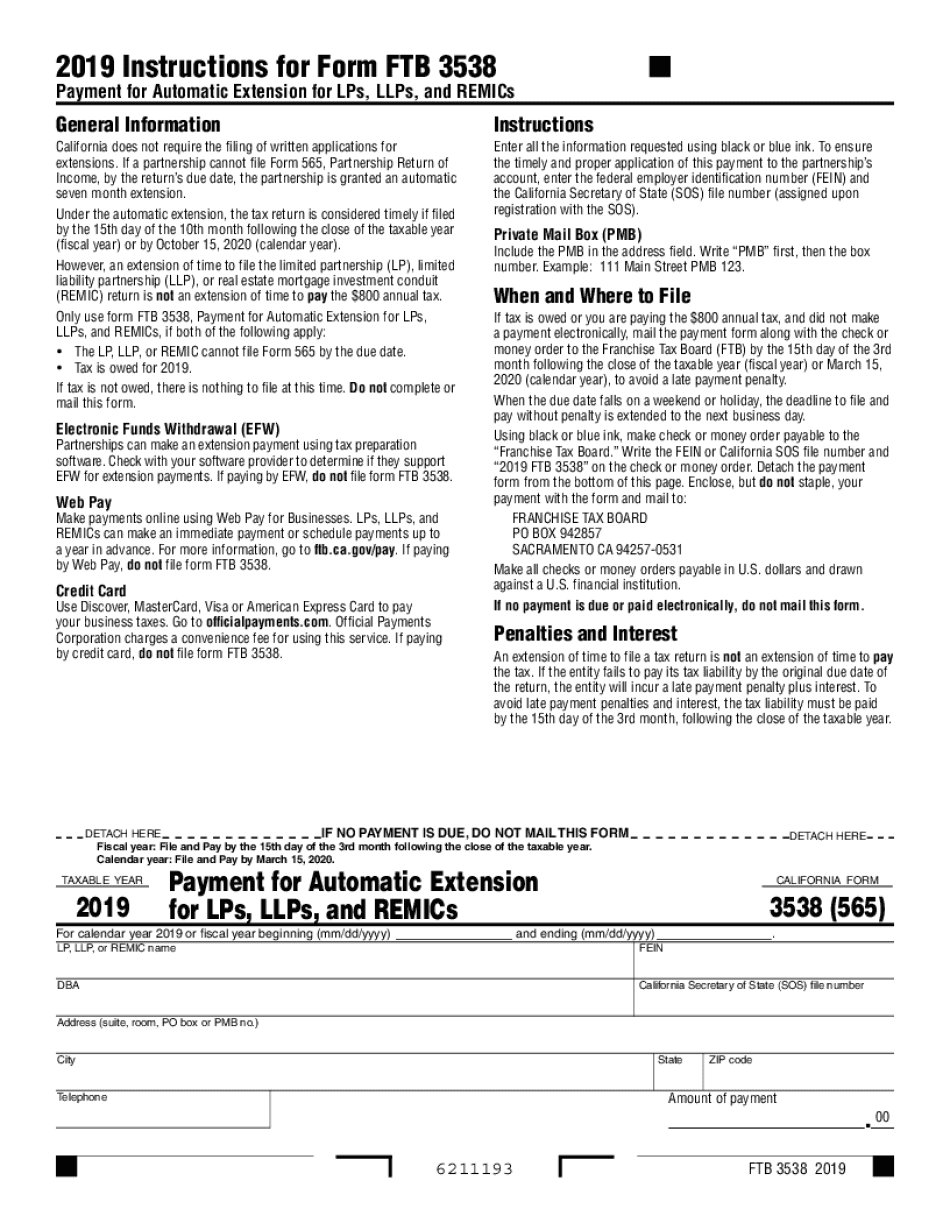

The Instructions for Form FTB 3538 provide essential guidance for individuals and businesses in California seeking to file for a tax extension. This form, often referred to as the California extension form, allows taxpayers to request an extension for filing their state income tax returns. Understanding the nuances of these instructions is crucial for ensuring compliance with California tax laws and avoiding potential penalties. The instructions detail the eligibility criteria, the necessary information to include, and the deadlines for submission, making it easier for taxpayers to navigate the process.

Steps to Complete Form FTB 3538

Completing the Instructions for Form FTB 3538 involves several key steps to ensure accuracy and compliance. First, gather all required documents, including your previous year’s tax return, income statements, and any relevant financial information. Next, follow the instructions carefully, filling out each section of the form accurately. Pay close attention to details such as your Social Security number, filing status, and the amount of tax you expect to owe. After completing the form, review it for any errors before submission to avoid delays or rejections.

Filing Deadlines for Form FTB 3538

Understanding the filing deadlines for Form FTB 3538 is vital for taxpayers seeking an extension. Typically, the deadline to file this form aligns with the original due date of your California income tax return. It is important to submit the form by this deadline to avoid penalties. For the current tax year, check the California Franchise Tax Board’s official website for specific dates, as they may vary annually. Timely submission ensures that you receive the extension you need without incurring additional fees.

Required Documents for Filing Form FTB 3538

When preparing to file Form FTB 3538, certain documents are necessary to complete the process effectively. These may include your previous year’s tax return, W-2 forms, 1099 forms, and any other income documentation. Additionally, if you are claiming deductions or credits, gather supporting documents such as receipts or statements. Having these documents ready will streamline the completion of the form and help ensure that all information provided is accurate and complete.

Legal Use of Form FTB 3538 Instructions

The legal use of the Instructions for Form FTB 3538 is crucial for maintaining compliance with California tax regulations. These instructions serve as an official guide for taxpayers, outlining their rights and responsibilities when filing for a tax extension. Using the form in accordance with the provided instructions ensures that taxpayers are protected under California law, minimizing the risk of penalties for late filing or non-compliance. It is advisable to consult a tax professional if there are any uncertainties regarding the legal implications of the form.

Form Submission Methods for FTB 3538

Form FTB 3538 can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include online filing through the California Franchise Tax Board’s website, mailing a paper form, or delivering it in person to a local office. Each method has its advantages, such as immediate confirmation for online submissions or the ability to track mailed forms. Choosing the right submission method can enhance the efficiency of your filing process, ensuring that your request for an extension is received on time.

Penalties for Non-Compliance with FTB 3538

Failing to comply with the requirements of Form FTB 3538 can result in significant penalties. If the form is not filed by the deadline, taxpayers may face late filing fees, interest on unpaid taxes, and potential legal action from the California Franchise Tax Board. It is essential to adhere to the instructions and submit the form on time to avoid these consequences. Understanding the potential penalties emphasizes the importance of timely and accurate filing, ensuring that taxpayers remain in good standing with state tax authorities.

Quick guide on how to complete instructions for form ftb 3538 e form rs login

Easily Prepare Instructions For Form FTB 3538 E Form RS Login on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Instructions For Form FTB 3538 E Form RS Login on any device with airSlate SignNow’s Android or iOS applications and simplify any process involving paperwork today.

The easiest way to edit and electronically sign Instructions For Form FTB 3538 E Form RS Login effortlessly

- Obtain Instructions For Form FTB 3538 E Form RS Login and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Stop worrying about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Instructions For Form FTB 3538 E Form RS Login to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3538 e form rs login

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3538 e form rs login

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What are form 565 instructions and why are they important?

Form 565 instructions provide crucial guidelines on how to correctly fill out and file Form 565 for California partnerships. These instructions help ensure compliance with state regulations and can prevent costly errors during filing. Adhering to the form 565 instructions is key to successful tax reporting and optimizing potential tax benefits.

-

How can airSlate SignNow assist with form 565 instructions?

airSlate SignNow simplifies the process of managing documents related to form 565 instructions by allowing users to send, sign, and store forms electronically. This helps streamline the completion of necessary paperwork and ensures that all parties have access to the latest form 565 instructions. Our platform's ease of use enhances productivity and minimizes the risk of errors.

-

What features does airSlate SignNow offer for managing form 565 instructions?

AirSlate SignNow offers features such as document templates, interactive signing, and real-time tracking to support users with form 565 instructions. These tools enable efficient collaboration among team members and clients, making the filing process smoother. With secure storage options, users can always access the form 565 instructions whenever needed.

-

Is there a cost for using airSlate SignNow for form 565 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when utilizing form 565 instructions. Our cost-effective solutions ensure you have access to all necessary features for document management while remaining budget-friendly. For accurate pricing based on your requirements, you can visit our pricing page.

-

What benefits can businesses expect from using airSlate SignNow with form 565 instructions?

By using airSlate SignNow for form 565 instructions, businesses can expect increased efficiency in document processing, reduced turnaround times, and improved accuracy in filing. The platform enhances organization, making it easier to manage tax documents. Furthermore, our eSignature feature ensures that all required parties can sign documents seamlessly, expediting the filing process.

-

Can I integrate airSlate SignNow into my existing software for form 565 instructions?

Yes, airSlate SignNow offers seamless integrations with many popular software applications, facilitating efficient workflows for managing form 565 instructions. These integrations allow users to connect with CRM systems, accounting software, and more, ensuring that all necessary data is in one place. This makes the overall process of handling form 565 instructions more streamlined and effective.

-

What types of businesses can benefit from airSlate SignNow related to form 565 instructions?

Any business that needs to file Form 565, including partnerships across various industries, can benefit from airSlate SignNow. Whether you're a small business, a startup, or a large corporation, our platform provides the tools necessary to comply with form 565 instructions efficiently. It optimally fits companies that wish to improve their document workflow related to tax forms.

Get more for Instructions For Form FTB 3538 E Form RS Login

Find out other Instructions For Form FTB 3538 E Form RS Login

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format