California Form 3538 565 Payment for Automatic Extension for LPs, LLPs, and REMICs 2022-2026

Understanding the California Form 3538 565 Payment for Automatic Extension

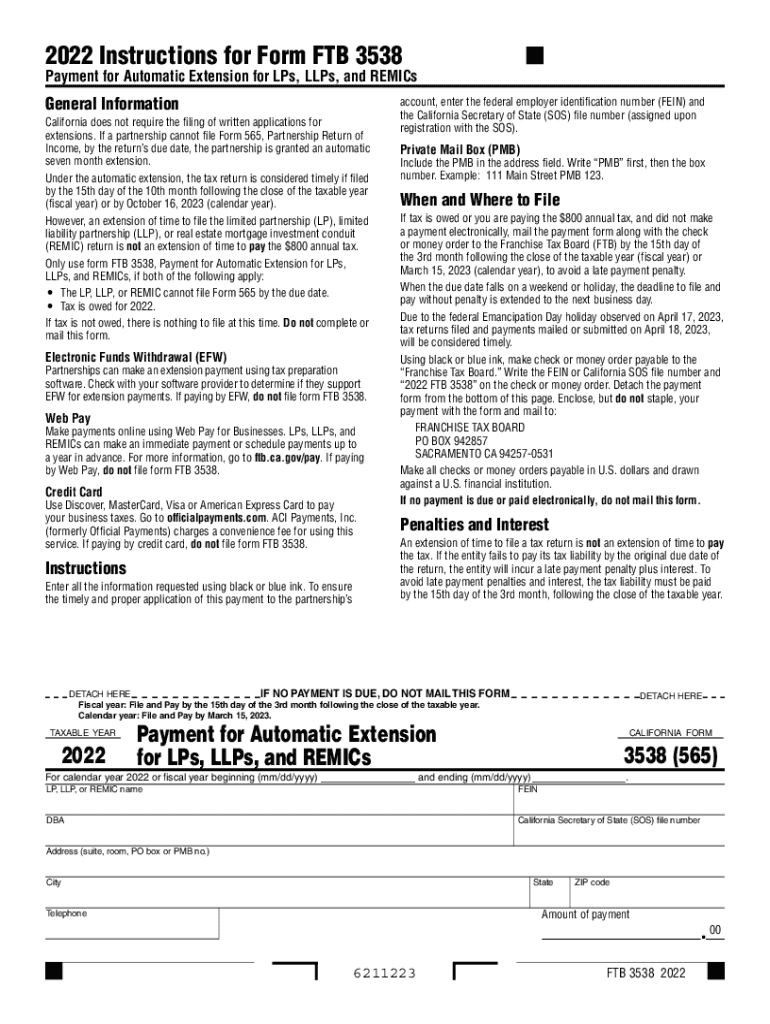

The California Form 3538 565 is specifically designed for limited partnerships (LPs), limited liability partnerships (LLPs), and real estate mortgage investment conduits (REMICs) seeking an automatic extension for their tax filing. This form allows these entities to request an extension of time to file their California tax returns without incurring penalties, as long as the payment is submitted by the due date. It is essential for businesses to understand the implications of this form to ensure compliance with state tax regulations.

Steps to Complete the California Form 3538 565

Completing the California Form 3538 565 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information related to your partnership or entity. This includes income statements, deductions, and any relevant tax documents. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to the payment section, as this will determine the amount owed for the extension. Finally, review the form for any errors before submission to avoid delays or penalties.

Filing Deadlines for the California Form 3538 565

Timely submission of the California Form 3538 565 is crucial to avoid penalties. The form is typically due on the original due date of the tax return for the entity. For most partnerships, this date falls on the 15th day of the third month after the end of the taxable year. It is important to stay informed about any changes to these deadlines and ensure that the form and payment are submitted on time to maintain compliance with California tax laws.

Legal Use of the California Form 3538 565

The legal use of the California Form 3538 565 is governed by state tax laws. This form serves as a formal request for an extension, allowing LPs and LLPs to defer their tax filing without incurring immediate penalties. However, it is important to note that while the extension allows for additional time to file, it does not extend the time to pay any taxes owed. Therefore, entities must ensure that they make the appropriate payment by the deadline to avoid interest and penalties.

Key Elements of the California Form 3538 565

Several key elements must be included when completing the California Form 3538 565. These include the entity's name, address, and federal employer identification number (EIN). Additionally, the form requires the total amount of the payment being submitted for the extension. Accurate reporting of these elements is vital to ensure that the form is processed correctly by the California Franchise Tax Board.

Obtaining the California Form 3538 565

The California Form 3538 565 can be easily obtained from the California Franchise Tax Board's official website. It is available in a fillable PDF format, allowing businesses to complete the form electronically. Additionally, physical copies can be requested if preferred. Ensuring that you have the most current version of the form is essential for compliance and accurate submission.

Quick guide on how to complete 2022 california form 3538 565 payment for automatic extension for lps llps and remics

Easily Prepare California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Handle California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Edit and eSign California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs Effortlessly

- Find California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this task.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 california form 3538 565 payment for automatic extension for lps llps and remics

Create this form in 5 minutes!

People also ask

-

What is 2022 3538 llps?

The 2022 3538 llps refers to a specific solution or feature set that businesses can utilize through airSlate SignNow. It includes capabilities for efficiently managing electronic signatures and document workflows, making it ideal for modern business needs. By leveraging the 2022 3538 llps, companies can enhance their productivity while ensuring compliance.

-

How does the pricing for 2022 3538 llps work?

Pricing for the 2022 3538 llps is designed to be cost-effective, catering to businesses of all sizes. Depending on your specific needs and volume of usage, there are various pricing tiers available to choose from. This flexibility allows businesses to select a plan that best fits their budget while still accessing essential features.

-

What features are included in the 2022 3538 llps?

The 2022 3538 llps includes a variety of features such as customizable templates, advanced security options, and real-time document tracking. These features empower businesses to streamline their document management processes effectively. Access to these functionalities can greatly improve efficiency in signing and managing contracts.

-

What are the benefits of using the 2022 3538 llps for signing documents?

Using the 2022 3538 llps offers several benefits, including enhanced speed, reduced costs, and improved security for document transactions. By digitizing the signing process, businesses can save time and eliminate the need for paper-based workflows. Additionally, the built-in security features help protect sensitive information.

-

Can the 2022 3538 llps integrate with other software solutions?

Yes, the 2022 3538 llps is designed to easily integrate with a variety of software applications, including CRM and project management tools. This integration capability allows businesses to create a seamless workflow that enhances productivity. By connecting with existing tools, teams can work more efficiently without disrupting their established processes.

-

Is training available for using the 2022 3538 llps?

Absolutely! Training and support for using the 2022 3538 llps are readily available through airSlate SignNow. They provide comprehensive tutorials, webinars, and customer support to ensure all users can maximize the effectiveness of the platform. This support is critical in helping teams adopt the solution smoothly.

-

What kind of customer support is offered for the 2022 3538 llps?

Customer support for the 2022 3538 llps is robust and includes various channels such as live chat, email support, and a detailed help center. This ensures that users can access assistance whenever they encounter challenges or have questions. Reliable customer support contributes to a positive user experience with airSlate SignNow.

Get more for California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs

Find out other California Form 3538 565 Payment For Automatic Extension For LPs, LLPs, And REMICs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors