Ga Form 500 Nol Instructions 2020

Understanding the Georgia Form 500 NOL Instructions

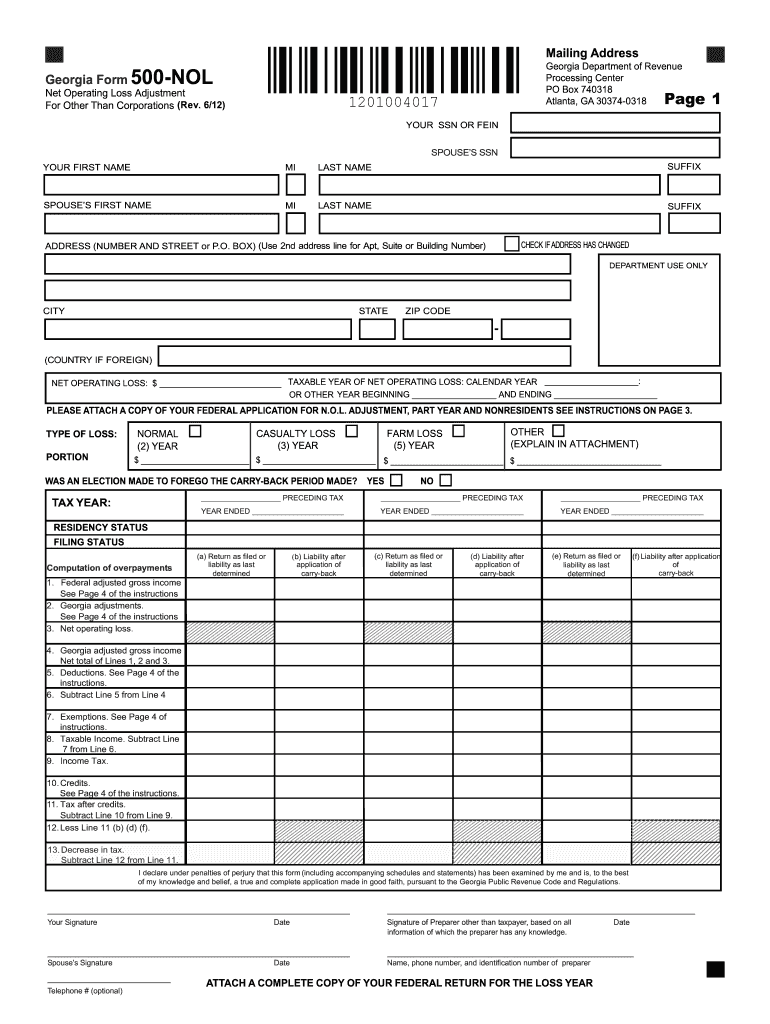

The Georgia Form 500 NOL is designed for taxpayers who have incurred a net operating loss and wish to carry it back or forward to offset taxable income. This form is critical for individuals and businesses to ensure they maximize their tax benefits. The instructions provide detailed guidance on how to correctly fill out the form, including eligibility criteria and necessary calculations. Understanding these instructions is essential for compliance and to avoid potential penalties.

Steps to Complete the Georgia Form 500 NOL

Completing the Georgia Form 500 NOL involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Calculate your net operating loss based on your total income and allowable deductions.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the instructions for any specific requirements related to your situation.

- Submit the completed form by the designated deadline.

Following these steps carefully will help ensure that your filing is accurate and compliant with state regulations.

Key Elements of the Georgia Form 500 NOL Instructions

The instructions for the Georgia Form 500 NOL include several key elements that are crucial for successful completion:

- Eligibility Criteria: Defines who can use the form, including individual taxpayers and business entities.

- Calculation Methods: Provides formulas for determining the net operating loss.

- Filing Requirements: Details what additional documentation must accompany the form.

- Submission Methods: Outlines how to submit the form, whether electronically or by mail.

Understanding these elements will facilitate a smoother filing process.

Filing Deadlines for the Georgia Form 500 NOL

Timely filing of the Georgia Form 500 NOL is essential to avoid penalties. The deadlines may vary based on whether you are carrying back or carrying forward the loss. Generally, the form must be filed within three years from the original due date of the return for the year in which the loss occurred. Keeping track of these deadlines ensures that you can take full advantage of your net operating loss.

Legal Use of the Georgia Form 500 NOL Instructions

The Georgia Form 500 NOL instructions are legally binding and must be followed to ensure compliance with state tax laws. The instructions outline the legal framework surrounding net operating losses, including how they can be utilized for tax relief. Any deviation from these guidelines may result in penalties or denial of the loss carryback or carryforward claims. Therefore, it is important to adhere strictly to the instructions provided.

Obtaining the Georgia Form 500 NOL Instructions

The Georgia Form 500 NOL instructions can be obtained through the Georgia Department of Revenue website or by contacting their office directly. They are typically available in a downloadable PDF format, making it easy to access and print. Ensuring you have the most current version of the instructions is essential for accurate completion of the form.

Quick guide on how to complete ga form 500 nol instructions

Effortlessly Prepare Ga Form 500 Nol Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly and without hassles. Manage Ga Form 500 Nol Instructions on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Ga Form 500 Nol Instructions with Ease

- Find Ga Form 500 Nol Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ga Form 500 Nol Instructions to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ga form 500 nol instructions

Create this form in 5 minutes!

How to create an eSignature for the ga form 500 nol instructions

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Georgia Form 500 NOL?

The Georgia Form 500 NOL is a tax form used to carry forward Net Operating Losses for state tax purposes in Georgia. Businesses can utilize this form to reduce their taxable income for future tax years. Make sure to understand the guidelines for filing and reporting to maximize your benefits.

-

How can airSlate SignNow help with Georgia Form 500 NOL submissions?

airSlate SignNow simplifies the process of signing and sending Georgia Form 500 NOL documents electronically. With its user-friendly interface, you can ensure compliance and accuracy when submitting this important tax form. Plus, the platform allows for quick turnaround times, enhancing your overall efficiency.

-

Is there a cost associated with using airSlate SignNow for Georgia Form 500 NOL?

Yes, airSlate SignNow offers various pricing plans that cater to different needs and budgets. Whether you are a small business or a larger enterprise, you can find a plan that suits your requirements for preparing Georgia Form 500 NOL. Check our website for detailed pricing information and features.

-

What features are available for managing Georgia Form 500 NOL?

airSlate SignNow includes features such as document templates, electronic signatures, and workflow automation specifically tailored for forms like the Georgia Form 500 NOL. These features help streamline your documentation process and ensure your submissions are efficient and error-free.

-

Can I integrate airSlate SignNow with other accounting software for Georgia Form 500 NOL?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software to enhance your workflow for managing the Georgia Form 500 NOL. This integration allows you to easily import and export data, ensuring that your documentation is consistent and accurate.

-

What benefits does airSlate SignNow provide for businesses handling Georgia Form 500 NOL?

Using airSlate SignNow for your Georgia Form 500 NOL offers several benefits, including improved efficiency, reduced paperwork, and enhanced tracking capabilities. The digital process not only saves time but also minimizes the likelihood of errors associated with traditional paper forms.

-

Is airSlate SignNow secure for handling Georgia Form 500 NOL?

Absolutely, airSlate SignNow employs robust security measures to protect your documents and sensitive information, including those pertaining to the Georgia Form 500 NOL. With features like encrypted storage and authenticated access, you can trust that your data is safe.

Get more for Ga Form 500 Nol Instructions

Find out other Ga Form 500 Nol Instructions

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile