PIT ITNRC Return Instructions Draft FI 121015 Indd 2020

What is the PIT ITNRC Return Instructions Draft FI 121015 indd

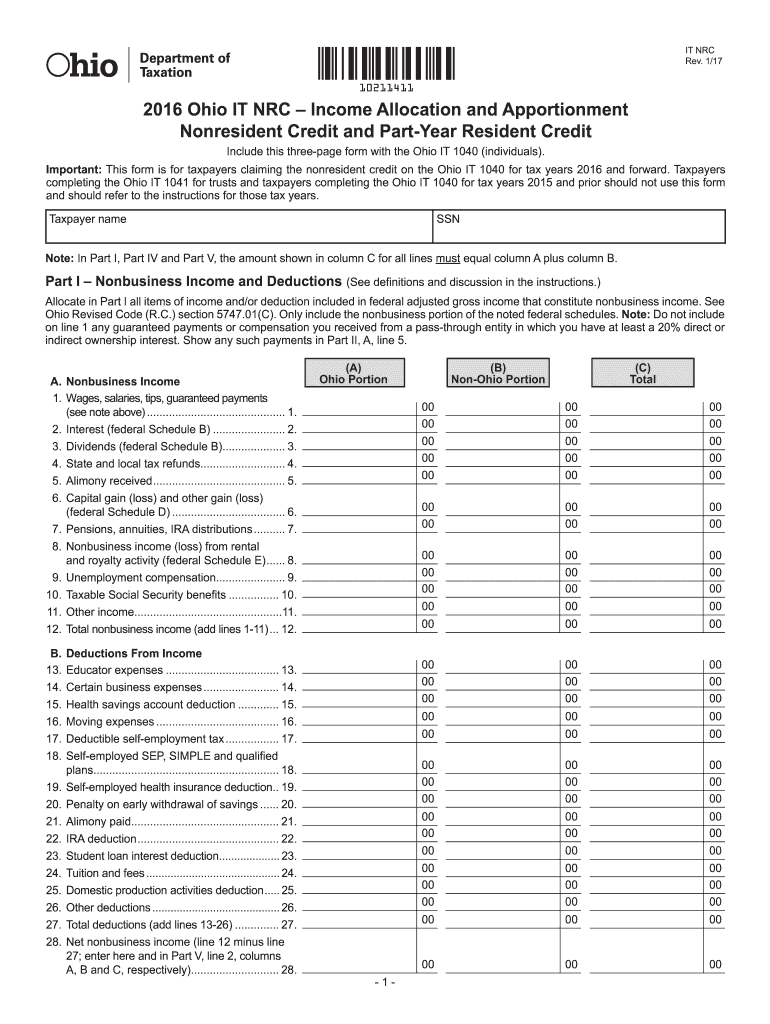

The PIT ITNRC Return Instructions Draft FI 121015 indd is a specific document designed to provide guidance on the completion and submission of the PIT ITNRC return. This form is typically used by individuals and businesses to ensure compliance with tax regulations. It outlines the necessary steps, required information, and important deadlines associated with the return process. Understanding this document is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the PIT ITNRC Return Instructions Draft FI 121015 indd

Completing the PIT ITNRC Return Instructions Draft FI 121015 indd involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Review the instructions carefully to understand the specific requirements for your situation.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check your entries for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the PIT ITNRC Return Instructions Draft FI 121015 indd

The legal use of the PIT ITNRC Return Instructions Draft FI 121015 indd is governed by federal and state tax laws. To be considered valid, the form must be completed in accordance with the guidelines provided. This includes using appropriate signatures and ensuring that all required fields are filled out. Compliance with these regulations is essential to avoid legal issues and ensure that the return is processed without complications.

Filing Deadlines / Important Dates

Filing deadlines for the PIT ITNRC Return Instructions Draft FI 121015 indd are critical to ensure timely submission and avoid penalties. Typically, the deadline falls on April fifteenth of each year, unless it falls on a weekend or holiday. It is important to stay informed about any changes to the filing schedule, as extensions or adjustments may be announced by tax authorities.

Required Documents

To complete the PIT ITNRC Return Instructions Draft FI 121015 indd, several documents are required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation requested by the IRS or state tax authority.

Examples of using the PIT ITNRC Return Instructions Draft FI 121015 indd

Examples of using the PIT ITNRC Return Instructions Draft FI 121015 indd include:

- Individuals filing their annual income tax returns.

- Small business owners reporting their earnings and expenses.

- Freelancers compiling income from various sources for tax purposes.

Quick guide on how to complete pit itnrc return instructions draft fi 121015indd

Effortlessly Prepare PIT ITNRC Return Instructions Draft FI 121015 indd on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly, without any holdups. Handle PIT ITNRC Return Instructions Draft FI 121015 indd on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign PIT ITNRC Return Instructions Draft FI 121015 indd effortlessly

- Locate PIT ITNRC Return Instructions Draft FI 121015 indd and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in a few clicks from whichever device you prefer. Modify and eSign PIT ITNRC Return Instructions Draft FI 121015 indd to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pit itnrc return instructions draft fi 121015indd

Create this form in 5 minutes!

How to create an eSignature for the pit itnrc return instructions draft fi 121015indd

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is PIT ITNRC Return Instructions Draft FI 121015 indd?

The PIT ITNRC Return Instructions Draft FI 121015 indd is a document designed to guide users through the process of filing their PIT ITNRC returns. It provides detailed instructions, ensuring that businesses comply with the necessary regulations. Utilizing this document can streamline the filing process and minimize errors.

-

How can airSlate SignNow help with the PIT ITNRC Return Instructions Draft FI 121015 indd?

airSlate SignNow offers a user-friendly platform that allows users to electronically sign and send the PIT ITNRC Return Instructions Draft FI 121015 indd quickly. By digitizing the process, businesses can enhance efficiency and reduce time spent on paperwork. This ensures that important documents are handled securely and promptly.

-

Is there a cost associated with using airSlate SignNow for PIT ITNRC Return Instructions Draft FI 121015 indd?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses using the PIT ITNRC Return Instructions Draft FI 121015 indd. Pricing is competitive, providing a cost-effective solution for essential document management. Be sure to check the website for the latest pricing details and available offers.

-

What features does airSlate SignNow offer for managing PIT ITNRC Return Instructions Draft FI 121015 indd?

airSlate SignNow includes features such as electronic signatures, customizable templates, and automated workflows specifically for documents like the PIT ITNRC Return Instructions Draft FI 121015 indd. These tools enhance collaboration and make managing important documentation more straightforward. Additionally, integration with other platforms further improves usability.

-

Can I integrate airSlate SignNow with other software for PIT ITNRC Return Instructions Draft FI 121015 indd?

Absolutely! airSlate SignNow provides seamless integration with various applications, enhancing its functionality for managing the PIT ITNRC Return Instructions Draft FI 121015 indd. This capability allows businesses to incorporate document management into their current workflows easily, leading to a more efficient process.

-

What are the benefits of using airSlate SignNow for PIT ITNRC Return Instructions Draft FI 121015 indd?

Using airSlate SignNow for the PIT ITNRC Return Instructions Draft FI 121015 indd can save time and resources by simplifying the signing process. It ensures secure document handling and provides a comprehensive solution for electronic signatures, enabling businesses to focus on their core operations while enhancing compliance.

-

Is training available for using airSlate SignNow with PIT ITNRC Return Instructions Draft FI 121015 indd?

Yes, airSlate SignNow offers guides and resources to assist users in navigating the platform effectively, particularly when dealing with the PIT ITNRC Return Instructions Draft FI 121015 indd. This training ensures that users can fully leverage the tool's features for optimal document management and compliance.

Get more for PIT ITNRC Return Instructions Draft FI 121015 indd

- Fillable std results form

- Church employment application form

- Pedi ikdc pdf form

- Sample expression of interest proposal pdf form

- Healthy food lesson plan for grade 1 form

- Cgfns international sweepstakes form

- Download job application east coast property management form

- Ds 5511 affidavit for the surviving spouse or next of kin form

Find out other PIT ITNRC Return Instructions Draft FI 121015 indd

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple