Franklin County Area Tax Bureau Form 541

What is the Franklin County Area Tax Bureau Form 541

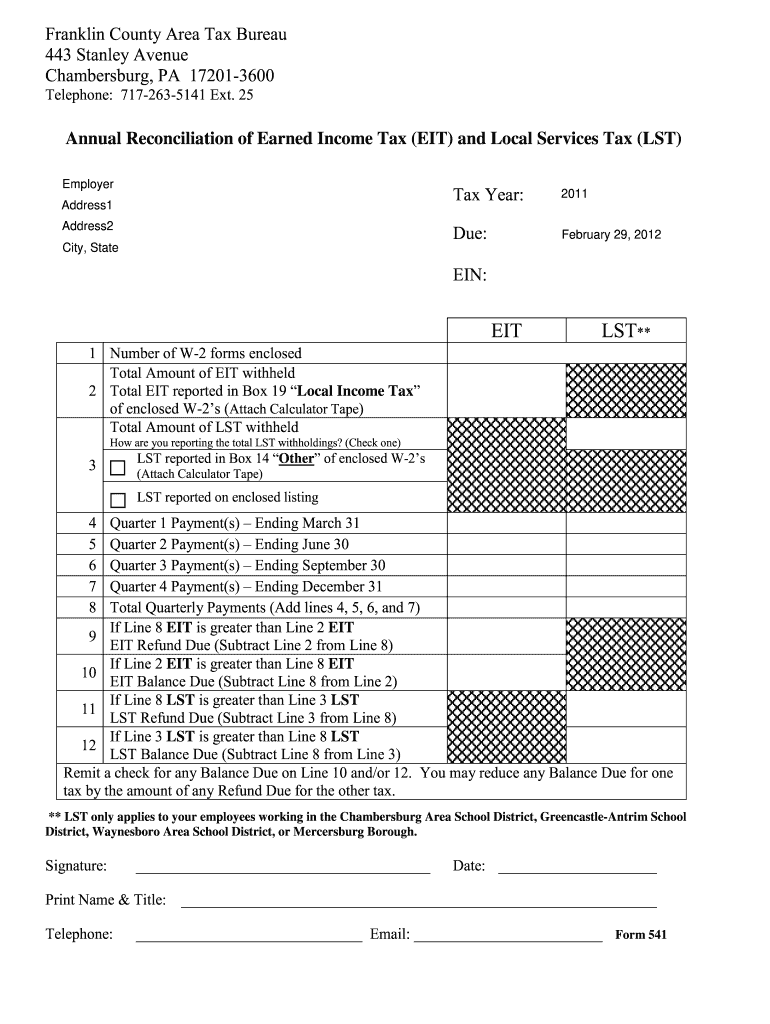

The Franklin County Area Tax Bureau Form 541 is a tax document used by residents of Franklin County, Pennsylvania, to report local earned income and net profits tax. This form is essential for individuals and businesses to ensure compliance with local tax regulations. It collects information about income earned within the county and helps determine the appropriate tax liabilities.

How to use the Franklin County Area Tax Bureau Form 541

Using the Franklin County Area Tax Bureau Form 541 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form, ensuring that all income sources are reported. After completing the form, review it for accuracy before submission. This helps prevent delays or issues with processing your tax return.

Steps to complete the Franklin County Area Tax Bureau Form 541

Completing the Franklin County Area Tax Bureau Form 541 can be broken down into a series of straightforward steps:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the Franklin County Area Tax Bureau via the chosen method.

Legal use of the Franklin County Area Tax Bureau Form 541

The legal use of the Franklin County Area Tax Bureau Form 541 is crucial for ensuring compliance with local tax laws. When filled out correctly, this form serves as a legally binding document that reflects your tax obligations. It is important to adhere to all guidelines and regulations set forth by the Franklin County Area Tax Bureau to avoid penalties or legal issues.

Key elements of the Franklin County Area Tax Bureau Form 541

Key elements of the Franklin County Area Tax Bureau Form 541 include:

- Personal identification information, such as name and Social Security number.

- Detailed reporting of all income sources, including wages, self-employment income, and other earnings.

- Calculations for tax liabilities based on the reported income.

- Signature and date to validate the information provided.

Form Submission Methods

The Franklin County Area Tax Bureau Form 541 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Franklin County Area Tax Bureau's official website.

- Mailing the completed form to the designated tax bureau address.

- In-person submission at the tax bureau office during business hours.

Quick guide on how to complete franklin county area tax bureau form 541

Complete Franklin County Area Tax Bureau Form 541 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Franklin County Area Tax Bureau Form 541 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Franklin County Area Tax Bureau Form 541 with ease

- Locate Franklin County Area Tax Bureau Form 541 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Franklin County Area Tax Bureau Form 541 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the franklin county area tax bureau form 541

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What services does the Franklin County Area Tax Bureau offer?

The Franklin County Area Tax Bureau provides a range of tax-related services including property tax assessment, income tax collection, and tax compliance assistance. Their goal is to support residents and businesses in understanding their tax obligations. Utilizing the bureau's resources can also help individuals navigate complex tax regulations efficiently.

-

How can I contact the Franklin County Area Tax Bureau for assistance?

You can signNow the Franklin County Area Tax Bureau by phone, email, or through their official website. They offer various contact options to ensure you receive the assistance you need regarding tax-related inquiries. It’s recommended to check their website for specific contact hours and additional resources.

-

Is there a fee for using services provided by the Franklin County Area Tax Bureau?

The Franklin County Area Tax Bureau may impose fees for certain services, such as document processing or compliance assistance. Typically, these fees are outlined clearly on their website or in communications from the bureau. It's advisable to review their pricing structure to understand any potential costs involved.

-

What benefits does airSlate SignNow provide for interacting with the Franklin County Area Tax Bureau?

Using airSlate SignNow can signNowly streamline interactions with the Franklin County Area Tax Bureau by allowing you to eSign necessary documents quickly and securely. This eliminates the hassle of printing, signing, and scanning, making the entire process more efficient. Additionally, it enhances document tracking, ensuring you stay organized.

-

Can airSlate SignNow integrate with other software used by the Franklin County Area Tax Bureau?

Yes, airSlate SignNow offers integrations with various software applications that can be utilized by the Franklin County Area Tax Bureau. This interoperability enhances user experience by enabling seamless document flow between platforms. As a result, users can manage their tax documentation effortlessly, enhancing productivity.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow offers features like custom templates, automated workflows, and secure cloud storage specifically designed for tax document management. These features cater to the needs of those dealing with the Franklin County Area Tax Bureau, making it easier to prepare, sign, and store essential tax documents. This solution promotes organizational efficiency and compliance.

-

How does airSlate SignNow ensure the security of documents sent to the Franklin County Area Tax Bureau?

airSlate SignNow employs top-tier security measures, including encryption and authentication protocols, to protect documents sent to the Franklin County Area Tax Bureau. Users can trust that their sensitive information is handled securely throughout the eSigning process. Additionally, compliance with industry standards ensures privacy and legal validity.

Get more for Franklin County Area Tax Bureau Form 541

- Reference check form 12417066

- Wced housing allowance forms

- Bi mart application form

- Ps4595 form

- California legacy license plate pre order form reg 17l apps dmv ca

- Hazardous materials business plan environment health amp safety www ehs ucsd form

- Tim turner dom documents form

- Emergency rental assistance program erap written form

Find out other Franklin County Area Tax Bureau Form 541

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online