Sc Form 8453 2015

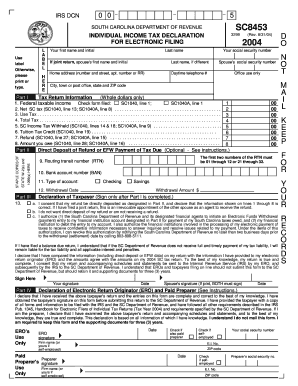

What is the SC Form 8453?

The SC Form 8453, officially known as the South Carolina Individual Income Tax Declaration for Electronic Filing, is a crucial document for taxpayers who file their income tax returns electronically. This form serves as a declaration that the taxpayer has reviewed their electronic return and affirms its accuracy. It is a necessary component for ensuring compliance with state tax regulations when submitting tax returns online.

How to Use the SC Form 8453

To effectively use the SC Form 8453, taxpayers must first complete their electronic income tax return. Once the return is finalized, the SC Form 8453 must be filled out to confirm the accuracy of the information provided. This form can be submitted electronically along with the tax return, or it can be printed and mailed to the South Carolina Department of Revenue if required. It is essential to retain a copy of this form for personal records as it serves as proof of the electronic filing.

Steps to Complete the SC Form 8453

Completing the SC Form 8453 involves several straightforward steps:

- Gather Required Information: Collect necessary details such as your Social Security number, tax filing status, and income information.

- Fill Out the Form: Enter the required information accurately, ensuring that it matches the data on your electronic return.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to complications with your tax filing.

- Submit the Form: Depending on your filing method, either submit it electronically with your return or print and mail it to the appropriate address.

Legal Use of the SC Form 8453

The SC Form 8453 is legally binding when completed and submitted according to South Carolina tax laws. It acts as a declaration that the taxpayer has reviewed their electronic return and affirms its accuracy. Compliance with the legal requirements for eSignature is essential, as it ensures that the form holds validity in the eyes of the law. Utilizing a reliable eSignature solution, such as airSlate SignNow, can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the SC Form 8453 to avoid penalties. The general filing deadline for individual income tax returns in South Carolina aligns with the federal deadline, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to ensure timely submission of both the form and the tax return.

Required Documents

When preparing to complete the SC Form 8453, taxpayers should have the following documents on hand:

- Previous year’s tax return for reference

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions and credits

Having these documents readily available will facilitate a smoother completion process and help ensure that all information is accurate.

Quick guide on how to complete sc form 8453

Complete Sc Form 8453 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and eSign your documents quickly without any delays. Handle Sc Form 8453 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sc Form 8453 with ease

- Locate Sc Form 8453 and click Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Sc Form 8453 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc form 8453

Create this form in 5 minutes!

How to create an eSignature for the sc form 8453

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to south carolina sc8453?

airSlate SignNow is an eSignature platform that provides businesses the ability to send and sign documents electronically. In south carolina sc8453, it offers a reliable solution for streamlining document workflows while ensuring compliance and security.

-

How much does airSlate SignNow cost for users in south carolina sc8453?

Pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit any budget. In south carolina sc8453, you can select from a range of plans tailored to meet your business needs, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for businesses in south carolina sc8453?

airSlate SignNow includes features such as document templates, bulk sending, and customizable workflows, all designed to improve efficiency. For businesses in south carolina sc8453, these features help simplify the signing process and enhance overall productivity.

-

What are the benefits of using airSlate SignNow in south carolina sc8453?

Using airSlate SignNow can signNowly reduce turnaround times for contracts and agreements. Businesses in south carolina sc8453 benefit from faster transactions and improved customer satisfaction through streamlined eSignature processes.

-

Can airSlate SignNow integrate with other software used in south carolina sc8453?

Yes, airSlate SignNow integrates seamlessly with various business applications such as Microsoft Office, Google Workspace, and CRM systems. This capability ensures that businesses in south carolina sc8453 can maintain their existing workflows while enhancing functionality.

-

Is airSlate SignNow compliant with South Carolina regulations?

Absolutely! airSlate SignNow is compliant with the legal standards for electronic signatures in South Carolina, including the ESIGN Act and UETA. Businesses in south carolina sc8453 can have peace of mind knowing their documents are securely signed and legally binding.

-

How easy is it to get started with airSlate SignNow in south carolina sc8453?

Getting started with airSlate SignNow is simple and quick. Businesses in south carolina sc8453 can sign up for a free trial, set up their accounts, and start sending documents for eSignature within minutes.

Get more for Sc Form 8453

- Form 4121 online

- Ct duplicate title application form pdf

- Oriental satisfaction voucher form

- Icd 10 mental health billable diagnosis codes form

- Alabama bid card form

- Laura belgray email pdf form

- Form it 604 claim for qeze tax reduction credit tax year

- Www state govtreaties in forcetreaties in force united states department of state form

Find out other Sc Form 8453

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple