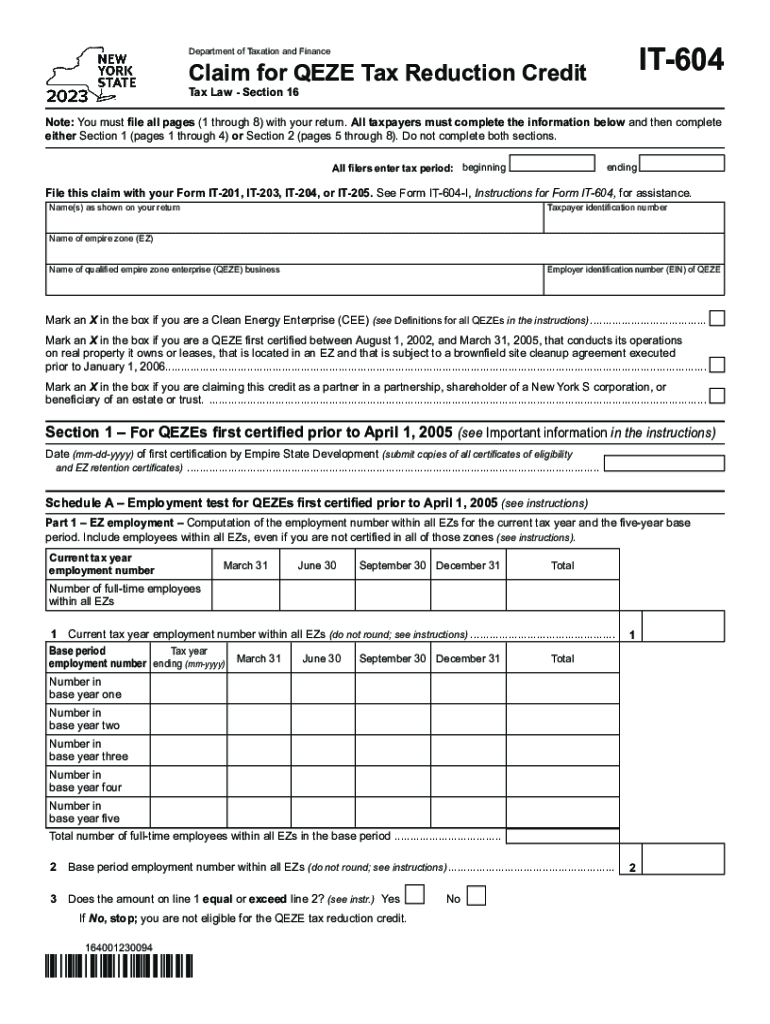

Form it 604 Claim for QEZE Tax Reduction Credit Tax Year 2023

What is the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

The Form IT-604 is a tax form used by businesses in New York State to claim the Qualified Empire Zone Enterprise (QEZE) Tax Reduction Credit. This credit is designed to encourage economic development by providing tax relief to eligible businesses operating within designated Empire Zones. By using this form, businesses can reduce their tax liability, thus promoting job creation and investment in these areas.

How to Use the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

To effectively utilize the Form IT-604, businesses must first determine their eligibility based on the criteria set forth by the New York State Department of Taxation and Finance. Once eligibility is confirmed, businesses should gather all necessary documentation, including proof of operations within an Empire Zone and financial records. The completed form should then be submitted with the business's tax return for the applicable tax year to ensure the credit is applied correctly.

Steps to Complete the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

Completing the Form IT-604 involves several key steps:

- Gather required information, including your business's identification details and financial records.

- Review the eligibility criteria for the QEZE Tax Reduction Credit.

- Fill out the form accurately, ensuring all sections are completed.

- Attach any necessary supporting documents that validate your claim.

- Submit the form along with your tax return by the designated deadline.

Eligibility Criteria for the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

Eligibility for the QEZE Tax Reduction Credit requires that the business is located within an Empire Zone and meets specific operational and employment criteria. Generally, businesses must demonstrate a commitment to job creation and investment in the area. Additionally, they must be in good standing with tax obligations and comply with all local and state regulations to qualify for this credit.

Required Documents for the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

When filing the Form IT-604, businesses must provide several supporting documents to substantiate their claim. Key documents include:

- Proof of business operations within the Empire Zone.

- Financial statements that reflect income and expenses.

- Records of employment and job creation efforts.

- Any correspondence with the New York State Department of Taxation and Finance regarding the Empire Zone designation.

Form Submission Methods for the Form IT-604 Claim for QEZE Tax Reduction Credit Tax Year

The Form IT-604 can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if necessary.

Quick guide on how to complete form it 604 claim for qeze tax reduction credit tax year

Effortlessly Prepare Form It 604 Claim For QEZE Tax Reduction Credit Tax Year on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Form It 604 Claim For QEZE Tax Reduction Credit Tax Year on any device with airSlate SignNow’s Android or iOS applications and enhance your document-centered workflow today.

How to Alter and eSign Form It 604 Claim For QEZE Tax Reduction Credit Tax Year with Ease

- Find Form It 604 Claim For QEZE Tax Reduction Credit Tax Year and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools available from airSlate SignNow designed specifically for these tasks.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal authority as a conventional handwritten signature.

- Review all details thoroughly and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form navigation, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form It 604 Claim For QEZE Tax Reduction Credit Tax Year to ensure effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 604 claim for qeze tax reduction credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 604 claim for qeze tax reduction credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow, and how does it relate to IT 604?

airSlate SignNow is an electronic signature solution that allows businesses to create, send, and eSign documents efficiently. It relates to IT 604 by providing a digital transformation tool that enhances the workflow processes within organizations, helping them stay compliant and secure.

-

What are the key features of airSlate SignNow within the context of IT 604?

Key features of airSlate SignNow include templates for repetitive documents, advanced security measures, and seamless integrations with existing software. These features support IT 604 initiatives by streamlining the signing process and eliminating the need for paper documents, ultimately saving time and resources.

-

How does airSlate SignNow support compliance with regulations associated with IT 604?

airSlate SignNow ensures compliance with various regulations, such as eIDAS and ESIGN, making it a reliable choice for businesses concerned with legal standards. By utilizing its secure eSignature technology, companies can confidently handle documents related to IT 604 while maintaining necessary compliance.

-

What pricing options does airSlate SignNow offer for IT 604-related solutions?

airSlate SignNow offers flexible pricing plans ranging from basic to advanced solutions tailored for different business needs. Each plan includes features that enhance the signing experience for IT 604, ensuring that organizations can find a cost-effective option that fits their budget.

-

What benefits does airSlate SignNow provide in enhancing document management for IT 604?

airSlate SignNow signNowly improves document management by allowing users to send, sign, and track documents in real-time. This efficiency directly supports IT 604 by ensuring that all document-related tasks are completed quickly and accurately, reducing workflow bottlenecks.

-

Can airSlate SignNow be integrated with other software relevant to IT 604?

Yes, airSlate SignNow offers a wide range of integrations with popular business applications, making it easy to incorporate into your existing systems. These integrations are crucial for supporting IT 604 as they provide streamlined operations across various platforms, improving overall productivity.

-

Is airSlate SignNow suitable for small businesses focusing on IT 604?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent solution for small businesses looking to implement IT 604 initiatives. Its scalable features allow small teams to manage document signing efficiently without the need for extensive resources.

Get more for Form It 604 Claim For QEZE Tax Reduction Credit Tax Year

- Sat channel list pdf form

- Hipaa notice of privacy practices therapysites form

- Private property no trespassing berkeley california form

- Residential careassisted living facility notice of move out apps state or form

- Critical thinking mindset self rating form

- F c a 522 523 s s l 111g note personal info form

- Alarm registration form metuchen metuchennj

- Scpa 708 form

Find out other Form It 604 Claim For QEZE Tax Reduction Credit Tax Year

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free