Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware 2019

What is the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware

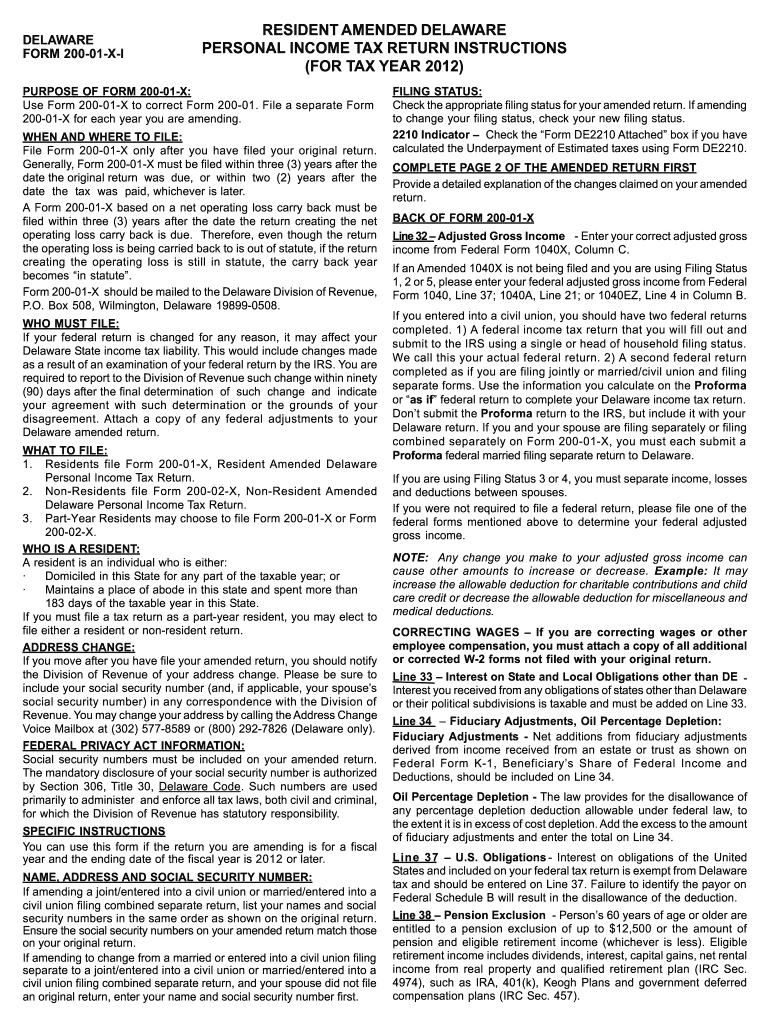

The Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware form is designed for individuals who need to amend their previously filed Delaware personal income tax returns. This form allows taxpayers to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that tax filings are accurate and compliant with state regulations.

Steps to complete the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware

Completing the Resident Amended Delaware Personal Income Tax Return involves several key steps:

- Gather all necessary documents, including your original tax return and any supporting documentation for the changes you wish to make.

- Carefully read the instructions provided with the form to understand the requirements and process.

- Fill out the amended return form, ensuring that all changes are clearly indicated and supported by appropriate documentation.

- Review the completed form for accuracy before submission.

- Submit the amended return either electronically or by mail, following the specified submission guidelines.

Legal use of the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware

The Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it is crucial to provide accurate information and to sign the document appropriately. Electronic signatures are acceptable if they comply with the relevant eSignature laws, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Timeliness is critical when filing an amended return. The deadline for submitting the Resident Amended Delaware Personal Income Tax Return typically aligns with the original filing deadline. Taxpayers should be aware of the following important dates:

- The due date for filing the amended return is usually three years from the original filing date.

- Any taxes owed must be paid by the original due date to avoid penalties and interest.

Required Documents

To complete the Resident Amended Delaware Personal Income Tax Return, taxpayers should gather the following documents:

- The original personal income tax return.

- Any W-2s, 1099s, or other income statements relevant to the amended return.

- Documentation supporting the changes being made, such as receipts for deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

The Resident Amended Delaware Personal Income Tax Return can be submitted through various methods:

- Online submission through the Delaware Division of Revenue’s e-filing system, if available.

- Mailing a printed copy of the completed form to the appropriate state revenue office.

- In-person submission at designated state tax offices, if applicable.

Quick guide on how to complete resident amended delaware personal income tax return instructions revenue delaware

Edit Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly and without delays. Manage Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

Steps to alter and eSign Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware effortlessly

- Find Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Alter and eSign Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct resident amended delaware personal income tax return instructions revenue delaware

Create this form in 5 minutes!

How to create an eSignature for the resident amended delaware personal income tax return instructions revenue delaware

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What are the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware?

The Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware provide step-by-step guidance on how to amend your personal income tax return in Delaware. Following these instructions ensures that you accurately complete the necessary forms and submit them correctly to avoid any penalties.

-

How can airSlate SignNow help with the Resident Amended Delaware Personal Income Tax Return process?

airSlate SignNow streamlines the Resident Amended Delaware Personal Income Tax Return process by allowing users to easily eSign and send documents securely. With its user-friendly interface, you can quickly complete your amended tax return while ensuring compliance with Delaware's tax regulations.

-

Is airSlate SignNow cost-effective for handling Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware?

Yes, airSlate SignNow offers a cost-effective solution for managing the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware. With competitive pricing plans tailored to various needs, businesses can optimize their document processes without breaking the bank.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage that are invaluable for managing tax documents like the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware. These tools enhance productivity and ensure that all documents are easily accessible and properly managed.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow offers integrations with various software solutions that can assist with tax preparation and document management. This allows users to seamlessly incorporate the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware into their existing workflows.

-

What benefits does eSigning provide for tax returns in Delaware?

ESigning provides a multitude of benefits for filing tax returns in Delaware, including increased efficiency and reduced turnaround time. By utilizing airSlate SignNow’s platform, you can easily manage the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware and quickly secure the necessary signatures electronically.

-

Are there any customer support options available for using airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to help you navigate the Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware effectively. Users can access a range of resources, including FAQs, live chat support, and detailed guides.

Get more for Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware

- Fc 029 form

- Angle of elevation and depression trig worksheet form

- Beneficiary nomination form template

- Self declaration form for scholarship 443896256

- Fast food nutrition web quest answers form

- Palkkatodistus malli word form

- Skillbridge training plan example form

- New patient welcome kit family medicine centers of south form

Find out other Resident Amended Delaware Personal Income Tax Return Instructions Revenue Delaware

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement