F 1120 Form 2020

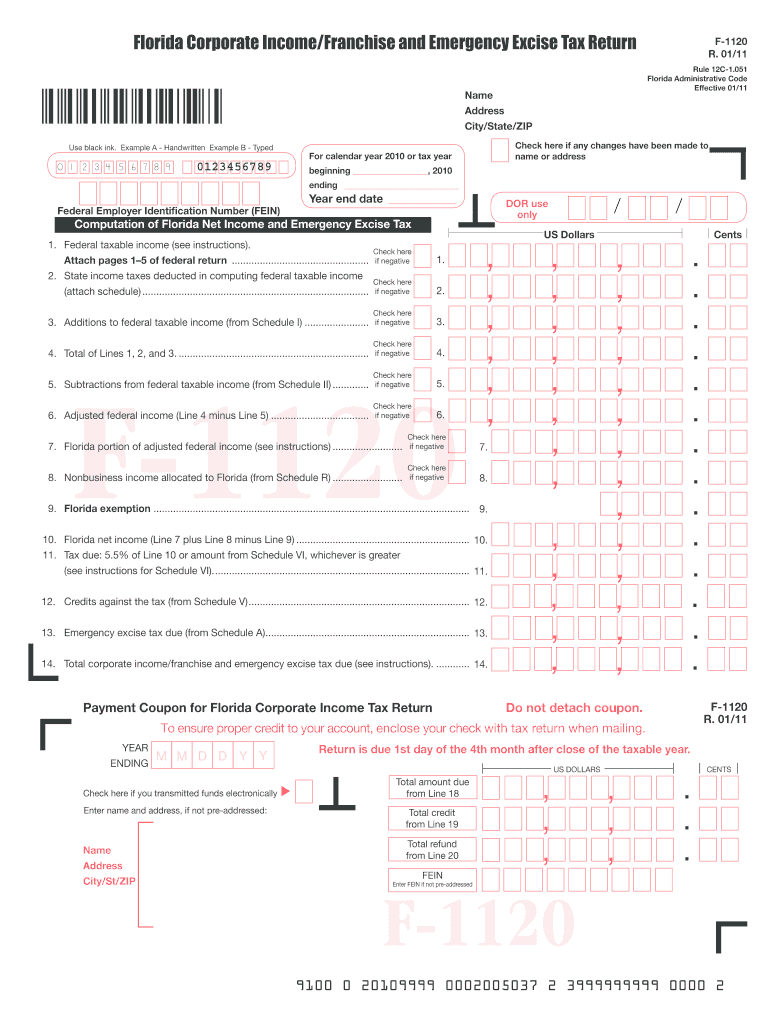

What is the F 1120 Form

The F 1120 Form is a tax return form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. The information provided on the F 1120 Form helps the Internal Revenue Service (IRS) determine the corporation's tax liability. It includes various sections where corporations disclose their financial activities for the tax year, ensuring compliance with federal tax regulations.

How to use the F 1120 Form

Using the F 1120 Form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Corporations must report their total income, calculate their taxable income, and apply any deductions or credits they qualify for. Finally, review the form for accuracy before submitting it to the IRS by the appropriate deadline.

Steps to complete the F 1120 Form

Completing the F 1120 Form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather financial records, including income and expense statements.

- Fill out the form starting with basic information such as the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales, dividends, and interest.

- Calculate deductions for business expenses, depreciation, and other allowable deductions.

- Determine the taxable income by subtracting total deductions from total income.

- Apply any tax credits that the corporation is eligible for.

- Review the completed form for accuracy and completeness.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the F 1120 Form. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the filing deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for corporations to be aware of these dates to avoid penalties for late filing.

Legal use of the F 1120 Form

The F 1120 Form serves a legal purpose by ensuring that corporations report their financial activities accurately to the IRS. Proper completion of this form is essential for compliance with federal tax laws. Failure to file the F 1120 Form or providing inaccurate information can result in penalties, interest on unpaid taxes, and potential audits. Therefore, corporations must take the legal implications of this form seriously and ensure that all information is truthful and complete.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the F 1120 Form. The form can be filed electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, corporations may choose to mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available for tax forms, as the IRS encourages electronic filing for efficiency. Each submission method has its own processing times and requirements, so corporations should choose the one that best suits their needs.

Quick guide on how to complete 2011 f 1120 form

Prepare F 1120 Form with ease on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage F 1120 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign F 1120 Form effortlessly

- Obtain F 1120 Form and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to the issues of lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign F 1120 Form and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 f 1120 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 f 1120 form

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the F 1120 Form and who needs it?

The F 1120 Form is used by U.S. corporations to report their income, gains, losses, deductions, and credits. Businesses that operate as C corporations must file this form annually with the IRS. Understanding the F 1120 Form requirements is crucial for compliance and to avoid penalties.

-

How does airSlate SignNow assist with the F 1120 Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the F 1120 Form and other important documents. With its streamlined workflow, businesses can manage their forms digitally, making the eSignature process faster and more efficient. This simplifies the filing process, ensuring timely submission.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to businesses of all sizes. Plans typically include features for managing documents, eSigning, and an intuitive user interface that accommodates the filing of forms like the F 1120 Form. Prospective users can select a plan based on their specific needs.

-

What features does airSlate SignNow provide for F 1120 Form management?

With airSlate SignNow, users benefit from template creation, real-time tracking of document status, and automated reminders for the F 1120 Form. The platform also ensures compliance with eSignature laws, making it a reliable solution for your business tax needs. Enhanced security features protect sensitive information throughout the process.

-

Can I integrate airSlate SignNow with other software for filing the F 1120 Form?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications, enhancing your workflow for filing the F 1120 Form. Integrations with platforms like Salesforce, Google Drive, and Dropbox allow for easy document import and export, simplifying the overall filing process. This connectivity makes managing your business forms more efficient.

-

What are the benefits of using airSlate SignNow for the F 1120 Form?

Using airSlate SignNow for the F 1120 Form offers numerous benefits, including speed, convenience, and legal compliance. The eSigning capabilities eliminate the need for physical paperwork, while its cloud-based system ensures access from anywhere. Overall, it enhances productivity for businesses needing to file important tax documents.

-

Is airSlate SignNow secure for submitting the F 1120 Form?

Absolutely, airSlate SignNow prioritizes security by employing top-notch encryption practices to protect your documents, including the F 1120 Form. Sensitive data is safeguarded throughout the process, ensuring compliance with privacy regulations. Users can trust that their information is handled securely and confidentially.

Get more for F 1120 Form

Find out other F 1120 Form

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online