How to File a Return Tax in Florida Form 2020

What is the How To File A Return Tax In Florida Form

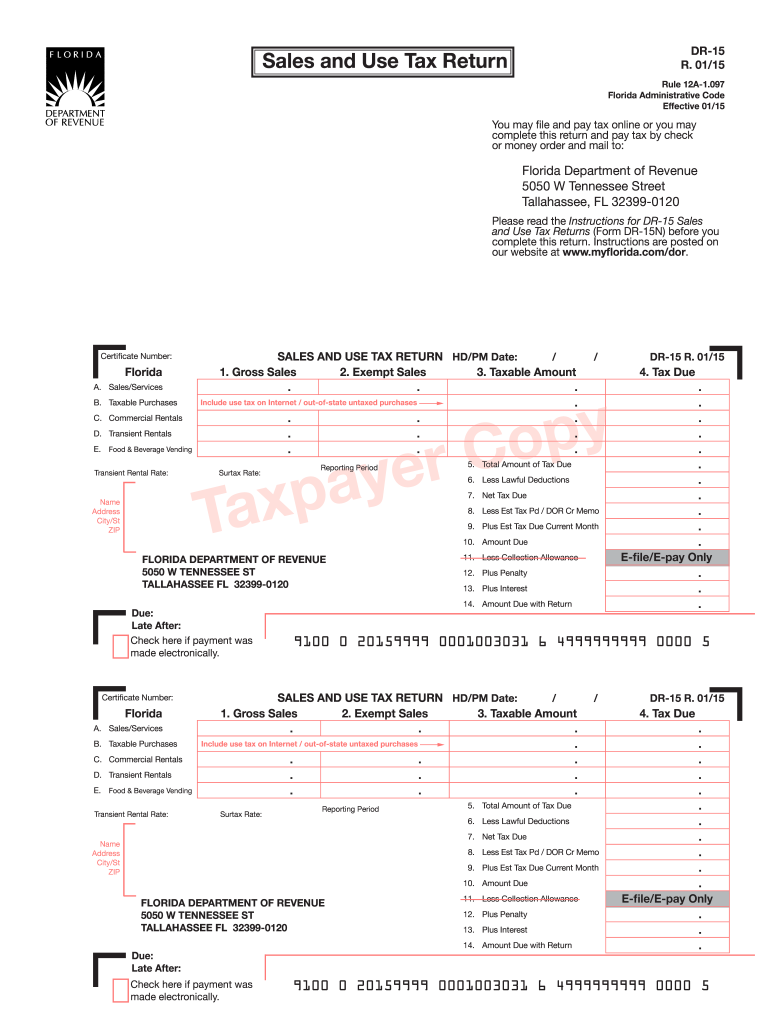

The How To File A Return Tax In Florida Form is a crucial document for individuals and businesses in Florida to report their income and calculate their tax obligations. This form is designed to ensure compliance with state tax laws and to facilitate the proper assessment of taxes owed. It includes various sections where taxpayers must provide personal information, income details, deductions, and credits. Understanding this form is essential for accurate tax filing and avoiding penalties.

Steps to complete the How To File A Return Tax In Florida Form

Completing the How To File A Return Tax In Florida Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim applicable deductions and credits, which can significantly reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

How to use the How To File A Return Tax In Florida Form

Using the How To File A Return Tax In Florida Form requires careful attention to detail. Begin by downloading the form from the Florida Department of Revenue website or accessing it through a tax preparation software. Once you have the form, follow the instructions provided for each section. It is advisable to complete the form electronically, as this can minimize errors and streamline the filing process. Ensure that you sign and date the form before submission.

Legal use of the How To File A Return Tax In Florida Form

The How To File A Return Tax In Florida Form is legally binding once signed and submitted. To ensure its legal validity, it must be completed accurately and in compliance with Florida tax laws. Any discrepancies or inaccuracies could lead to audits or penalties. It is important to retain copies of your filed form and any supporting documents for your records, as these may be required for future reference or in the event of an audit.

Required Documents

To complete the How To File A Return Tax In Florida Form, several documents are typically required:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Receipts for deductible expenses, including medical costs, charitable contributions, and education expenses.

- Any prior year tax returns for reference.

Filing Deadlines / Important Dates

Filing deadlines for the How To File A Return Tax In Florida Form are critical to avoid penalties. Typically, the deadline for individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the Florida Department of Revenue website for any updates or changes to filing deadlines, as well as for information on extensions if needed.

Quick guide on how to complete how to file a return tax in florida 2013 form

Complete How To File A Return Tax In Florida Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage How To File A Return Tax In Florida Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and eSign How To File A Return Tax In Florida Form without any hassle

- Obtain How To File A Return Tax In Florida Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the details and click the Done button to preserve your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign How To File A Return Tax In Florida Form and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to file a return tax in florida 2013 form

Create this form in 5 minutes!

How to create an eSignature for the how to file a return tax in florida 2013 form

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the process for How To File A Return Tax In Florida Form?

To file a return tax in Florida, you'll first need to gather all necessary documents, including your income records and deductions. Once you have your documents ready, you can either fill out the appropriate tax form manually or use an e-signing solution like airSlate SignNow for a streamlined process. This allows you to eSign and send your forms quickly and securely.

-

What forms do I need to file a return tax in Florida?

When filing a return tax in Florida, you'll typically use Form 1040 or the Florida Department of Revenue’s specific forms. Depending on your situation, you might also need additional schedules or forms for different income types or deductions. It's important to review the requirements carefully to ensure you have everything needed for a successful submission.

-

How can airSlate SignNow help with How To File A Return Tax In Florida Form?

AirSlate SignNow simplifies the process of how to file a return tax in Florida form by allowing users to create, send, and eSign documents easily. The platform ensures that all your tax forms are securely stored and delivered, helping you meet your filing deadlines without the hassle of traditional paperwork. This saves you time and ensures compliance with state regulations.

-

Are there any fees associated with using airSlate SignNow for filing tax forms?

Yes, there are subscription plans that provide different features for using airSlate SignNow when filing tax forms, including how to file a return tax in Florida form. The pricing is competitive and based on the functionalities you need, such as document templates and advanced workflow capabilities. It's advisable to review the pricing structure on the website to find the plan that best fits your needs.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Absolutely! AirSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your documents when learning how to file a return tax in Florida form. By integrating with tools like QuickBooks or TurboTax, you can streamline your documentation process and enhance your overall workflow.

-

What features does airSlate SignNow provide for tax filing purposes?

AirSlate SignNow comes equipped with features designed for efficient tax filing, such as document templates, eSignature options, and secure cloud storage. These features are particularly beneficial when you are looking to understand how to file a return tax in Florida form, as they allow for easy edits, sharing, and finalizing necessary documents with just a few clicks.

-

Is there support available for users who have questions about filing taxes?

Yes, airSlate SignNow provides excellent customer support for users, especially regarding how to file a return tax in Florida form. You can access various resources like tutorials, online guides, and live support if you encounter any challenges during your filing process. This ensures that you have the assistance you need every step of the way.

Get more for How To File A Return Tax In Florida Form

Find out other How To File A Return Tax In Florida Form

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online