Florida Department of Revenue Power of Attorney Form 2011

What is the Florida Department Of Revenue Power Of Attorney Form

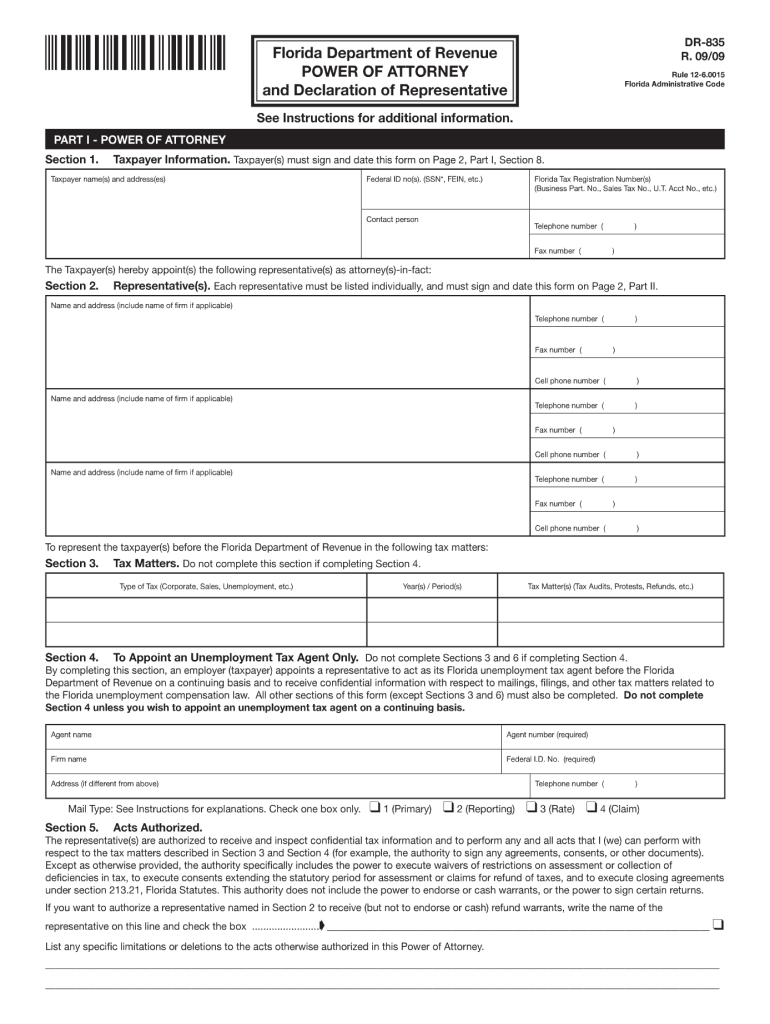

The Florida Department Of Revenue Power Of Attorney Form is a legal document that allows an individual to appoint another person to act on their behalf in matters related to state taxes. This form is essential for individuals or businesses that need to delegate authority to a representative, such as an attorney or accountant, to handle tax-related issues with the Florida Department of Revenue. By completing this form, the principal grants the agent the power to receive confidential tax information, file returns, and make tax payments.

How to use the Florida Department Of Revenue Power Of Attorney Form

Using the Florida Department Of Revenue Power Of Attorney Form involves several straightforward steps. First, the individual must download the form from the Florida Department of Revenue’s official website. Once obtained, the principal needs to fill out the required fields, including their personal information and that of the appointed agent. After completing the form, it should be signed and dated by the principal. Finally, the completed form must be submitted to the Florida Department of Revenue to ensure that the agent is authorized to act on behalf of the principal.

Steps to complete the Florida Department Of Revenue Power Of Attorney Form

Completing the Florida Department Of Revenue Power Of Attorney Form requires careful attention to detail. Follow these steps:

- Download the form from the Florida Department of Revenue's website.

- Provide your personal information, including your name, address, and Social Security number.

- Enter the agent's details, including their name and contact information.

- Specify the scope of authority granted to the agent, such as tax filing and payment permissions.

- Sign and date the form to validate it.

- Submit the completed form to the Florida Department of Revenue through the appropriate method.

Legal use of the Florida Department Of Revenue Power Of Attorney Form

The legal use of the Florida Department Of Revenue Power Of Attorney Form is crucial for ensuring that the appointed agent can legally represent the principal in tax matters. This form must be properly executed to be considered valid. The principal should ensure they are aware of the powers they are granting and that the agent understands their responsibilities. It is also important to note that the form must comply with state laws regarding power of attorney documents to be enforceable.

Key elements of the Florida Department Of Revenue Power Of Attorney Form

Several key elements must be included in the Florida Department Of Revenue Power Of Attorney Form to ensure its validity:

- Principal's Information: Full name, address, and Social Security number.

- Agent's Information: Name and contact details of the person being appointed.

- Scope of Authority: Specific powers granted to the agent, such as filing returns and accessing tax information.

- Signature: The principal's signature is required to validate the document.

- Date: The date on which the form is signed.

Form Submission Methods

The Florida Department Of Revenue Power Of Attorney Form can be submitted through various methods. The most common submission methods include:

- Online: Some forms may be submitted electronically through the Florida Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the Florida Department of Revenue.

- In-Person: Individuals may also submit the form in person at designated Florida Department of Revenue offices.

Quick guide on how to complete florida department of revenue power of attorney 2009 form

Effortlessly prepare Florida Department Of Revenue Power Of Attorney Form on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Handle Florida Department Of Revenue Power Of Attorney Form on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Florida Department Of Revenue Power Of Attorney Form with ease

- Locate Florida Department Of Revenue Power Of Attorney Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the specialized tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Florida Department Of Revenue Power Of Attorney Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue power of attorney 2009 form

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the Florida Department Of Revenue Power Of Attorney Form?

The Florida Department Of Revenue Power Of Attorney Form is a legal document that allows an individual to designate another person to represent them before the Florida Department of Revenue. This form is essential for managing tax matters, ensuring that the appointed representative can act on behalf of the taxpayer regarding their tax affairs.

-

How do I complete the Florida Department Of Revenue Power Of Attorney Form?

Completing the Florida Department Of Revenue Power Of Attorney Form involves filling out your personal information, specifying the powers granted, and signing the document. Once completed, it must be submitted to the Department of Revenue to authorize the designated representative to act on your behalf.

-

Is there a fee for using the Florida Department Of Revenue Power Of Attorney Form?

Submitting the Florida Department Of Revenue Power Of Attorney Form typically does not involve a fee. However, ensure you check with the Department of Revenue or consult with a tax professional for any associated costs that may arise during the process.

-

Can I revoke my Florida Department Of Revenue Power Of Attorney Form?

Yes, you can revoke your Florida Department Of Revenue Power Of Attorney Form at any time. To do this, you must notify the Department of Revenue in writing and provide details about the revocation of powers granted, ensuring that your intentions are clear and documented.

-

What are the benefits of using the Florida Department Of Revenue Power Of Attorney Form?

The benefits of using the Florida Department Of Revenue Power Of Attorney Form include the ability to delegate tax-related tasks and access to professional assistance. This can save time and reduce stress, allowing your representative to handle communications and representations effectively on your behalf.

-

Does airSlate SignNow support the Florida Department Of Revenue Power Of Attorney Form?

Yes, airSlate SignNow supports the Florida Department Of Revenue Power Of Attorney Form, providing a streamlined process for creating, sending, and eSigning the document. With our easy-to-use platform, you can efficiently manage all your document signing needs in one place.

-

Can I integrate airSlate SignNow with other applications for managing the Florida Department Of Revenue Power Of Attorney Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the Florida Department Of Revenue Power Of Attorney Form seamlessly alongside your existing workflow tools. This flexibility enhances productivity and reduces the hassle of document management.

Get more for Florida Department Of Revenue Power Of Attorney Form

Find out other Florida Department Of Revenue Power Of Attorney Form

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed