Business Tax Receipt Form 2017

What is the Business Tax Receipt Form

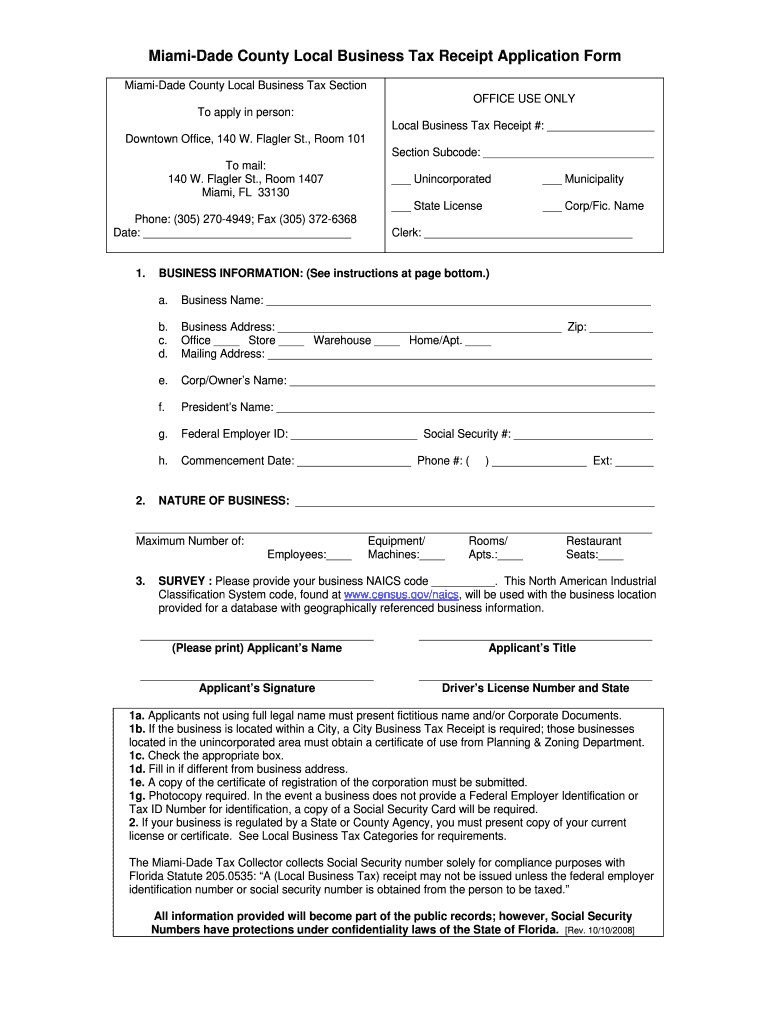

The Business Tax Receipt Form is a document that businesses in the United States must complete to demonstrate compliance with local tax regulations. This form serves as proof that a business is authorized to operate within a specific jurisdiction and has fulfilled its tax obligations. It typically includes details such as the business name, address, type of business entity, and the nature of services provided. The form is essential for maintaining good standing with local authorities and ensuring that businesses meet their legal requirements.

How to use the Business Tax Receipt Form

Using the Business Tax Receipt Form involves several key steps. First, businesses need to gather relevant information, including their business identification details and tax identification number. Next, they should accurately fill out the form, ensuring all sections are complete and correct. Once completed, the form must be submitted to the appropriate local tax authority, either online or via mail, depending on jurisdictional requirements. Keeping a copy of the submitted form is advisable for record-keeping and future reference.

Steps to complete the Business Tax Receipt Form

Completing the Business Tax Receipt Form involves a systematic approach:

- Gather necessary information, including your business name, address, and tax identification number.

- Access the form through your local tax authority’s website or office.

- Carefully fill out each section, ensuring accuracy and completeness.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified method, whether online, by mail, or in person.

- Retain a copy of the submitted form for your records.

Legal use of the Business Tax Receipt Form

The legal use of the Business Tax Receipt Form is paramount for businesses operating in the United States. This form not only serves as a tax compliance document but also acts as proof of legitimacy when dealing with clients, vendors, and financial institutions. Failure to complete and submit this form can lead to penalties, including fines or loss of business licenses. Therefore, understanding the legal implications of the form is essential for maintaining operational integrity.

Who Issues the Form

The Business Tax Receipt Form is typically issued by local government authorities, such as city or county tax offices. Each jurisdiction may have its own version of the form and specific requirements for completion and submission. It is important for businesses to check with their local tax authority to ensure they are using the correct form and following the appropriate procedures for their area.

Filing Deadlines / Important Dates

Filing deadlines for the Business Tax Receipt Form can vary by jurisdiction. Generally, businesses should be aware of the following important dates:

- Initial filing deadlines, which may coincide with the start of the fiscal year or specific local tax deadlines.

- Renewal deadlines, often required annually or biennially, depending on local regulations.

- Any additional deadlines for amendments or updates to the form, particularly if there are changes in business operations or ownership.

State-specific rules for the Business Tax Receipt Form

Each state in the U.S. may have unique rules and regulations governing the Business Tax Receipt Form. These rules can pertain to the information required, submission methods, and deadlines. Businesses should familiarize themselves with their state’s specific requirements to ensure compliance. This may include consulting with local tax authorities or legal advisors to navigate any complexities related to state laws.

Quick guide on how to complete business tax receipt 2008 form

Complete Business Tax Receipt Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without interruptions. Manage Business Tax Receipt Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Business Tax Receipt Form with ease

- Locate Business Tax Receipt Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Edit and electronically sign Business Tax Receipt Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax receipt 2008 form

Create this form in 5 minutes!

How to create an eSignature for the business tax receipt 2008 form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a Business Tax Receipt Form?

A Business Tax Receipt Form is a document that businesses need to obtain from local authorities to legally operate in a specific area. It verifies that the business is compliant with local tax obligations. Using airSlate SignNow, you can easily create, manage, and eSign your Business Tax Receipt Form, streamlining the compliance process.

-

How can airSlate SignNow help me with my Business Tax Receipt Form?

airSlate SignNow simplifies the process of managing your Business Tax Receipt Form by allowing you to fill it out electronically, ensuring accuracy and saving time. Our user-friendly platform enables you to eSign the document, ensuring a quick turnaround. Additionally, it allows for easy sharing and storage of your forms, improving your overall business efficiency.

-

Is there a cost associated with using the Business Tax Receipt Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing. Our plans are designed to accommodate various business sizes and needs. With the value added through our features like eSigning and document management, the investment in your Business Tax Receipt Form becomes even more worthwhile.

-

What features does airSlate SignNow offer for Business Tax Receipt Forms?

airSlate SignNow provides tools such as customizable templates, eSignature capabilities, and real-time collaboration for your Business Tax Receipt Form. Additionally, our document tracking and audit trails enhance security and accountability. These features ensure that your forms are completed accurately and efficiently.

-

Are there any integrations available with airSlate SignNow for handling Business Tax Receipt Forms?

Absolutely! airSlate SignNow offers integrations with various platforms such as Google Drive, Salesforce, and Dropbox. This means you can import or export your Business Tax Receipt Form seamlessly across different applications, enhancing your workflow and productivity. These integrations provide a holistic approach to managing your business documentation.

-

How does eSigning a Business Tax Receipt Form work on airSlate SignNow?

ESigning a Business Tax Receipt Form on airSlate SignNow is straightforward. Once your form is ready, simply add the required signers' email addresses, and they will receive a link to sign electronically. The process is secure and compliant with legal standards, ensuring that your Business Tax Receipt Form is binding and reliable.

-

Can I save my Business Tax Receipt Form for future use with airSlate SignNow?

Yes, airSlate SignNow allows you to save your Business Tax Receipt Form templates for future use. This feature is particularly beneficial for businesses that need to fill out similar forms repeatedly. You can access your saved forms anytime, ensuring consistency and saving time in the preparation process.

Get more for Business Tax Receipt Form

Find out other Business Tax Receipt Form

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free