Florida Return Form 2016

What is the Florida Return Form

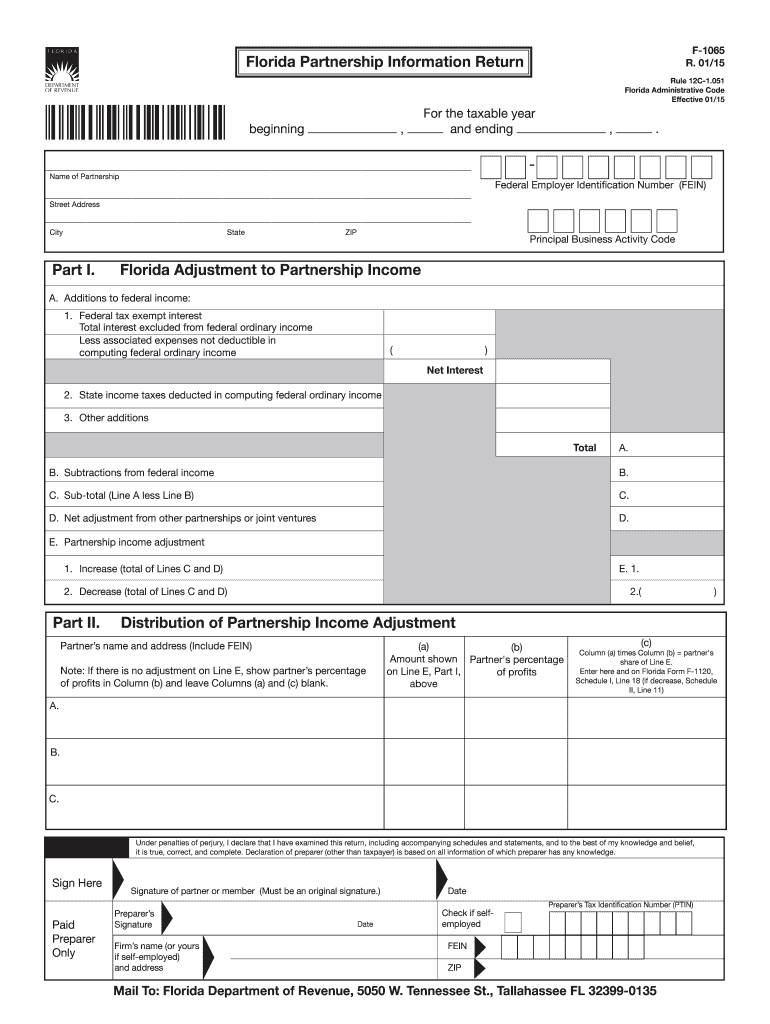

The Florida Return Form is a tax document used by residents of Florida to report their income and calculate their state tax obligations. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax laws. The form collects various information, including income sources, deductions, and credits, which are necessary for determining the amount of tax owed or any refund due. Understanding the purpose and requirements of the Florida Return Form is crucial for effective tax management.

How to use the Florida Return Form

Using the Florida Return Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with the required information, ensuring that all figures are accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on your preference and the specific guidelines provided by the Florida Department of Revenue.

Steps to complete the Florida Return Form

Completing the Florida Return Form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, such as income statements and previous tax returns.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income from various sources, ensuring to include all taxable income.

- List any deductions or credits you may be eligible for, as these can reduce your overall tax liability.

- Calculate your total tax owed or refund due based on the information provided.

- Review the completed form for accuracy, making sure all calculations are correct.

- Submit the form according to the specified guidelines, ensuring it is sent before the filing deadline.

Legal use of the Florida Return Form

The Florida Return Form is legally binding when completed and submitted according to state regulations. It is essential to provide truthful and accurate information, as any discrepancies may lead to penalties or legal issues. The form must be signed and dated to validate the submission. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that eSignatures are legally recognized. Understanding the legal implications of the Florida Return Form helps taxpayers navigate their responsibilities and avoid potential complications.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Return Form are crucial for compliance. Typically, the deadline for submitting the form is April fifteenth of each year. However, it is important to check for any changes or extensions that may apply. Taxpayers should also be aware of any specific deadlines for estimated tax payments, which may differ from the annual filing deadline. Keeping track of these important dates helps ensure timely submissions and avoids penalties for late filing.

Required Documents

To complete the Florida Return Form accurately, several documents are required. These typically include:

- W-2 forms from employers detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, reporting income earned.

- Records of any other income sources, such as rental income or investment earnings.

- Documentation for deductions, including receipts for business expenses or charitable contributions.

- Previous year’s tax return for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The Florida Return Form can be submitted through various methods, providing flexibility for taxpayers. Submissions can be made online via the Florida Department of Revenue's website, which often allows for quicker processing. Alternatively, taxpayers may choose to mail their completed forms to the designated address provided in the form instructions. In-person submissions can also be made at local tax offices, offering assistance if needed. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual circumstances.

Quick guide on how to complete 2015 florida return form

Fill out Florida Return Form seamlessly on any gadget

Digital document management has become increasingly favored among organizations and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without hold-ups. Manage Florida Return Form on any gadget with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Steps to modify and eSign Florida Return Form effortlessly

- Obtain Florida Return Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign Florida Return Form to ensure excellent communication throughout every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 florida return form

Create this form in 5 minutes!

How to create an eSignature for the 2015 florida return form

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is a Florida Return Form and why is it important?

The Florida Return Form is a crucial document required for filing tax returns in Florida. It ensures compliance with state tax regulations and helps in calculating any tax liabilities or refunds. Using the Florida Return Form correctly can facilitate a smoother tax filing experience.

-

How does airSlate SignNow simplify the Florida Return Form submission process?

airSlate SignNow streamlines the submission of the Florida Return Form by providing a user-friendly eSigning platform. This allows users to fill out and sign their documents electronically, reducing the hassle of printing and mailing. The platform ensures that your completed Florida Return Form is secure and properly submitted.

-

What are the pricing options for using airSlate SignNow for the Florida Return Form?

airSlate SignNow offers various pricing plans designed to meet different business needs for handling the Florida Return Form. You can choose a plan that fits your budget, from basic to advanced features. Additionally, airSlate SignNow often provides trial periods, so you can evaluate the service before committing.

-

Can I integrate airSlate SignNow with other tools while working on the Florida Return Form?

Yes, airSlate SignNow offers numerous integrations with popular software tools, enhancing the convenience of managing your Florida Return Form. This includes CRM software, cloud storage services, and productivity applications. Such integrations help streamline the entire document workflow associated with your tax filings.

-

What benefits does eSigning offer for the Florida Return Form?

eSigning the Florida Return Form through airSlate SignNow provides several benefits, including enhanced security and faster processing times. You join the growing trend of businesses moving towards digital solutions, ensuring your forms are signed and submitted efficiently. This not only saves time but also helps you maintain accurate records.

-

Is airSlate SignNow compliant with state regulations for the Florida Return Form?

Absolutely, airSlate SignNow is designed to meet the compliance standards necessary for submitting the Florida Return Form. The platform adheres to electronic signature laws, ensuring that all transactions are legally binding. This compliance gives users peace of mind when handling sensitive tax documents.

-

How can I track the status of my submitted Florida Return Form?

With airSlate SignNow, you can easily track the status of your submitted Florida Return Form through the dashboard. You'll receive notifications and updates on each step of the submission process, keeping you informed and allowing you to manage your documents efficiently. This tracking feature eliminates uncertainty and enhances your filing experience.

Get more for Florida Return Form

- Record of divorce michigan fillable form

- Document general form 4

- Dmf kontrakt form

- Employee advance salary form

- First bank account opening form

- Petition for grandparent visitation parent deceased handwritten www2 co fresno ca form

- Preparing for surgery at uva main hospital form

- Www thebalancecareers comletter of introductionletter of introduction examples and writing tips form

Find out other Florida Return Form

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document