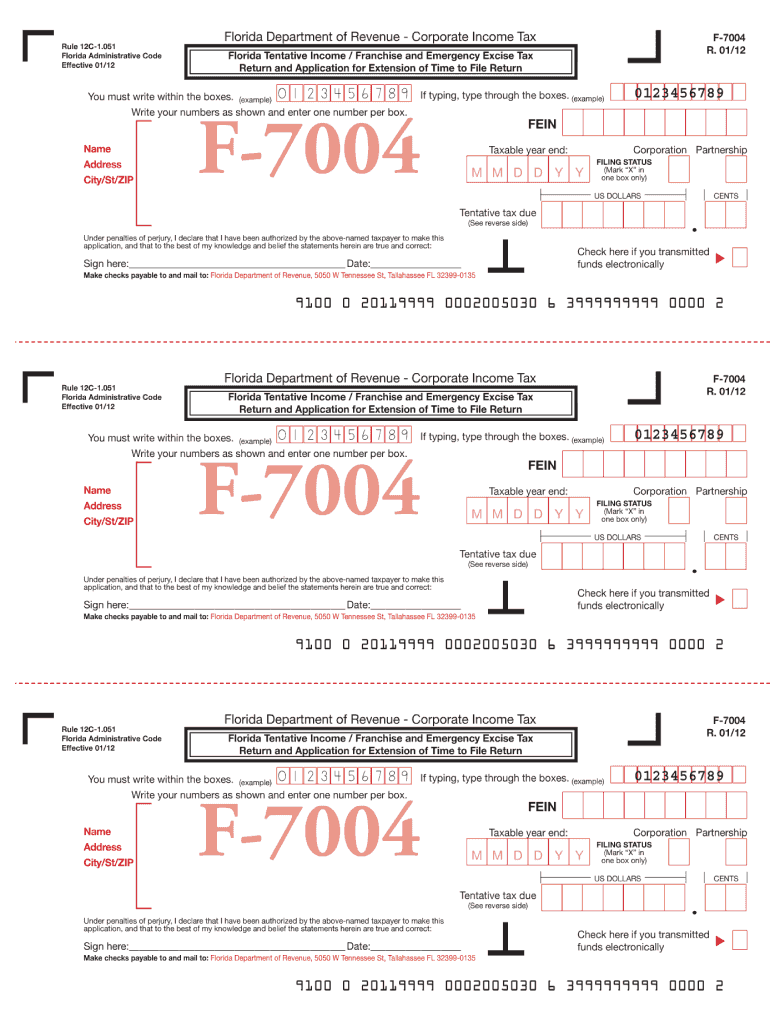

Florida Department of Revenue F7004 Form 2017

What is the Florida Department Of Revenue F7004 Form

The Florida Department Of Revenue F7004 Form is a crucial document used by businesses in Florida to request an extension of time to file their corporate income tax returns. This form is specifically designed for corporations that need additional time beyond the standard filing deadline. By submitting the F7004 Form, businesses can avoid late filing penalties and ensure compliance with state tax regulations.

Steps to complete the Florida Department Of Revenue F7004 Form

Completing the Florida Department Of Revenue F7004 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the business's legal name, address, and federal employer identification number (FEIN). Next, indicate the tax year for which the extension is being requested. The form also requires the estimated tax liability for the year, which helps the Department of Revenue assess the extension request. Finally, review the completed form for any errors before submitting it.

How to use the Florida Department Of Revenue F7004 Form

The F7004 Form is used to formally request an extension for filing corporate income tax returns. To use the form, fill it out completely and accurately, ensuring all required fields are addressed. Once completed, the form can be submitted electronically or via mail to the appropriate address provided by the Florida Department of Revenue. It is important to keep a copy of the submitted form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Department Of Revenue F7004 Form are critical to avoid penalties. Generally, the form must be filed by the original due date of the corporate income tax return. For most corporations, this is the first day of the fourth month following the end of the tax year. It is advisable to check for any specific deadlines that may apply to your business type or tax year.

Required Documents

When completing the Florida Department Of Revenue F7004 Form, certain documents may be required to support the extension request. This typically includes financial statements, prior year tax returns, and any documentation related to the estimated tax liability. Having these documents ready can streamline the completion process and ensure that the form is filled out accurately.

Legal use of the Florida Department Of Revenue F7004 Form

The legal use of the Florida Department Of Revenue F7004 Form is governed by state tax laws. Submitting this form properly allows businesses to obtain an official extension for their tax filings, thereby avoiding potential penalties for late submissions. It is essential that the form is completed in accordance with the guidelines set forth by the Florida Department of Revenue to maintain its legal standing.

Quick guide on how to complete florida department of revenue f7004 2012 form

Effortlessly Prepare Florida Department Of Revenue F7004 Form on Any Device

Digital document management has become increasingly favored among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Florida Department Of Revenue F7004 Form on any system with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Optimal Method to Modify and Electronically Sign Florida Department Of Revenue F7004 Form with Ease

- Locate Florida Department Of Revenue F7004 Form and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information using features specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to record your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign Florida Department Of Revenue F7004 Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida department of revenue f7004 2012 form

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue f7004 2012 form

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the Florida Department Of Revenue F7004 Form?

The Florida Department Of Revenue F7004 Form is an important document for taxpayers in Florida who are requesting an extension of time to file their tax returns. This form is specifically designed to allow businesses additional time without incurring penalties. Understanding how to properly complete this form can streamline your filing process.

-

How can airSlate SignNow assist with the Florida Department Of Revenue F7004 Form?

airSlate SignNow provides a user-friendly platform that simplifies the electronic signing and submission of the Florida Department Of Revenue F7004 Form. Our solution allows you to prepare your documents quickly, share them with stakeholders for their signatures, and submit them electronically to ensure compliance. This saves you time and reduces the risk of errors.

-

What are the costs associated with using airSlate SignNow for the Florida Department Of Revenue F7004 Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Depending on the chosen plan, costs vary, but they generally provide exceptional value for the features you receive, especially when using the Florida Department Of Revenue F7004 Form and other essential documents. We also offer a free trial to explore our features before committing.

-

Are there any features in airSlate SignNow specifically for the Florida Department Of Revenue F7004 Form?

Yes, airSlate SignNow includes features that are particularly useful for managing the Florida Department Of Revenue F7004 Form. These features include customizable templates, automated reminders for signers, and compliance tracking, ensuring your documents are filed accurately and on time.

-

Can I integrate airSlate SignNow with other tools for handling the Florida Department Of Revenue F7004 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems and project management tools. This means you can easily manage your workflows while handling the Florida Department Of Revenue F7004 Form, enhancing efficiency and collaboration across your team.

-

What benefits does using airSlate SignNow provide when working with the Florida Department Of Revenue F7004 Form?

Using airSlate SignNow when dealing with the Florida Department Of Revenue F7004 Form benefits you by ensuring a faster, secure, and compliant document management process. Our solution reduces paper usage and increases the overall efficiency of your tax preparation, allowing you to focus on your business.

-

How secure is the submission of the Florida Department Of Revenue F7004 Form with airSlate SignNow?

Security is a top priority for airSlate SignNow. When submitting the Florida Department Of Revenue F7004 Form through our platform, your documents are encrypted and securely stored to protect sensitive information. We comply with industry standards to provide a safe and reliable electronic signing experience.

Get more for Florida Department Of Revenue F7004 Form

Find out other Florida Department Of Revenue F7004 Form

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word