Mass 355 7004 Payment Form 2018

What is the Mass Payment Form

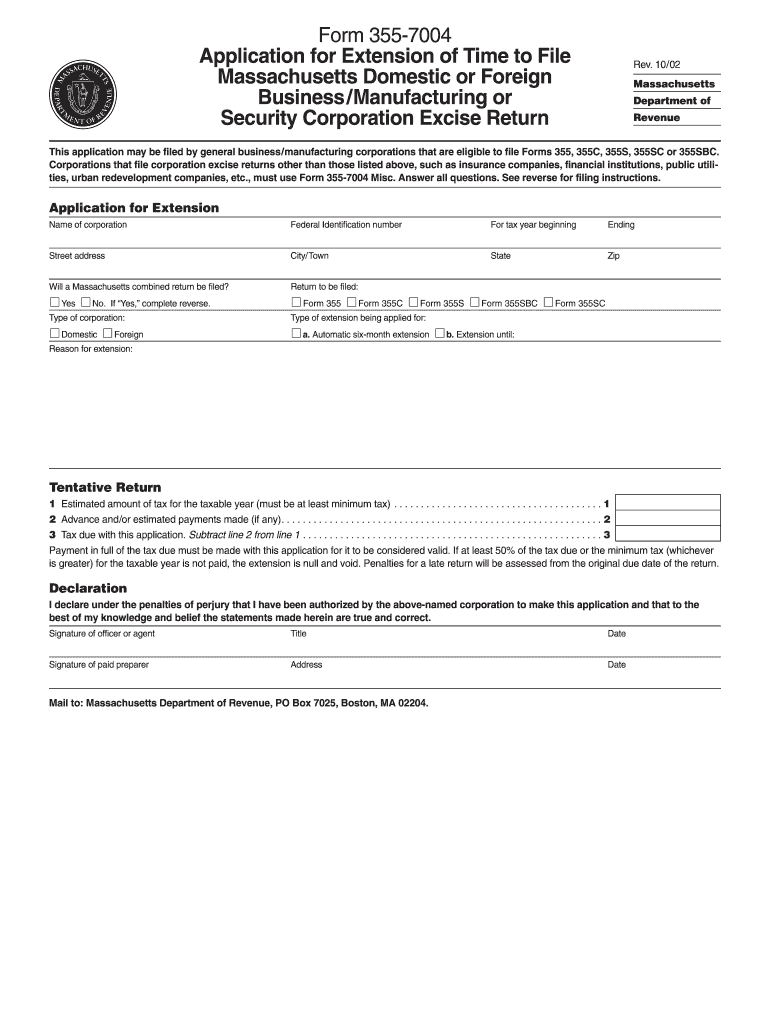

The Mass Payment Form is a specific document used for making payments related to certain tax obligations in the state of Massachusetts. This form is essential for individuals and businesses who need to remit payments for various tax liabilities, ensuring compliance with state tax regulations. Understanding this form is crucial for maintaining good standing with the Massachusetts Department of Revenue.

How to use the Mass Payment Form

Using the Mass Payment Form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the Massachusetts Department of Revenue website or other official sources. Next, fill out the required fields accurately, including your personal or business information and the payment amount. Once completed, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the Mass Payment Form

Completing the Mass Payment Form requires careful attention to detail. Follow these steps:

- Download or print the form from an official source.

- Fill in your name, address, and other identifying information.

- Indicate the payment amount and the tax period it corresponds to.

- Review the form for accuracy to avoid delays.

- Sign and date the form where required.

- Choose your preferred submission method and send the form accordingly.

Legal use of the Mass Payment Form

The Mass Payment Form is legally binding when completed and submitted according to the guidelines set by the Massachusetts Department of Revenue. To ensure its legal standing, it is important to provide accurate information and comply with all submission requirements. Electronic submissions are accepted and must adhere to the relevant eSignature regulations to maintain their validity.

Form Submission Methods

There are several methods available for submitting the Mass Payment Form. These methods include:

- Online Submission: Many taxpayers prefer submitting forms electronically through the Massachusetts Department of Revenue's online portal.

- Mail: You can print the completed form and mail it to the designated address provided on the form.

- In-Person: Submitting the form in person at a local tax office is also an option for those who prefer direct interaction.

Key elements of the Mass Payment Form

Understanding the key elements of the Mass Payment Form is essential for accurate completion. The main components include:

- Taxpayer Information: This section requires your name, address, and identification numbers.

- Payment Amount: Clearly indicate the total amount you are remitting.

- Tax Period: Specify the tax period for which the payment is being made.

- Signature: A signature is often required to validate the submission.

Quick guide on how to complete mass 355 7004 payment 2002 form

Complete Mass 355 7004 Payment Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Mass 355 7004 Payment Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Mass 355 7004 Payment Form effortlessly

- Locate Mass 355 7004 Payment Form and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mass 355 7004 Payment Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mass 355 7004 payment 2002 form

Create this form in 5 minutes!

How to create an eSignature for the mass 355 7004 payment 2002 form

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the Mass 355 7004 Payment Form?

The Mass 355 7004 Payment Form is a dedicated document designed to facilitate the hassle-free payment processing for specific transactions. Utilizing airSlate SignNow, businesses can customize and electronically sign this form, ensuring a streamlined workflow. This feature enhances efficiency and security in handling payments.

-

How does the Mass 355 7004 Payment Form improve transaction efficiency?

The Mass 355 7004 Payment Form improves transaction efficiency by enabling users to create, send, and sign documents faster than ever. With airSlate SignNow, the entire process can be managed online, eliminating the need for physical paperwork. This not only speeds up transactions but also reduces errors associated with manual entry.

-

Is the Mass 355 7004 Payment Form secure?

Yes, the Mass 355 7004 Payment Form is designed with top-notch security features to protect sensitive payment information. airSlate SignNow employs encryption and secure cloud storage, ensuring that all documents, including payment forms, are safe from unauthorized access. Your data integrity is our priority.

-

Can I integrate the Mass 355 7004 Payment Form with other software?

Absolutely! The Mass 355 7004 Payment Form can be seamlessly integrated with various software solutions through airSlate SignNow's robust API. This allows for enhanced connectivity with your existing tools, ensuring a cohesive experience for tracking and managing payments across platforms.

-

What features does the Mass 355 7004 Payment Form offer?

The Mass 355 7004 Payment Form offers features such as customizable templates, electronic signatures, and real-time tracking. With airSlate SignNow, businesses can easily adapt the form to meet their specific needs, ensuring compliance and efficient document handling. These features work together to simplify the payment process.

-

What are the pricing options for using the Mass 355 7004 Payment Form?

The pricing for using the Mass 355 7004 Payment Form varies based on the plan you choose with airSlate SignNow. Options are available for businesses of all sizes, ensuring affordability without compromising essential features. You can explore various tiers to find the right fit for your organization's payment processing needs.

-

How can the Mass 355 7004 Payment Form benefit my business?

Using the Mass 355 7004 Payment Form can signNowly benefit your business by streamlining your payment processes and enhancing customer satisfaction. With fast, secure electronic signatures, you can reduce turnaround times and improve cash flow. Additionally, it minimizes paperwork and enhances your professional image.

Get more for Mass 355 7004 Payment Form

Find out other Mass 355 7004 Payment Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple