Form 355s 2020

What is the Form 355s

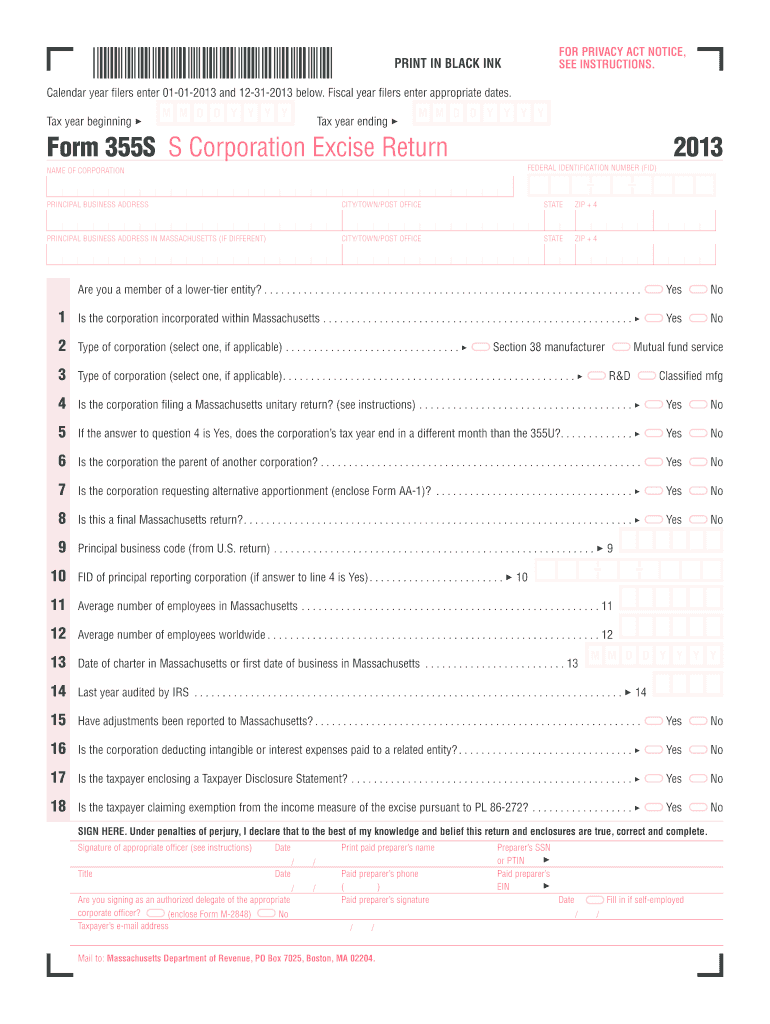

The Form 355s is a tax form used by businesses in the United States to report specific financial information to state tax authorities. This form is particularly relevant for entities that operate within certain states and may have unique reporting requirements. It typically includes details about income, deductions, and credits that affect the overall tax liability of the business. Understanding the purpose and requirements of the Form 355s is essential for compliance and accurate tax reporting.

How to use the Form 355s

Using the Form 355s involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to follow the specific instructions provided for the form to avoid errors that could lead to penalties. Once completed, the form can be submitted according to the guidelines set forth by the relevant state tax authority.

Steps to complete the Form 355s

Completing the Form 355s requires a systematic approach to ensure accuracy. Begin by reviewing the form's instructions to understand the required information. Then, follow these steps:

- Gather financial documents, including income and expense reports.

- Fill in the business information section, including the entity's name, address, and tax identification number.

- Report income and deductions in the designated sections, ensuring all figures are accurate.

- Double-check all entries for completeness and correctness.

- Sign and date the form, as required.

After completing these steps, ensure that the form is submitted by the deadline specified by the state tax authority.

Legal use of the Form 355s

The legal use of the Form 355s is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframe. Compliance with state regulations is crucial, as failure to do so can result in penalties or legal repercussions. Additionally, maintaining proper records and documentation to support the information reported on the form is essential for legal and audit purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 355s can vary by state and are crucial for compliance. Typically, the form must be submitted by the due date for the business's annual tax return. It is important to check with the specific state tax authority for the exact deadlines, as late submissions may incur penalties. Keeping a calendar of important dates related to tax filings can help ensure timely compliance.

Required Documents

When preparing to complete the Form 355s, certain documents are essential to ensure accurate reporting. Required documents may include:

- Income statements detailing revenue generated by the business.

- Expense records, including receipts and invoices.

- Previous tax returns, which can provide context for current reporting.

- Any additional documentation required by state tax authorities.

Having these documents readily available can streamline the completion process and help prevent errors.

Form Submission Methods (Online / Mail / In-Person)

The Form 355s can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer electronic filing options, which can expedite the submission process.

- Mail: The form can often be printed and mailed to the appropriate state tax office.

- In-Person: Some businesses may choose to submit the form in person at their local tax office.

It is important to verify the preferred submission methods with the relevant state tax authority to ensure compliance.

Quick guide on how to complete 2013 form 355s

Complete Form 355s with ease on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed papers, allowing you to obtain the correct form and safely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 355s on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Form 355s effortlessly

- Obtain Form 355s and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to finalize your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 355s to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 355s

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 355s

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 355s?

Form 355s is a specific tax form that businesses may need to file in certain jurisdictions. It is essential for compliance with local regulations. Understanding how to properly fill out Form 355s can help avoid penalties and ensure smooth processing.

-

How can airSlate SignNow help with Form 355s?

airSlate SignNow streamlines the process of sending and eSigning Form 355s. Our platform allows you to create, edit, and securely sign documents, making compliance easier. You can efficiently manage all aspects of Form 355s submission with our user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for Form 355s?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes access to tools for managing Form 355s and other documents. You can choose a plan that suits your volume of signings and necessary features.

-

What features does airSlate SignNow provide for Form 355s management?

Our platform provides features such as electronic signatures, document templates, and cloud storage specifically for Form 355s. You can track the status of each form and automate your workflow, ensuring timely submissions. Additionally, these features enhance team collaboration and document security.

-

Can I integrate airSlate SignNow with other platforms for Form 355s management?

Yes, airSlate SignNow offers seamless integrations with various applications to optimize your workflow for Form 355s. You can connect it with popular tools like CRM systems or accounting software. This helps centralize all your document management processes, including tax form submissions.

-

What benefits can I expect from using airSlate SignNow for Form 355s?

Using airSlate SignNow for Form 355s offers time savings, increased accuracy, and enhanced compliance. The platform's eSigning capabilities expedite the process, while robust security ensures that sensitive information is protected. Overall, it simplifies the workflow for document signing and management.

-

Is airSlate SignNow user-friendly for handling Form 355s?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to handle Form 355s. Whether you are tech-savvy or new to digital document management, our intuitive interface guides you through the process of creating, signing, and managing your forms.

Get more for Form 355s

Find out other Form 355s

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online