Ma Estate Tax Return Form 2018

What is the Ma Estate Tax Return Form

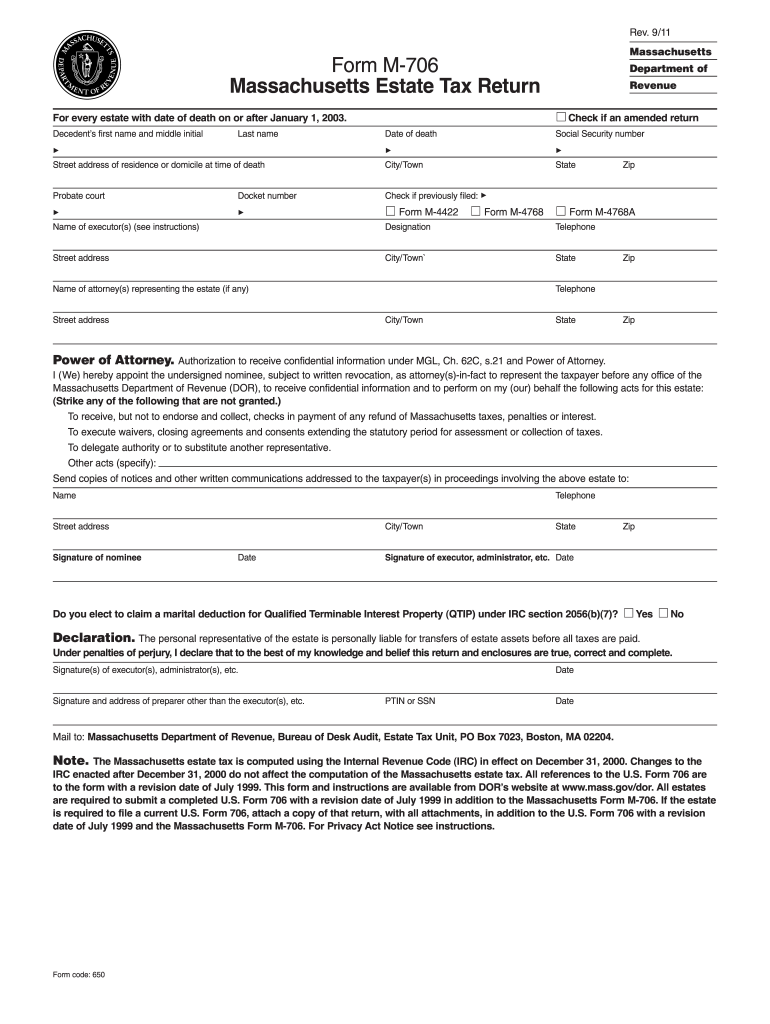

The Ma Estate Tax Return Form is a legal document required for reporting the estate tax obligations of a deceased individual's estate in Massachusetts. This form is essential for determining the tax liability based on the value of the estate at the time of death. The estate tax applies to estates exceeding a certain threshold, and the form must be filed to ensure compliance with state tax laws. Understanding the specifics of this form is crucial for executors and administrators managing the estate.

How to use the Ma Estate Tax Return Form

Using the Ma Estate Tax Return Form involves several steps to accurately report the estate's value and calculate the tax owed. Executors should first gather all necessary financial documents, including appraisals of assets, debts, and any previous tax returns. After collecting this information, the executor can fill out the form, ensuring that all sections are completed accurately. It is advisable to consult with a tax professional to ensure compliance with all state regulations and to facilitate a smooth filing process.

Steps to complete the Ma Estate Tax Return Form

Completing the Ma Estate Tax Return Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents, including asset valuations and debts.

- Fill out the form, starting with the decedent's information and estate details.

- Report all assets, including real estate, bank accounts, and personal property.

- List any debts or expenses that can be deducted from the estate's value.

- Calculate the total value of the estate and determine the tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Required Documents

To complete the Ma Estate Tax Return Form, certain documents are necessary. These typically include:

- Death certificate of the decedent.

- List of all assets owned by the decedent at the time of death.

- Documentation of any debts or liabilities of the estate.

- Appraisals for real estate and other significant assets.

- Prior tax returns, if applicable.

Filing Deadlines / Important Dates

Filing the Ma Estate Tax Return Form must be done within specific deadlines to avoid penalties. Generally, the form is due nine months after the date of death. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for executors to be aware of these dates to ensure timely submission and compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the Ma Estate Tax Return Form on time can result in significant penalties. The Massachusetts Department of Revenue may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes, increasing the overall liability. Executors should prioritize timely filing to avoid these financial repercussions.

Quick guide on how to complete ma estate tax return 2011 form

Complete Ma Estate Tax Return Form effortlessly on any device

Digital document management has gained signNow traction among both organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Ma Estate Tax Return Form on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Ma Estate Tax Return Form effortlessly

- Locate Ma Estate Tax Return Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ma Estate Tax Return Form while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma estate tax return 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ma estate tax return 2011 form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Ma Estate Tax Return Form?

The Ma Estate Tax Return Form is a document required for reporting the estate tax obligations of a decedent’s estate in Massachusetts. This form must be filed to account for the value of taxable estates and calculate any associated tax liabilities. Understanding the details of the Ma Estate Tax Return Form is crucial for beneficiaries to ensure compliance with state law.

-

How do I complete the Ma Estate Tax Return Form?

Completing the Ma Estate Tax Return Form involves gathering necessary information about the decedent's assets, liabilities, and deductions. It is essential to have accurate valuations and documentation ready to reflect the estate’s financial situation. Utilizing resources or consulting with a tax professional can also help streamline the process.

-

Are there any fees associated with filing the Ma Estate Tax Return Form?

While filing the Ma Estate Tax Return Form itself does not incur a direct fee, there may be costs related to professional assistance or preparation. Additionally, any estate taxes owed will need to be paid based on the valuation of the estate. It is advisable to budget for these potential expenses when planning for estate settlement.

-

What benefits does using airSlate SignNow provide for managing the Ma Estate Tax Return Form?

Using airSlate SignNow for your Ma Estate Tax Return Form allows for seamless eSignature capabilities, ensuring that all necessary signatures are collected quickly and efficiently. The platform is designed to be user-friendly and cost-effective, enabling users to manage their documentation without the hassle of traditional filing methods. This enhances the overall efficiency of the estate tax process.

-

Can I integrate airSlate SignNow with other accounting software for the Ma Estate Tax Return Form?

Yes, airSlate SignNow offers integration capabilities with various accounting and tax preparation software programs. This allows users to import necessary data directly into the Ma Estate Tax Return Form, streamlining the documentation process. Such integrations save time and reduce the risk of errors in data entry.

-

What features does airSlate SignNow offer to assist with the Ma Estate Tax Return Form?

airSlate SignNow provides features such as document collaboration, eSigning, and customizable templates specifically for tax forms like the Ma Estate Tax Return Form. These tools enhance communication and ensure that all parties involved in the filing process can work together seamlessly. Users can also track document status in real-time.

-

How secure is my information when using airSlate SignNow for the Ma Estate Tax Return Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive information related to the Ma Estate Tax Return Form. The platform employs robust encryption and security protocols to safeguard user data against unauthorized access. This ensures that your estate’s financial information remains confidential and protected.

Get more for Ma Estate Tax Return Form

- India immigration form arrival

- Alabama child support application online form

- Parq pdf form

- Certificate of conformance pasig

- Moyle mink and tannery order form

- Construction pre task plan template form

- Borang notifikasi penyakit berjangkit form

- 511007 bescheinigung fr arbeitnehmerinnen ber die zahlung eines zuschusses zum mutterschaftsgeld anlage 2 bescheinigung fr form

Find out other Ma Estate Tax Return Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free