Massachusetts Form Estate 2018-2026

What is the Massachusetts Form Estate?

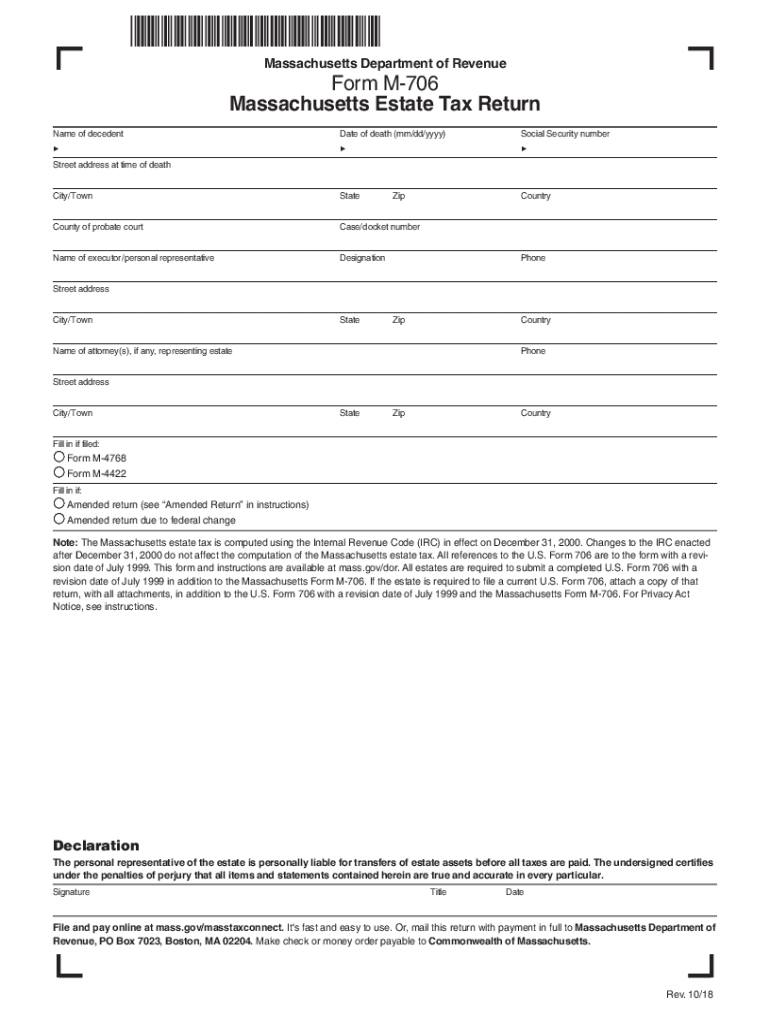

The Massachusetts Form Estate, commonly referred to as the Massachusetts estate tax return, is a legal document required for reporting the estate of a deceased individual when the estate's value exceeds a certain threshold. This form is essential for calculating the estate tax owed to the state of Massachusetts. The estate tax applies to the total value of the deceased's assets, including real estate, bank accounts, investments, and personal property. Understanding this form is crucial for executors and administrators responsible for managing the estate.

Steps to Complete the Massachusetts Form Estate

Completing the Massachusetts Form Estate involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including bank statements, property deeds, and investment portfolios.

- Determine the Gross Estate Value: Calculate the total value of the deceased's assets at the time of death.

- Complete the Form: Fill out the Massachusetts estate tax return accurately, ensuring all required sections are addressed.

- Calculate the Tax Owed: Use the provided tax tables to determine the estate tax liability based on the gross estate value.

- Review and Sign: Ensure all information is correct, then sign and date the form.

- Submit the Form: File the completed form with the Massachusetts Department of Revenue by the specified deadline.

Required Documents for the Massachusetts Form Estate

When preparing to file the Massachusetts Form Estate, several documents are necessary to support the information provided:

- Death certificate of the deceased.

- List of all assets owned by the deceased, including real estate and bank accounts.

- Valuation documents for property and investments.

- Documentation of any debts or liabilities of the estate.

- Previous tax returns of the deceased, if applicable.

Filing Deadlines for the Massachusetts Form Estate

Timely filing of the Massachusetts Form Estate is crucial to avoid penalties. The estate tax return must be filed within nine months of the date of death. If additional time is needed, an extension can be requested, but it is important to pay any estimated tax owed by the original due date to avoid interest and penalties.

Legal Use of the Massachusetts Form Estate

The Massachusetts Form Estate is legally binding and must be completed in accordance with state laws. It is used to report the estate's value and calculate the tax owed. Executors and administrators must ensure that the form is filled out accurately to avoid legal complications. Misreporting or failing to file can result in penalties, including fines and interest on unpaid taxes.

Digital vs. Paper Version of the Massachusetts Form Estate

Both digital and paper versions of the Massachusetts Form Estate are available for filing. The digital version allows for easier data entry and submission through secure online channels, while the paper form can be filled out manually and submitted via mail. Choosing the digital option can streamline the process, reduce the risk of errors, and ensure timely filing.

Quick guide on how to complete 3 form m 2018 2019

Your assistance manual on how to prepare your Massachusetts Form Estate

If you’re interested in discovering how to complete and submit your Massachusetts Form Estate, below are a few straightforward instructions on how to simplify tax filing.

To begin, all you need to do is register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that allows you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures and return to modify details as necessary. Streamline your tax processing with advanced PDF editing, eSigning, and easy sharing capabilities.

Follow these steps to complete your Massachusetts Form Estate in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Select Get form to access your Massachusetts Form Estate in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Keep in mind that submitting in paper format can lead to an increase in errors and delays in refunds. It is advisable to check the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 3 form m 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 3 form m 2018 2019

How to make an electronic signature for the 3 Form M 2018 2019 online

How to create an eSignature for your 3 Form M 2018 2019 in Google Chrome

How to generate an eSignature for putting it on the 3 Form M 2018 2019 in Gmail

How to generate an eSignature for the 3 Form M 2018 2019 right from your mobile device

How to generate an eSignature for the 3 Form M 2018 2019 on iOS

How to create an eSignature for the 3 Form M 2018 2019 on Android devices

People also ask

-

What is the Massachusetts Form Estate and how can airSlate SignNow help with it?

The Massachusetts Form Estate is a legal document required for estate management in Massachusetts. airSlate SignNow simplifies the process of sending and electronically signing these forms, ensuring that you can manage your estate documents efficiently and securely.

-

How much does it cost to use airSlate SignNow for Massachusetts Form Estate?

airSlate SignNow offers flexible pricing plans that cater to different needs and budgets. You can choose from various subscription options, allowing you to find the right plan that fits your requirements for handling the Massachusetts Form Estate.

-

What features does airSlate SignNow offer for managing Massachusetts Form Estate?

airSlate SignNow provides features such as customizable templates, easy document sharing, and secure e-signature capabilities. These tools make it easy to fill out and manage the Massachusetts Form Estate without hassle.

-

Is airSlate SignNow compliant with Massachusetts laws regarding estate forms?

Yes, airSlate SignNow is designed to comply with Massachusetts laws, ensuring that your use of the Massachusetts Form Estate adheres to legal standards. Our platform prioritizes compliance and security, so you can trust your documents are handled correctly.

-

Can I integrate airSlate SignNow with other software for managing Massachusetts Form Estate?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and more. This allows you to streamline your workflow when dealing with the Massachusetts Form Estate and other related documents.

-

How does airSlate SignNow enhance the efficiency of submitting the Massachusetts Form Estate?

With airSlate SignNow, you can quickly fill out, sign, and send the Massachusetts Form Estate electronically. This eliminates the need for physical paperwork, reducing processing time and increasing efficiency in managing your estate documents.

-

What are the benefits of using airSlate SignNow for estate management in Massachusetts?

Using airSlate SignNow for the Massachusetts Form Estate offers numerous benefits, including cost-effectiveness, ease of use, and enhanced security. These features allow you to manage your estate documents efficiently, saving time and resources while ensuring legal compliance.

Get more for Massachusetts Form Estate

- Lab 11 1 cardiovascular health form

- Certificate of occupancy checklist form

- Killer kitties worksheet answer key 537189191 form

- Medicare part d prior authorization form trs swhp

- Congruent shapes worksheet pdf form

- Incella screenfect form

- Auto insurance verification form

- Eylea4u enrollment form 54996728

Find out other Massachusetts Form Estate

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online