M990t Form 2020

What is the M990t Form

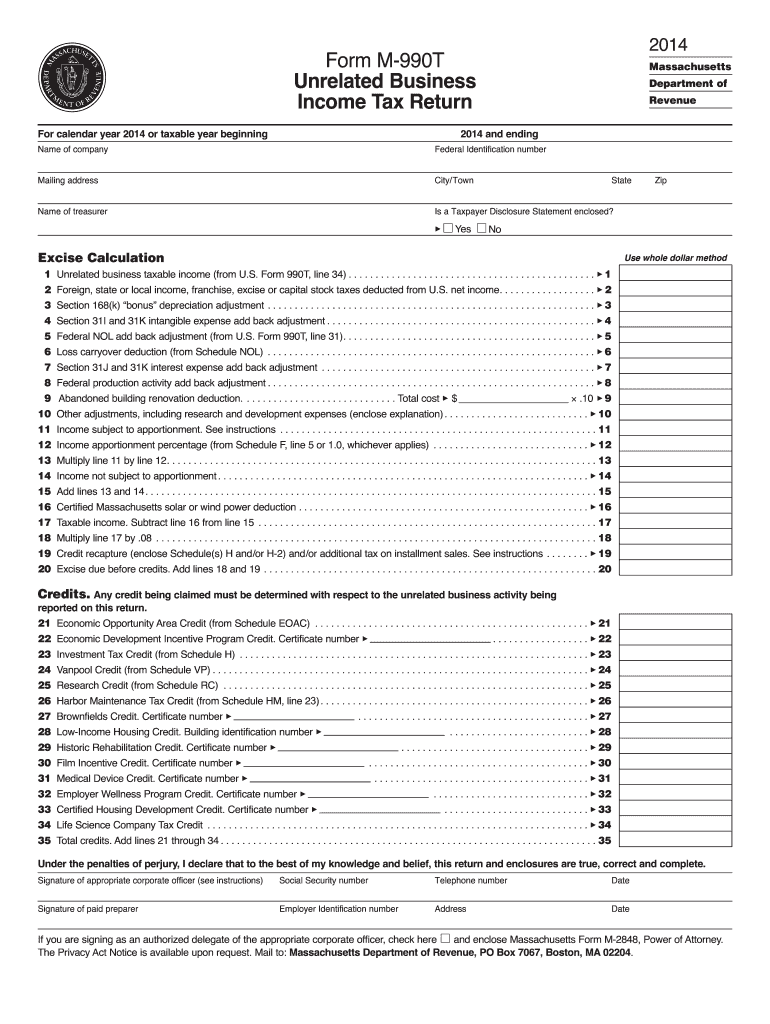

The M990t Form is a tax-related document used by certain organizations to report their unrelated business income to the Internal Revenue Service (IRS). This form is essential for tax-exempt entities that engage in activities not directly related to their primary purpose. By filing the M990t Form, organizations ensure compliance with federal tax regulations while maintaining their tax-exempt status.

How to use the M990t Form

To effectively use the M990t Form, organizations must first determine if they have any unrelated business income. This income is generated from activities that are not substantially related to the organization's exempt purpose. Once identified, the organization can fill out the form, providing necessary details about the income, expenses, and any applicable deductions. It is crucial to keep accurate records of all transactions related to the unrelated business income for reporting purposes.

Steps to complete the M990t Form

Completing the M990t Form involves several steps:

- Gather financial records related to unrelated business activities.

- Identify and report all sources of unrelated business income.

- Calculate allowable deductions related to the income.

- Fill out the M990t Form accurately, ensuring all sections are completed.

- Review the form for accuracy and completeness before submission.

Legal use of the M990t Form

The M990t Form is legally binding when filled out and submitted in accordance with IRS guidelines. Organizations must ensure that the information provided is truthful and accurate to avoid penalties. Compliance with the regulations set forth by the IRS is critical for maintaining tax-exempt status and avoiding legal complications.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the M990t Form to ensure timely submission. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. If the organization operates on a calendar year basis, the form is due by May fifteenth. Extensions may be available, but they must be requested in advance.

Who Issues the Form

The M990t Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides the necessary forms and guidelines for organizations to report their unrelated business income accurately. It is important for organizations to refer to the IRS website or official publications for the most current version of the form and any updates to filing requirements.

Quick guide on how to complete m990t 2014 form

Effortlessly Create M990t Form on Any Device

Digital document administration has gained immense traction among businesses and individuals alike. It offers an ideal green substitute to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage M990t Form across any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and Electronically Sign M990t Form with Ease

- Obtain M990t Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive details using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download to your PC.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign M990t Form to ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m990t 2014 form

Create this form in 5 minutes!

How to create an eSignature for the m990t 2014 form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the M990t Form and its purpose?

The M990t Form is primarily used by tax-exempt organizations to report unrelated business income. It helps these organizations calculate their tax liability on such income, ensuring compliance with IRS regulations. Understanding the M990t Form is crucial for proper tax management.

-

How can airSlate SignNow assist with M990t Form submissions?

airSlate SignNow simplifies the process of preparing and submitting the M990t Form through its eSignature solution. Users can easily upload, sign, and send the form directly from the platform, ensuring a seamless filing experience. This not only saves time but also enhances document security.

-

What features does airSlate SignNow offer for managing the M990t Form?

With airSlate SignNow, you can access features like custom templates, automated reminders, and secure cloud storage specifically for the M990t Form. These tools help streamline the document workflow, making it easier to manage multiple forms and submissions efficiently. Plus, real-time tracking ensures you never miss an update.

-

Is there a cost associated with using airSlate SignNow for the M990t Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including access to the M990t Form functionalities. Pricing is competitive and designed to provide a cost-effective solution for organizations seeking to manage their documents digitally. You can find a plan that fits your budget while meeting your eSignature needs.

-

Can I integrate airSlate SignNow with other software when working with the M990t Form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and Dropbox that are particularly useful when handling the M990t Form. This interoperability enhances your workflow and ensures that your document management is both comprehensive and efficient.

-

What are the security features related to submitting the M990t Form through airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like the M990t Form. The platform employs state-of-the-art encryption and complies with industry standards to protect your data. Additionally, user authentication features ensure that only authorized personnel can access or sign the forms.

-

How does airSlate SignNow improve the efficiency of filling out the M990t Form?

airSlate SignNow enhances the efficiency of filling out the M990t Form by providing fillable templates and auto-fill capabilities. This reduces the manual effort required and minimizes the risk of errors during completion. The streamlined workflow allows for quicker submission and review processes.

Get more for M990t Form

- Saurashtra university degree certificate form

- Survey ipsos com au patientsurvey form

- Dominica passport form

- Proof of no health insurance coverage letter from employer template form

- Door order form template

- Technical rider template word form

- Funny contract template form

- Withdrawal form for the non registered employee stock

Find out other M990t Form

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed