PT 300 Form the South Carolina Department of Revenue Sctax 2021

What is the PT 300 Form The South Carolina Department Of Revenue Sctax

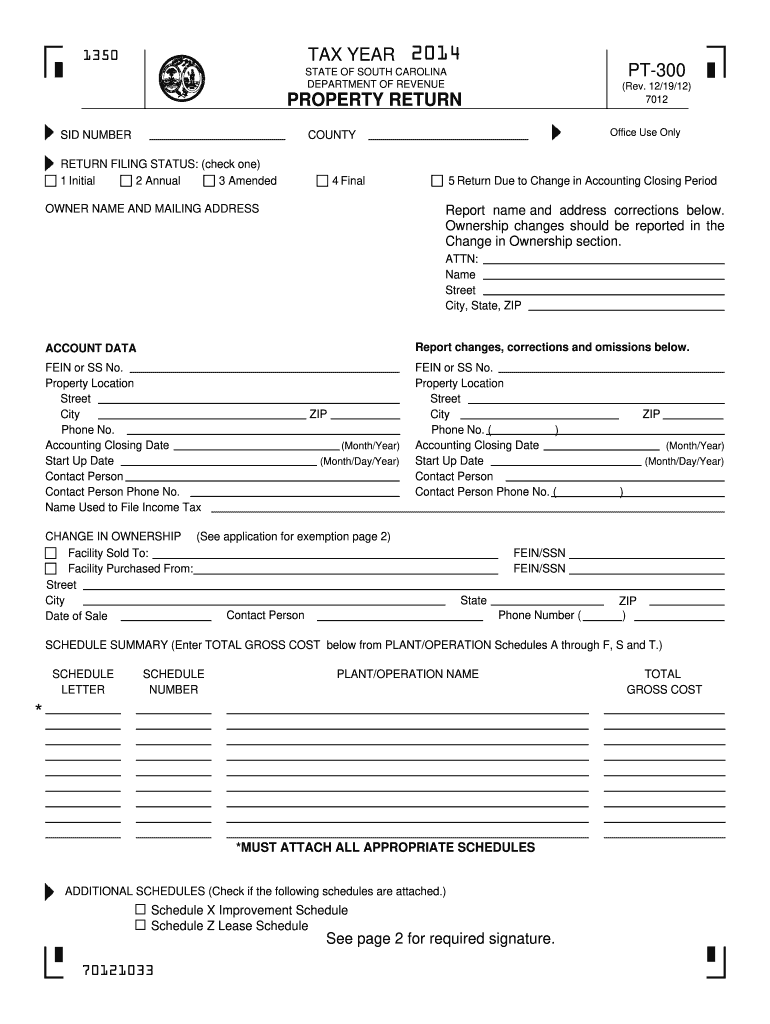

The PT 300 Form is a crucial document issued by the South Carolina Department of Revenue. It is primarily used for reporting property tax information. This form is essential for businesses and individuals who own property in South Carolina, as it helps ensure compliance with state tax regulations. The PT 300 Form collects information regarding the value of property and any applicable exemptions, which are vital for accurate tax assessments.

How to use the PT 300 Form The South Carolina Department Of Revenue Sctax

Using the PT 300 Form involves several steps to ensure proper completion and submission. First, gather all necessary information regarding the property, including its location, value, and any exemptions that may apply. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it can be submitted either electronically or via mail, depending on the preferences outlined by the South Carolina Department of Revenue.

Steps to complete the PT 300 Form The South Carolina Department Of Revenue Sctax

Completing the PT 300 Form requires careful attention to detail. Begin by entering basic information such as the property owner's name and contact details. Next, provide specific information about the property, including its physical address and assessed value. Be sure to check for any applicable tax exemptions and include relevant documentation. After reviewing the form for accuracy, submit it according to the guidelines provided by the South Carolina Department of Revenue.

Key elements of the PT 300 Form The South Carolina Department Of Revenue Sctax

The PT 300 Form includes several key elements that are critical for accurate reporting. These elements typically encompass the property owner's information, detailed descriptions of the property, assessed value, and any exemptions claimed. Additionally, the form may require signatures from the property owner or authorized representatives to validate the information provided. Understanding these components is essential for ensuring compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the PT 300 Form are crucial for property owners to avoid penalties. Typically, the form must be submitted by a specific date each year, which is set by the South Carolina Department of Revenue. It is important to stay informed about these deadlines to ensure timely submission. Missing the deadline may result in late fees or other penalties, so keeping track of important dates is essential for compliance.

Legal use of the PT 300 Form The South Carolina Department Of Revenue Sctax

The PT 300 Form serves a legal purpose in the context of property taxation in South Carolina. When completed accurately and submitted on time, it provides a legal basis for the assessment of property taxes. The information contained within the form is used by the state to determine tax liabilities and ensure that property owners are complying with local tax laws. Understanding the legal implications of this form is vital for property owners.

Quick guide on how to complete pt 300 2014 form the south carolina department of revenue sctax

Complete PT 300 Form The South Carolina Department Of Revenue Sctax effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle PT 300 Form The South Carolina Department Of Revenue Sctax on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign PT 300 Form The South Carolina Department Of Revenue Sctax effortlessly

- Find PT 300 Form The South Carolina Department Of Revenue Sctax and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and eSign PT 300 Form The South Carolina Department Of Revenue Sctax while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pt 300 2014 form the south carolina department of revenue sctax

Create this form in 5 minutes!

How to create an eSignature for the pt 300 2014 form the south carolina department of revenue sctax

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the PT 300 Form from the South Carolina Department of Revenue?

The PT 300 Form from the South Carolina Department of Revenue (Sctax) is a property tax return that must be filed by businesses to report their personal property. This form is essential for businesses to ensure compliance with South Carolina's tax regulations and to accurately assess their property tax obligations.

-

How can airSlate SignNow help with the PT 300 Form?

airSlate SignNow provides an efficient way to electronically sign and send the PT 300 Form to the South Carolina Department of Revenue. With our platform, you can streamline the process of submitting this important document, ensuring that it is completed accurately and submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the PT 300 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost for using our platform to manage documents, including the PT 300 Form for the South Carolina Department of Revenue, is designed to be budget-friendly while providing exceptional value and features.

-

What features does airSlate SignNow offer for filing the PT 300 Form?

airSlate SignNow offers features like eSigning, document templates, and secure cloud storage, which are invaluable for filing the PT 300 Form. Our platform allows you to customize and automate the signing process, making it easier to manage your tax documents efficiently.

-

Are there integrations available for airSlate SignNow to assist with the PT 300 Form?

Absolutely! airSlate SignNow integrates with various applications, allowing you to easily streamline your workflow when dealing with the PT 300 Form. Whether you use CRM software or other business tools, our integrations help you manage your documents seamlessly.

-

What are the benefits of using airSlate SignNow for the PT 300 Form?

Using airSlate SignNow for the PT 300 Form simplifies the tax filing process, ensuring compliance and accuracy. With features like easy collaboration and document tracking, businesses can save time and reduce stress while managing their property tax returns for the South Carolina Department of Revenue.

-

How does airSlate SignNow ensure the security of the PT 300 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect sensitive information, ensuring that your PT 300 Form submitted to the South Carolina Department of Revenue remains confidential and safe.

Get more for PT 300 Form The South Carolina Department Of Revenue Sctax

Find out other PT 300 Form The South Carolina Department Of Revenue Sctax

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application