Scwithholding Quartly Tax Return Wh 1605 Form 2019

What is the Scwithholding Quartly Tax Return Wh 1605 Form

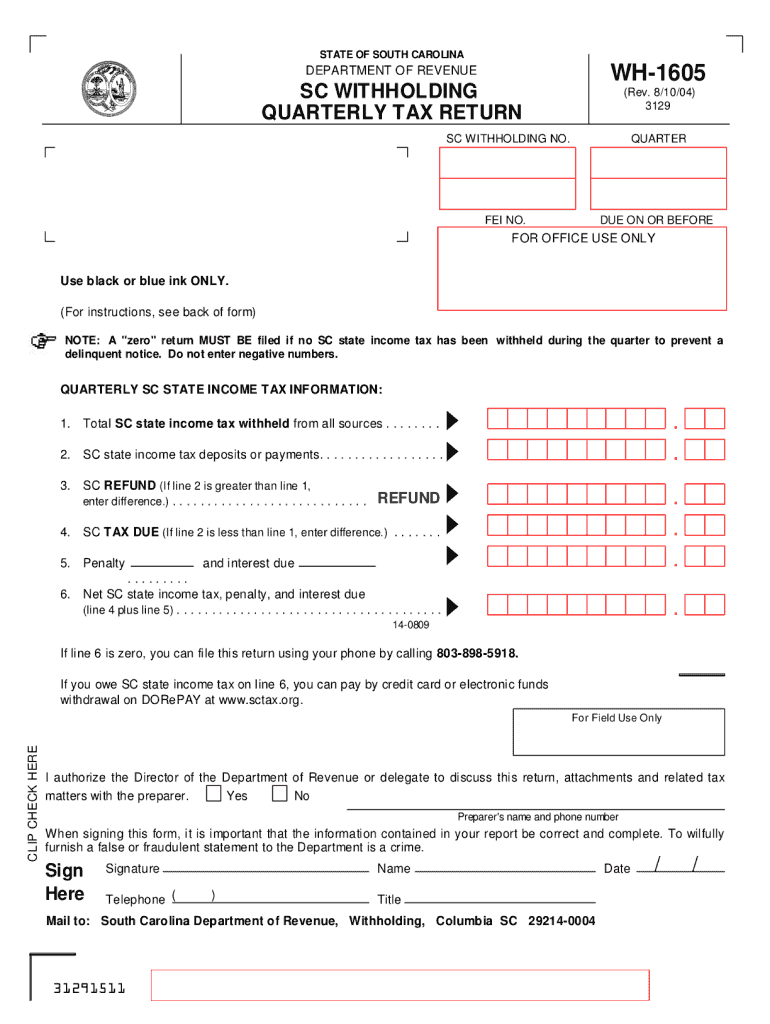

The Scwithholding Quartly Tax Return Wh 1605 Form is a tax document used by employers in the United States to report and remit withholding taxes on wages paid to employees. This form is essential for ensuring compliance with federal and state tax regulations. It helps employers calculate the amount of tax they need to withhold from employee paychecks and submit to the appropriate tax authorities on a quarterly basis.

How to use the Scwithholding Quartly Tax Return Wh 1605 Form

Using the Scwithholding Quartly Tax Return Wh 1605 Form involves a few key steps. First, employers must gather all necessary payroll information, including employee wages and the applicable withholding rates. Next, they complete the form by entering the required data accurately. Once the form is filled out, it must be submitted to the relevant tax authority, either electronically or by mail, depending on the jurisdiction's requirements.

Steps to complete the Scwithholding Quartly Tax Return Wh 1605 Form

Completing the Scwithholding Quartly Tax Return Wh 1605 Form involves several important steps:

- Gather payroll records for the quarter.

- Determine the total wages paid to employees.

- Calculate the total amount of withholding taxes based on the wages and applicable rates.

- Fill out the form with accurate information, ensuring all calculations are correct.

- Review the form for any errors before submission.

- Submit the completed form to the appropriate tax authority by the deadline.

Legal use of the Scwithholding Quartly Tax Return Wh 1605 Form

The legal use of the Scwithholding Quartly Tax Return Wh 1605 Form is crucial for employers to avoid penalties and ensure compliance with tax laws. This form serves as an official record of the taxes withheld from employees' wages and demonstrates that the employer is fulfilling their tax obligations. Failure to use this form correctly can result in fines, interest on unpaid taxes, and potential audits by tax authorities.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the Scwithholding Quartly Tax Return Wh 1605 Form. Typically, the form is due on the last day of the month following the end of each quarter. For example, for the first quarter (January to March), the deadline is April 30. It is essential to adhere to these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Scwithholding Quartly Tax Return Wh 1605 Form can be submitted through various methods, depending on the preferences of the employer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's electronic filing system.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete scwithholding quartly tax return wh 1605 2004 form

Effortlessly Prepare Scwithholding Quartly Tax Return Wh 1605 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Scwithholding Quartly Tax Return Wh 1605 Form on any device with airSlate SignNow's Android or iOS applications, and simplify your document-related processes today.

How to Edit and eSign Scwithholding Quartly Tax Return Wh 1605 Form with Ease

- Find Scwithholding Quartly Tax Return Wh 1605 Form and click on Get Form to commence.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Scwithholding Quartly Tax Return Wh 1605 Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scwithholding quartly tax return wh 1605 2004 form

Create this form in 5 minutes!

How to create an eSignature for the scwithholding quartly tax return wh 1605 2004 form

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the SC Withholding Quarterly Tax Return WH 1605 Form?

The SC Withholding Quarterly Tax Return WH 1605 Form is a document that businesses in South Carolina must submit to report and pay state withholding taxes. This form provides essential information about the taxes withheld from employees' wages during the quarter. Understanding this form is crucial for compliance and helps avoid penalties.

-

How can airSlate SignNow assist with filing the SC Withholding Quarterly Tax Return WH 1605 Form?

airSlate SignNow simplifies the process of filing the SC Withholding Quarterly Tax Return WH 1605 Form by enabling businesses to eSign and send documents securely. The platform ensures that all necessary signatures are obtained electronically, streamlining the submission process. With its user-friendly interface, you can manage your tax documents with ease.

-

Is airSlate SignNow cost-effective for small businesses handling the SC Withholding Quarterly Tax Return WH 1605 Form?

Yes, airSlate SignNow offers a cost-effective solution that caters to small businesses needing to manage the SC Withholding Quarterly Tax Return WH 1605 Form. The pricing plans are designed to fit various budgets while providing essential features that help businesses stay compliant. This makes it an ideal choice for managing tax filings without breaking the bank.

-

What features does airSlate SignNow provide for managing the SC Withholding Quarterly Tax Return WH 1605 Form?

airSlate SignNow equips users with features such as eSignature capabilities, document templates, and automated reminders for filing the SC Withholding Quarterly Tax Return WH 1605 Form. Additionally, the platform allows for easy tracking of document status, ensuring that all parties are informed throughout the process. These features enhance efficiency and compliance.

-

Can I integrate airSlate SignNow with other accounting software for the SC Withholding Quarterly Tax Return WH 1605 Form?

Absolutely! airSlate SignNow offers numerous integrations with popular accounting software, making it easy to manage your finances alongside the SC Withholding Quarterly Tax Return WH 1605 Form. This integration helps streamline workflows, reduces manual data entry, and ensures accurate document handling for your tax obligations.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the SC Withholding Quarterly Tax Return WH 1605 Form, ensures a secure and efficient process. Businesses benefit from reduced paper usage, faster turnaround times for signatures, and simplified compliance with state regulations. Overall, it enhances productivity and helps maintain accurate tax records.

-

Is it easy to learn how to use airSlate SignNow for the SC Withholding Quarterly Tax Return WH 1605 Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for individuals to learn how to utilize the platform for the SC Withholding Quarterly Tax Return WH 1605 Form. The intuitive interface requires minimal training, allowing users to get started almost immediately. Comprehensive support resources are also available should you need assistance.

Get more for Scwithholding Quartly Tax Return Wh 1605 Form

Find out other Scwithholding Quartly Tax Return Wh 1605 Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document