SC WITHHOLDING QUARTERLY TAX RETURN South Carolina 2022-2026

What is the SC Withholding Quarterly Tax Return?

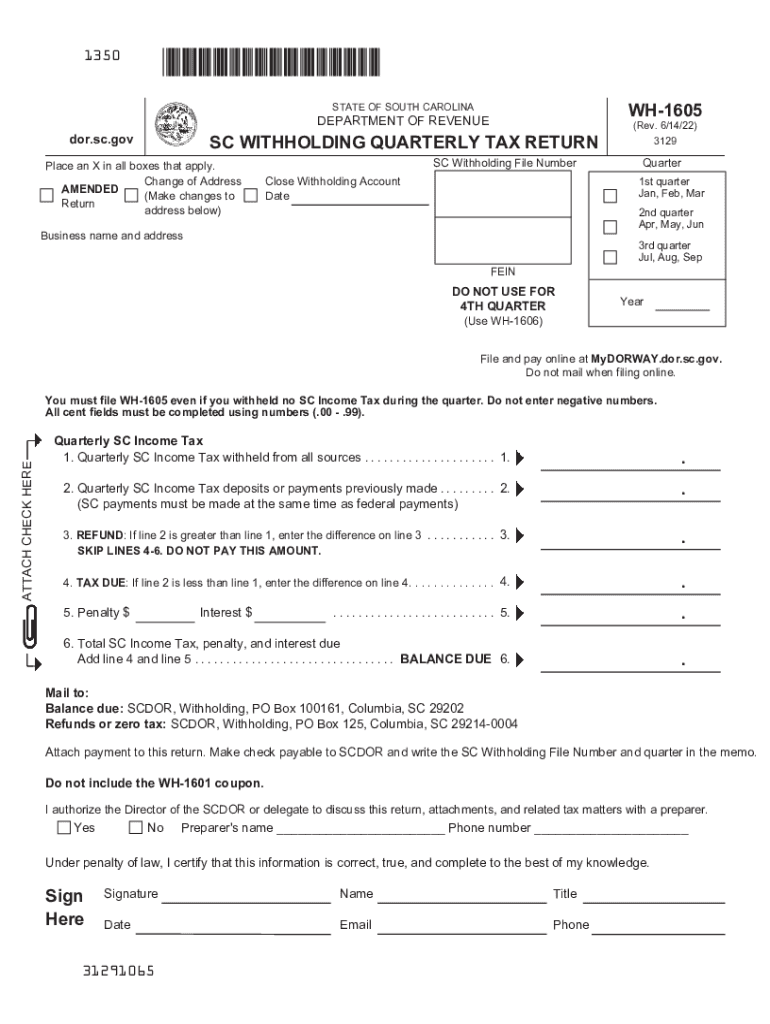

The SC Withholding Quarterly Tax Return, commonly referred to as the WH-1605, is a form used by employers in South Carolina to report and remit state income tax withheld from employee wages. This form is essential for maintaining compliance with state tax laws and ensuring that the appropriate amounts are paid to the South Carolina Department of Revenue. Employers must submit this form quarterly, reflecting the total withholding for the period, which helps the state track tax revenue and ensures that employees receive proper credit for their withholdings when filing their personal tax returns.

Steps to Complete the SC Withholding Quarterly Tax Return

Completing the SC Withholding Quarterly Tax Return involves several key steps:

- Gather necessary information, including the total wages paid to employees and the amount of state income tax withheld during the quarter.

- Fill out the WH-1605 form, ensuring that all sections are completed accurately. This includes providing your business information, total wages, and total withholding amounts.

- Review the completed form for any errors or omissions to avoid potential penalties.

- Submit the form to the South Carolina Department of Revenue by the specified deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for submitting the SC Withholding Quarterly Tax Return. The due dates are typically as follows:

- For the first quarter (January to March): Due by April 30.

- For the second quarter (April to June): Due by July 31.

- For the third quarter (July to September): Due by October 31.

- For the fourth quarter (October to December): Due by January 31 of the following year.

Legal Use of the SC Withholding Quarterly Tax Return

The SC Withholding Quarterly Tax Return serves a legal purpose in the context of state taxation. Filing this form is a requirement under South Carolina tax law, and failure to do so can result in penalties and interest on unpaid taxes. The information provided on the WH-1605 is used by the South Carolina Department of Revenue to ensure compliance with state tax regulations and to assist in the accurate assessment of tax liabilities for both employers and employees.

Key Elements of the SC Withholding Quarterly Tax Return

The WH-1605 form includes several key elements that are crucial for accurate reporting:

- Employer Information: Business name, address, and identification number.

- Total Wages: The total amount of wages paid to employees during the quarter.

- Withholding Amount: The total amount of state income tax withheld from employees' wages.

- Signature: A signature from an authorized representative of the business, confirming the accuracy of the information provided.

Form Submission Methods

The SC Withholding Quarterly Tax Return can be submitted through various methods, providing flexibility for employers:

- Online Submission: Employers can file the WH-1605 electronically through the South Carolina Department of Revenue's online portal.

- Mail: The form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Employers may also choose to submit the form in person at a local Department of Revenue office.

Quick guide on how to complete sc withholding quarterly tax return south carolina

Effortlessly Prepare SC WITHHOLDING QUARTERLY TAX RETURN South Carolina on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally responsible substitute for traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without complications. Handle SC WITHHOLDING QUARTERLY TAX RETURN South Carolina on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Steps to Modify and Electronically Sign SC WITHHOLDING QUARTERLY TAX RETURN South Carolina with Ease

- Find SC WITHHOLDING QUARTERLY TAX RETURN South Carolina and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign SC WITHHOLDING QUARTERLY TAX RETURN South Carolina to guarantee effective communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc withholding quarterly tax return south carolina

Create this form in 5 minutes!

People also ask

-

What is the WH 1605 form, and why is it important?

The WH 1605 form is a document used for requesting an exemption from withholding on wages for an employee. It's essential for ensuring compliant payroll processing and accurate tax reporting. By using airSlate SignNow, you can easily eSign and manage your WH 1605 forms digitally without hassle.

-

How does airSlate SignNow simplify the process of managing WH 1605 forms?

airSlate SignNow offers a user-friendly platform to create, send, and eSign WH 1605 forms efficiently. With its intuitive interface, you can quickly navigate through the necessary steps, ensuring your documents are completed accurately and securely. This speeds up your workflow and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for WH 1605 forms?

airSlate SignNow provides various pricing plans, including options specifically for managing forms like the WH 1605. You can choose a plan that best fits your business needs, ensuring that you get a cost-effective solution for managing your documents while enjoying comprehensive features.

-

What features of airSlate SignNow are beneficial for handling WH 1605 documents?

Key features include customizable templates, secure eSigning, and document tracking, which streamline the process of handling WH 1605 forms. Additionally, you can set reminders and automate workflows to ensure timely submissions. These features enhance efficiency and compliance.

-

Can airSlate SignNow integrate with other applications for processing WH 1605 forms?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more to enhance workflow for WH 1605 forms. This ensures that you can easily manage your documents and data across platforms, improving productivity without compromising data security.

-

What are the benefits of using airSlate SignNow for small businesses dealing with WH 1605?

For small businesses, airSlate SignNow offers an affordable, scalable solution to manage WH 1605 forms efficiently. It reduces paperwork and simplifies the signing process, freeing up time for more critical tasks. This makes it easier for small businesses to maintain compliance without adding complications.

-

How secure is airSlate SignNow when handling sensitive WH 1605 data?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with legal standards when processing WH 1605 forms. This ensures that your sensitive data remains protected throughout the signing and management process. Trust in airSlate SignNow for secure document handling.

Get more for SC WITHHOLDING QUARTERLY TAX RETURN South Carolina

- Assignment of lease and rent from borrower to lender nebraska form

- Assignment of lease from lessor with notice of assignment nebraska form

- Letter from landlord to tenant as notice of abandoned personal property nebraska form

- Guaranty or guarantee of payment of rent nebraska form

- Letter from landlord to tenant as notice of default on commercial lease nebraska form

- Residential or rental lease extension agreement nebraska form

- Commercial rental lease application questionnaire nebraska form

- Apartment lease rental application questionnaire nebraska form

Find out other SC WITHHOLDING QUARTERLY TAX RETURN South Carolina

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now