Wh 1605 2019

What is the WH-1605?

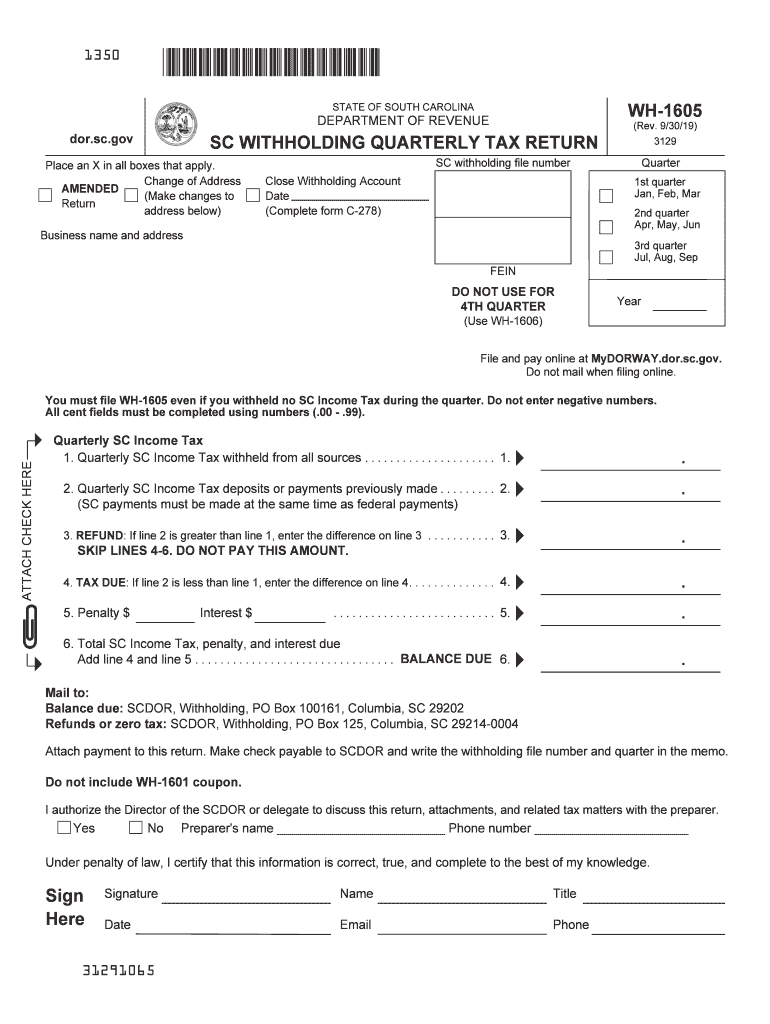

The WH-1605 form, also known as the South Carolina withholding form, is a crucial document for employers in South Carolina. This form is used to report and remit state income tax withheld from employees' wages. It ensures that the appropriate amounts are collected and submitted to the South Carolina Department of Revenue (SCDOR). Understanding the WH-1605 is essential for compliance with state tax laws and for maintaining accurate payroll records.

How to Use the WH-1605

Using the WH-1605 form involves a few straightforward steps. Employers must first gather the necessary information about their employees, including names, Social Security numbers, and the total amount of wages paid during the reporting period. Once this information is collected, it can be entered into the WH-1605 form. After completing the form, employers must submit it to the SCDOR along with the withheld taxes. This process can be done electronically, ensuring efficiency and accuracy in tax reporting.

Steps to Complete the WH-1605

Completing the WH-1605 form requires careful attention to detail. Here are the essential steps:

- Gather employee information, including names and Social Security numbers.

- Calculate the total wages paid to each employee during the reporting period.

- Determine the amount of state income tax withheld for each employee.

- Fill out the WH-1605 form with the collected data.

- Review the form for accuracy before submission.

- Submit the completed form to the SCDOR, along with the withheld taxes.

Legal Use of the WH-1605

The WH-1605 form is legally required for employers in South Carolina to report income tax withholding. Compliance with this requirement helps avoid penalties and ensures that employees' tax obligations are met. It is important for employers to understand the legal implications of this form, as failure to file or inaccuracies can lead to fines or legal issues. By using the WH-1605 correctly, employers contribute to the state's revenue and support public services.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the WH-1605 form to ensure timely filing. Typically, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadlines for submission are usually April 30, July 31, October 31, and January 31. Staying informed about these dates is crucial for maintaining compliance and avoiding late fees.

Form Submission Methods

The WH-1605 form can be submitted to the South Carolina Department of Revenue through various methods. Employers may choose to file electronically, which is often the most efficient option. Alternatively, the form can be mailed directly to the SCDOR or submitted in person at designated offices. Each submission method has its own guidelines and requirements, so it is important for employers to select the option that best suits their needs.

Quick guide on how to complete wh 1605

Complete Wh 1605 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Wh 1605 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to alter and eSign Wh 1605 without effort

- Find Wh 1605 and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Wh 1605 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wh 1605

Create this form in 5 minutes!

How to create an eSignature for the wh 1605

How to make an eSignature for the Wh 1605 in the online mode

How to make an electronic signature for your Wh 1605 in Chrome

How to make an eSignature for signing the Wh 1605 in Gmail

How to create an electronic signature for the Wh 1605 straight from your smart phone

How to generate an electronic signature for the Wh 1605 on iOS devices

How to generate an eSignature for the Wh 1605 on Android

People also ask

-

What is the South Carolina withholding form?

The South Carolina withholding form is a document used by employers to report and withhold income taxes from employee paychecks. It's essential for compliance with state tax regulations. Understanding this form is crucial for both employers and employees in South Carolina.

-

How can airSlate SignNow assist with filling out the South Carolina withholding form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the South Carolina withholding form. With our user-friendly interface, you can easily input your information and ensure that all necessary details are accurately captured. This reduces the chances of errors and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for the South Carolina withholding form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. Our solutions are cost-effective, providing great value for the services rendered. By using airSlate SignNow for the South Carolina withholding form, you not only save time but also money on administrative tasks.

-

What features does airSlate SignNow provide for managing the South Carolina withholding form?

airSlate SignNow offers features such as electronic signatures, document tracking, and secure cloud storage to effectively manage the South Carolina withholding form. These features ensure that your documents are signed promptly and safely stored for easy access. This comprehensive approach streamlines your payroll processes.

-

Can I integrate airSlate SignNow with my existing payroll software for the South Carolina withholding form?

Absolutely! airSlate SignNow is designed to seamlessly integrate with various payroll and accounting software. This integration allows you to automate the handling of the South Carolina withholding form, greatly enhancing your efficiency and ensuring accurate data flow between systems.

-

How does using airSlate SignNow for the South Carolina withholding form benefit my business?

Using airSlate SignNow to manage the South Carolina withholding form streamlines your workflow, minimizes paperwork, and enhances compliance with tax regulations. By reducing manual errors and administrative burdens, your team can focus more on core business activities. Ultimately, this leads to increased productivity and cost savings.

-

Is the South Carolina withholding form editable online with airSlate SignNow?

Yes, the South Carolina withholding form is fully editable online with airSlate SignNow. Users can easily make changes or updates to the form as needed, ensuring that all information is current and accurate. This capability enhances convenience for both employers and employees during tax season.

Get more for Wh 1605

- Recommendation on a potential new member kappa delta kappadelta form

- Legacy amp reference formpdf alpha phi und

- Nicolet high school transcript request form

- Oral presentation rubric college of science purdue university science purdue form

- Insurance verification request form pacific infusion center

- Infusion form

- 2014 form 8959

- Supplemental questionnaire to determine identity for a us passport form

Find out other Wh 1605

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form