South Carolina State Withholding Form 2019

What is the South Carolina State Withholding Form

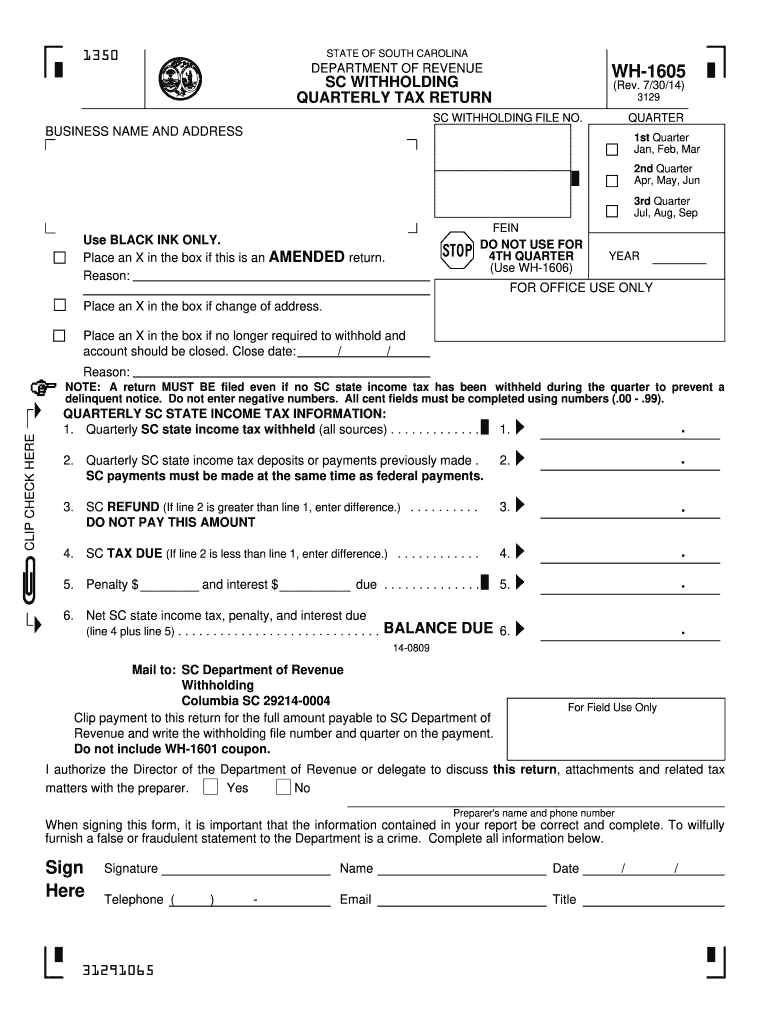

The South Carolina State Withholding Form is a crucial document used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with state tax regulations and helps employees manage their tax obligations effectively. By accurately completing this form, employees can specify their withholding allowances, which directly impact their take-home pay and overall tax liability.

How to use the South Carolina State Withholding Form

Using the South Carolina State Withholding Form involves a straightforward process. Employees should first obtain the form from their employer or download it from the South Carolina Department of Revenue website. Once in possession of the form, employees need to fill out their personal information, including name, address, and Social Security number. Additionally, they must indicate their filing status and the number of allowances they wish to claim. After completing the form, it should be submitted to the employer for processing.

Steps to complete the South Carolina State Withholding Form

Completing the South Carolina State Withholding Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from your employer or the South Carolina Department of Revenue.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status (single, married, etc.) and the number of allowances you are claiming.

- Review the information for accuracy to ensure proper withholding.

- Submit the completed form to your employer for processing.

Key elements of the South Carolina State Withholding Form

Several key elements are essential for the South Carolina State Withholding Form to be valid and effective. These include:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must indicate their marital status, which affects tax rates.

- Withholding Allowances: The number of allowances claimed will determine the amount withheld from paychecks.

- Signature: The employee must sign and date the form to validate it.

Legal use of the South Carolina State Withholding Form

The legal use of the South Carolina State Withholding Form is governed by state tax laws. Employers are required to withhold state income tax based on the information provided by employees on this form. Failure to comply with these regulations can result in penalties for both the employer and employee. It is important for employees to ensure that their form is accurately completed and submitted to avoid any legal issues related to tax withholding.

Form Submission Methods

The South Carolina State Withholding Form can be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online: Some employers may allow electronic submission of the form through their payroll systems.

- Mail: Employees can print the completed form and mail it directly to their employer.

- In-Person: Submitting the form in person may be an option for employees who prefer direct interaction.

Quick guide on how to complete south carolina state withholding form 2014

Effortlessly Prepare South Carolina State Withholding Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle South Carolina State Withholding Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign South Carolina State Withholding Form with Ease

- Locate South Carolina State Withholding Form and click on Get Form to get started.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign South Carolina State Withholding Form and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina state withholding form 2014

Create this form in 5 minutes!

How to create an eSignature for the south carolina state withholding form 2014

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the South Carolina State Withholding Form?

The South Carolina State Withholding Form is a document used by employers to report and withhold state income taxes from employees' paychecks. It's essential for compliance with state tax laws and ensures that the correct amount of tax is withheld. Understanding how to properly fill out this form can help businesses avoid penalties.

-

How can airSlate SignNow help with the South Carolina State Withholding Form?

airSlate SignNow offers a seamless way to eSign and send the South Carolina State Withholding Form electronically. Our platform simplifies document management and ensures that all signatures are legally binding. This allows businesses to process payroll documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the South Carolina State Withholding Form?

Using airSlate SignNow to manage the South Carolina State Withholding Form is cost-effective, with flexible pricing plans to suit various business needs. Our platform offers a free trial, allowing users to explore features without any upfront investment. Detailed pricing information is available on our website.

-

What features does airSlate SignNow offer for handling the South Carolina State Withholding Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure storage for the South Carolina State Withholding Form. These features ensure that documents are easily accessible and that the signing process is fast and efficient. Additionally, tracking and notifications keep users informed throughout the process.

-

Can I integrate airSlate SignNow with my payroll system for the South Carolina State Withholding Form?

Yes, airSlate SignNow supports integrations with various payroll systems, making it easy to manage the South Carolina State Withholding Form alongside your existing financial workflows. This integration helps streamline the process of sending and receiving completed forms, enhancing overall efficiency. Check our integration page for a full list of compatible software.

-

What are the benefits of using airSlate SignNow for the South Carolina State Withholding Form?

The benefits of using airSlate SignNow for the South Carolina State Withholding Form include improved speed, security, and ease of use. Electronic signatures reduce processing time signNowly, while our secure platform ensures document safety and compliance. Additionally, users can store all important tax forms in one place, simplifying record-keeping.

-

Is airSlate SignNow compliant with South Carolina state regulations for the withholding form?

Yes, airSlate SignNow is designed to comply with South Carolina state regulations regarding the South Carolina State Withholding Form. Our legal team continually updates our service to meet changing legal requirements, ensuring that your documents remain compliant. This gives businesses peace of mind when managing tax-related forms.

Get more for South Carolina State Withholding Form

- Venturer scout rank worksheet form

- Disability annexure a form

- Emt certificate template form

- Hair salon waiver form

- Montana office of public instruction re dissemination form

- Cbp 6043 form

- Cara mengisi borang permohonan lesen berniaga sabah form

- Michigan department of state licensing unit medical examination report form

Find out other South Carolina State Withholding Form

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online