CL 1 the South Carolina Department of Revenue Sctax 2019

What is the CL-1 The South Carolina Department Of Revenue Sctax?

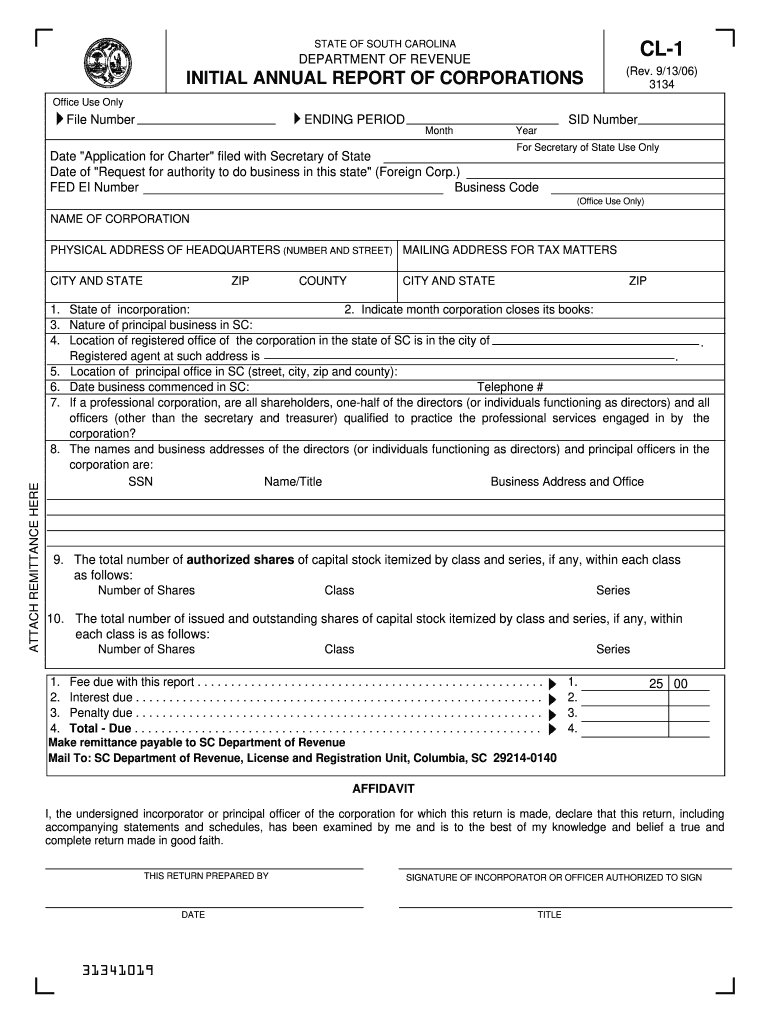

The CL-1 form is a crucial document issued by the South Carolina Department of Revenue, specifically designed for tax purposes. This form is primarily used for reporting and documenting specific tax-related information. Understanding its purpose is essential for compliance with state tax regulations. The CL-1 form helps ensure that taxpayers accurately report their income and any applicable deductions, thus facilitating the proper assessment of state taxes owed.

How to use the CL-1 The South Carolina Department Of Revenue Sctax

Using the CL-1 form involves several key steps. First, gather all necessary financial documentation, including income statements and any relevant deductions. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted either electronically or via traditional mail. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or in case of an audit.

Steps to complete the CL-1 The South Carolina Department Of Revenue Sctax

Completing the CL-1 form requires careful attention to detail. Follow these steps:

- Collect all necessary documents, including W-2s and 1099s.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and dividends.

- Detail any deductions you are eligible for, ensuring you have documentation to support these claims.

- Review the form for accuracy before submission.

Legal use of the CL-1 The South Carolina Department Of Revenue Sctax

The legal validity of the CL-1 form is upheld by compliance with state tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted by the designated deadlines. Additionally, using a reliable electronic signature solution can enhance the legal standing of the document, as it provides verification of identity and intent. Adhering to these guidelines helps prevent issues with tax compliance and potential penalties.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the CL-1 form. Taxpayers should be aware of the specific filing deadlines set by the South Carolina Department of Revenue. Typically, the form must be submitted by April fifteenth for individual taxpayers. However, those with extensions may have different deadlines. It is advisable to check the department's official website or consult a tax professional for the most current information regarding important dates.

Required Documents

When completing the CL-1 form, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions claimed, such as receipts or tax statements.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failing to file the CL-1 form on time or providing inaccurate information can result in significant penalties. The South Carolina Department of Revenue may impose fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial to ensure that all information is correct and submitted by the deadline to avoid these consequences. Being proactive in tax compliance can save taxpayers from unnecessary stress and financial burden.

Quick guide on how to complete cl 1 the south carolina department of revenue sctax

Prepare CL 1 The South Carolina Department Of Revenue Sctax seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Handle CL 1 The South Carolina Department Of Revenue Sctax on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign CL 1 The South Carolina Department Of Revenue Sctax with ease

- Find CL 1 The South Carolina Department Of Revenue Sctax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details thoroughly and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choosing. Edit and eSign CL 1 The South Carolina Department Of Revenue Sctax to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cl 1 the south carolina department of revenue sctax

Create this form in 5 minutes!

How to create an eSignature for the cl 1 the south carolina department of revenue sctax

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is CL 1 The South Carolina Department Of Revenue Sctax?

CL 1 The South Carolina Department Of Revenue Sctax refers to the specific tax document used by businesses in South Carolina for tax reporting. Utilizing airSlate SignNow makes it easier for businesses to manage their tax documents efficiently, ensuring compliance and accuracy.

-

How can airSlate SignNow help with CL 1 The South Carolina Department Of Revenue Sctax?

airSlate SignNow streamlines the process of completing and submitting CL 1 The South Carolina Department Of Revenue Sctax forms. Our platform allows for easy eSigning and secure document management, reducing errors and saving time for businesses.

-

Is there a cost associated with using airSlate SignNow for CL 1 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow offers a cost-effective solution for managing CL 1 The South Carolina Department Of Revenue Sctax and other documents. Pricing plans are designed to cater to various business needs, providing flexibility and value for users.

-

What features does airSlate SignNow offer for handling CL 1 The South Carolina Department Of Revenue Sctax?

Our platform includes features like document templates, secure eSigning, and progress tracking, specifically tailored for CL 1 The South Carolina Department Of Revenue Sctax handling. These features help businesses to increase efficiency and ensure all necessary documentation is properly completed.

-

Can I integrate airSlate SignNow with my existing systems for CL 1 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow offers integrations with popular business tools that simplify the process of managing CL 1 The South Carolina Department Of Revenue Sctax. This allows for seamless workflow and enhanced productivity without needing to switch platforms.

-

What are the benefits of using airSlate SignNow for CL 1 The South Carolina Department Of Revenue Sctax?

Using airSlate SignNow for CL 1 The South Carolina Department Of Revenue Sctax provides numerous benefits, including time-saving document workflows, reduced paperwork, and enhanced security. It ensures that your business stays compliant and organized in handling tax-related documents.

-

Is airSlate SignNow user-friendly for completing CL 1 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete CL 1 The South Carolina Department Of Revenue Sctax forms. Our interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effortlessly.

Get more for CL 1 The South Carolina Department Of Revenue Sctax

- Truancy letter to parents template form

- Daily pre task safety plan template form

- Bank change order form 46547706

- Cash verification form 42776657

- Illness or misadventure claim form cronulla high school web1 cronulla h schools nsw edu

- Fort hare online application 48053484 form

- Planning department filing instructions form

- E bundesagentur fr arbeit zentrale auslands und fachvermittlung form

Find out other CL 1 The South Carolina Department Of Revenue Sctax

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF