Dr95a Form

What is the DR95A Form

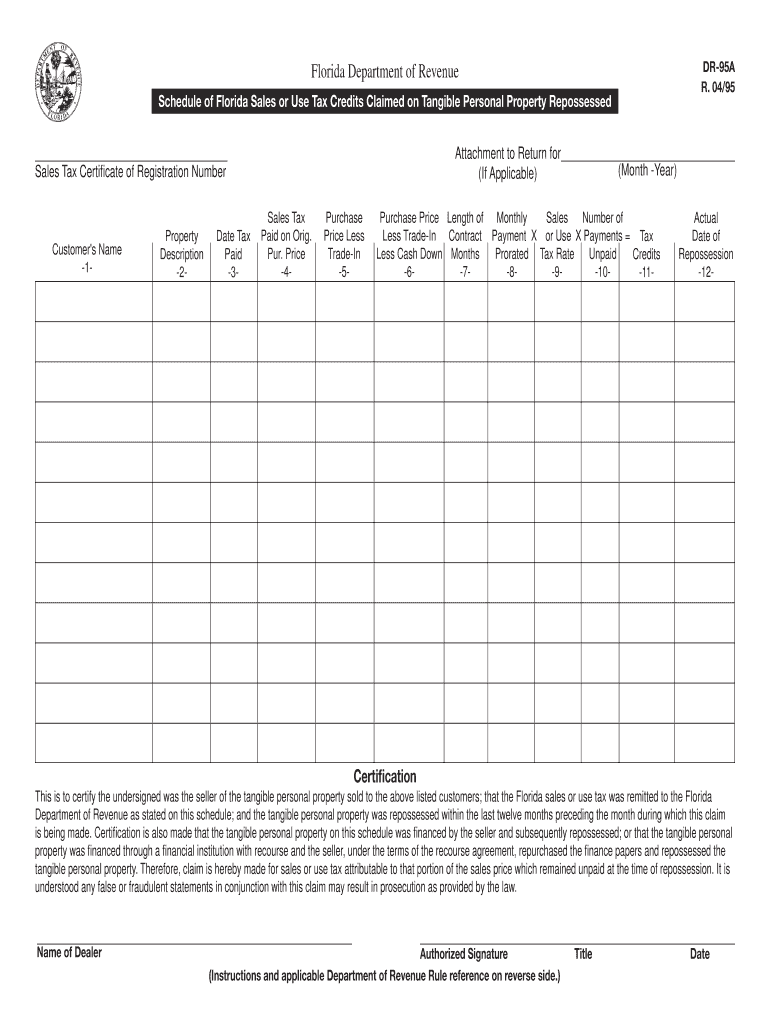

The DR95A form, also known as the Florida Credits Claimed Property form, is a crucial document used by property owners in Florida to claim sales tax credits for tangible personal property that has been repossessed. This form is specifically designed to facilitate the process of recovering sales tax previously paid on items that are no longer in the possession of the taxpayer due to repossession. Understanding the purpose of the DR95A form is essential for ensuring compliance with Florida tax regulations.

How to Use the DR95A Form

Using the DR95A form involves several key steps to ensure that it is completed accurately. First, gather all necessary information regarding the repossessed property, including purchase details and any relevant sales tax documentation. Next, fill out the form with precise details about the property, the original purchase, and the circumstances of the repossession. Once completed, the form must be submitted to the appropriate Florida tax authority to process your claim for sales tax credits.

Steps to Complete the DR95A Form

Completing the DR95A form requires careful attention to detail. Follow these steps:

- Obtain the DR95A form from the Florida Department of Revenue website or through authorized channels.

- Provide accurate information about the repossessed property, including its description and the sales tax paid during the original purchase.

- Indicate the reason for repossession and any supporting documentation that may be required.

- Review the completed form for accuracy before submission.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal Use of the DR95A Form

The legal use of the DR95A form is governed by Florida tax laws. It is essential that the form is filled out accurately and submitted in accordance with state regulations to ensure that the claim for sales tax credits is valid. Failure to comply with the legal requirements can result in denial of the claim or potential penalties. Therefore, understanding the legal implications of using the DR95A form is vital for property owners seeking to reclaim sales tax credits.

Required Documents

When submitting the DR95A form, certain documents may be required to support your claim. These typically include:

- Proof of purchase, such as receipts or invoices.

- Documentation of the repossession, including any legal notices or agreements.

- Previous sales tax payment records related to the repossessed property.

Having these documents ready can expedite the processing of your claim.

Form Submission Methods

The DR95A form can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online submission through the Florida Department of Revenue's official website.

- Mailing the completed form to the appropriate tax office.

- In-person delivery at designated tax offices across Florida.

Choosing the right submission method can help ensure timely processing of your claim.

Quick guide on how to complete dr95a form

Effortlessly Prepare Dr95a Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Dr95a Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Dr95a Form with Ease

- Locate Dr95a Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Dr95a Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr95a form

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What are Florida credits claimed property?

Florida credits claimed property are financial credits available to property owners in Florida who have made certain improvements or claims on their properties. These credits can help reduce property taxes, making property ownership more affordable over time. Understanding how to claim these credits can lead to signNow savings.

-

How can airSlate SignNow help with claiming Florida credits?

airSlate SignNow offers a streamlined eSigning process that simplifies the documentation required for claiming Florida credits on property. With our platform, you can securely send and sign necessary documents electronically, ensuring faster processing and submission. This efficiency is particularly beneficial for property owners looking to access credits quickly.

-

Are there any fees associated with using airSlate SignNow for Florida credits claimed property?

airSlate SignNow provides cost-effective pricing plans tailored to various business sizes and needs. Most plans include comprehensive features that facilitate the eSigning of documents related to Florida credits claimed property without hidden fees. Check our pricing page for detailed information on our subscription options.

-

What features does airSlate SignNow offer for Florida credits claimed property documentation?

airSlate SignNow includes features such as customizable templates, automated workflows, and mobile accessibility, making it easy to manage documents required for Florida credits claimed property. These features enhance productivity and ensure compliance with state regulations regarding property credits. Additionally, our platform has audit trails for security and verification.

-

Can I integrate airSlate SignNow with other applications for managing Florida credits claimed property?

Yes, airSlate SignNow offers seamless integrations with a variety of applications that can assist in managing workflows related to Florida credits claimed property. Whether you use CRM systems, document management tools, or financial software, our platform can connect easily to streamline your processes. This integration capability enhances efficiency and effectiveness.

-

What are the benefits of using airSlate SignNow for property owners in Florida?

Using airSlate SignNow allows Florida property owners to manage their documentation for credits effectively and securely. The platform reduces the time needed to process paperwork, which can lead to quicker access to Florida credits claimed property. Additionally, its user-friendly interface makes it easy for owners to navigate the claims process.

-

Is airSlate SignNow compliant with Florida regulations regarding property credits?

Absolutely! airSlate SignNow is designed to comply with all necessary Florida regulations regarding documentation for property credits. Our eSigning solutions meet legal standards, ensuring that your electronically signed documents for Florida credits claimed property hold up in court, should the need arise.

Get more for Dr95a Form

Find out other Dr95a Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online