New York 1099 Unemployment Get Form

What is the New York 1099 Unemployment?

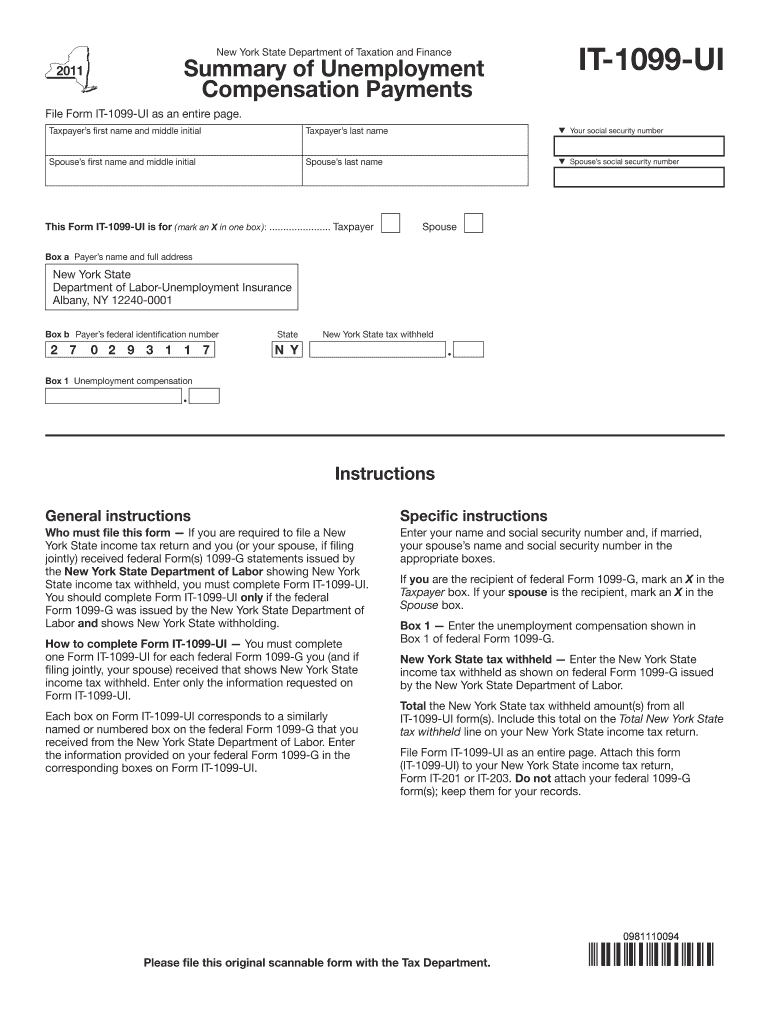

The New York 1099 unemployment form, also known as the NY 1099 UI, is a tax document issued to individuals who have received unemployment benefits in New York State. This form reports the total amount of unemployment compensation received during the tax year. It is essential for recipients to report this income accurately when filing their federal and state tax returns. The form includes important details such as the recipient's Social Security number, the total benefits paid, and any applicable state taxes withheld.

How to Obtain the New York 1099 Unemployment

To obtain the New York 1099 unemployment form, individuals can access it through the New York State Department of Labor's website or their online unemployment account. Typically, the form is made available by the end of January for the previous tax year. If you do not receive your form by this time, it is advisable to contact the New York State Department of Labor for assistance. Additionally, individuals can check their unemployment benefits account to download a copy of the form directly.

Steps to Complete the New York 1099 Unemployment

Completing the New York 1099 unemployment form involves several key steps:

- Gather necessary information, including your Social Security number and details of unemployment benefits received.

- Review the form for accuracy, ensuring that all amounts reported match your records.

- Complete any required sections, such as tax withheld, if applicable.

- Sign and date the form, if required, to validate the information provided.

- Keep a copy of the completed form for your records and for filing your tax return.

Legal Use of the New York 1099 Unemployment

The New York 1099 unemployment form is legally binding and must be filled out accurately to comply with tax regulations. Misreporting or failing to report unemployment benefits can lead to penalties from the IRS or the state tax authority. It is crucial to ensure that the information on the form is truthful and complete, as it serves as an official record of the income received during the year.

Filing Deadlines / Important Dates

Filing deadlines for the New York 1099 unemployment form align with the federal tax filing deadlines. Generally, individuals must file their tax returns by April 15 of the following year. It is important to keep track of any changes in deadlines, especially if they fall on a weekend or holiday. The New York State Department of Labor typically provides updates regarding any changes to filing dates or requirements.

Eligibility Criteria

To qualify for unemployment benefits in New York and subsequently receive a 1099 unemployment form, individuals must meet specific eligibility criteria. This includes having a sufficient work history, being unemployed through no fault of their own, and actively seeking new employment. Additionally, individuals must meet the income threshold set by the state to qualify for benefits. Understanding these criteria is essential for anyone applying for unemployment assistance.

Quick guide on how to complete new york 1099 unemployment get

Finalize New York 1099 Unemployment Get effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documentation, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, edit, and electronically sign your documents quickly without delays. Manage New York 1099 Unemployment Get on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The most efficient method to edit and electronically sign New York 1099 Unemployment Get with ease

- Obtain New York 1099 Unemployment Get and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign New York 1099 Unemployment Get to guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york 1099 unemployment get

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for New York 1099 unemployment documents?

airSlate SignNow provides an efficient platform for managing New York 1099 unemployment forms. With our solution, you can easily create, send, and eSign documents related to employment benefits, ensuring compliance with state requirements.

-

How does airSlate SignNow streamline the New York 1099 unemployment filing process?

Our platform simplifies the New York 1099 unemployment filing process with user-friendly features like templates and workflows. You can automate notifications and reminders to ensure that your documents are filed on time, reducing the risk of errors.

-

What are the pricing options for businesses handling New York 1099 unemployment forms?

airSlate SignNow offers competitive pricing plans designed for businesses dealing with New York 1099 unemployment documents. We provide flexible subscription options that cater to different needs, ensuring that you only pay for what you use.

-

Can I integrate airSlate SignNow with other tools for managing New York 1099 unemployment documentation?

Yes, airSlate SignNow can be seamlessly integrated with various applications to enhance your workflow. Common integrations include accounting software and document management systems, which facilitate easier handling of New York 1099 unemployment forms.

-

What benefits does airSlate SignNow provide for users dealing with New York 1099 unemployment?

Using airSlate SignNow for New York 1099 unemployment documents offers numerous benefits, including increased efficiency and reduced paperwork. Our eSigning capabilities also speed up document turnaround, helping you focus on what matters most.

-

Is airSlate SignNow compliant with regulations concerning New York 1099 unemployment?

Absolutely, airSlate SignNow ensures compliance with all relevant regulations regarding New York 1099 unemployment documents. Our solution is designed to meet state and federal guidelines, protecting your business from potential legal issues.

-

How secure is the airSlate SignNow platform for handling New York 1099 unemployment forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like New York 1099 unemployment forms. We employ advanced encryption and authentication measures to ensure that your data is protected and remains confidential.

Get more for New York 1099 Unemployment Get

Find out other New York 1099 Unemployment Get

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast