Ac 946 Form

What is the AC 946?

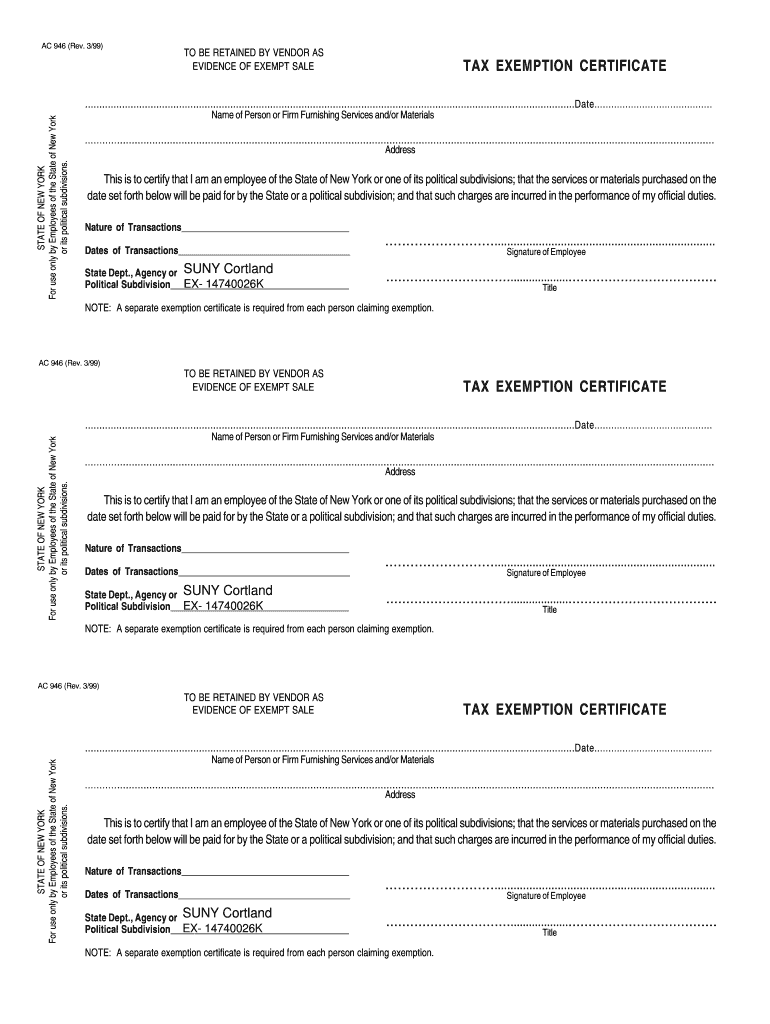

The AC 946, also known as the AC 946 exemption certificate, is a vital document used primarily in New York to claim certain tax exemptions. This form is often utilized by businesses and individuals to certify their eligibility for tax benefits, particularly in relation to sales tax. By submitting the AC 946, taxpayers can demonstrate their entitlement to exemptions that can lead to significant savings on purchases. Understanding the purpose and implications of this form is essential for anyone looking to navigate the complexities of tax regulations effectively.

How to Use the AC 946

Using the AC 946 involves a straightforward process that requires careful attention to detail. First, ensure that you qualify for the exemption by reviewing the eligibility criteria associated with the form. Once confirmed, you can obtain the AC 946 from the appropriate state resources. After filling out the necessary information, including your details and the specific exemption being claimed, the form must be submitted to the relevant tax authority. It is important to retain a copy for your records, as this can be crucial for future reference or audits.

Steps to Complete the AC 946

Completing the AC 946 involves several key steps to ensure accuracy and compliance. Start by downloading the form from the New York State Department of Taxation and Finance website. Next, fill in your personal information, including your name, address, and taxpayer identification number. Specify the type of exemption you are claiming and provide any additional details required. After reviewing the form for completeness and accuracy, sign and date it. Finally, submit the completed form to the appropriate agency, either electronically or by mail, depending on the submission methods available.

Legal Use of the AC 946

The AC 946 must be used in accordance with specific legal guidelines to ensure its validity. This form is legally binding when filled out correctly and submitted to the appropriate tax authority. It is crucial to understand that misuse or fraudulent claims can lead to penalties, including fines or legal action. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding eligibility or the completion of the form. Adhering to the legal requirements associated with the AC 946 helps protect taxpayers from potential issues with compliance.

Eligibility Criteria

To qualify for the AC 946 exemption, individuals and businesses must meet specific eligibility criteria outlined by the New York State Department of Taxation and Finance. Generally, the exemptions apply to certain types of purchases, such as those made for resale or for use in manufacturing. Additionally, the applicant must be a registered vendor or possess a valid tax identification number. It is essential to review the detailed guidelines provided by the state to ensure that all criteria are met before submitting the form.

Required Documents

When completing the AC 946, certain documents may be required to support your claim for exemption. These typically include proof of your business status, such as a sales tax certificate or a business license. Depending on the type of exemption being claimed, additional documentation may be necessary, such as invoices or receipts related to the purchases. Ensuring that all required documents are gathered and submitted alongside the AC 946 can help facilitate a smoother review process by tax authorities.

Form Submission Methods

The AC 946 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include online filing through the New York State Department of Taxation and Finance portal, mailing a physical copy of the form, or submitting it in person at designated tax offices. Each method has its own advantages, such as speed and convenience, so it is advisable to choose the one that best fits your needs while ensuring compliance with submission guidelines.

Quick guide on how to complete ac 946

Generate Ac 946 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, as you can easily access the right form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Ac 946 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Ac 946 with ease

- Find Ac 946 and then click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Complete button to save your modifications.

- Choose how you wish to share your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ac 946 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ac 946

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 946 exemption and how does it affect document signing?

The 946 exemption refers to specific circumstances under which businesses can benefit from reduced compliance regulations when eSigning documents. Understanding the 946 exemption is crucial for businesses seeking to streamline their document processes while maintaining legality. airSlate SignNow supports businesses in navigating these exemptions effectively.

-

How does airSlate SignNow support businesses utilizing the 946 exemption?

airSlate SignNow provides features that help businesses leverage the 946 exemption effectively. Our platform includes compliance checks and documentation management tools tailored for organizations benefiting from this exemption. This ensures that your eSigned documents remain valid and enforceable under applicable laws.

-

Is airSlate SignNow affordable for small businesses looking to benefit from the 946 exemption?

Yes, airSlate SignNow offers cost-effective pricing plans ideal for small businesses aiming to utilize the 946 exemption. We provide flexible subscription options to meet diverse budget needs while ensuring access to essential features that support compliance and efficient document signing. Optimize your costs while maximizing your benefits with the 946 exemption.

-

What features of airSlate SignNow are most beneficial for managing 946 exemption documentation?

Key features of airSlate SignNow for managing 946 exemption documentation include automated workflows, customizable templates, and comprehensive audit trails. These tools simplify the process of sending, signing, and storing documents while ensuring compliance with the 946 exemption guidelines. Additionally, integration capabilities with other platforms enhance functionality.

-

Can airSlate SignNow integrate with other software to help with the 946 exemption?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage documents while adhering to the 946 exemption. This interoperability helps streamline workflows, consolidates data management, and enhances overall efficiency in document handling, making it easier to maintain compliance.

-

What benefits does the 946 exemption provide to businesses using airSlate SignNow?

The 946 exemption offers businesses reduced regulatory burdens while ensuring efficient document signing and management. With airSlate SignNow, companies can take advantage of expedited processes, improved compliance, and cost savings. Leveraging this exemption enhances overall productivity, giving businesses a competitive edge.

-

Are there any specific compliance concerns related to the 946 exemption when using airSlate SignNow?

While the 946 exemption simplifies compliance for many businesses, it is essential to understand the relevant regulations specific to your industry. airSlate SignNow includes features designed to assist users in maintaining compliance with eSignature laws and highlight vital aspects of the 946 exemption. Always consult with legal professionals to ensure full compliance.

Get more for Ac 946

Find out other Ac 946

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile