Notice of Sale of Tangible Personal Property for Delinquent Taxes 2016-2026

What is the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

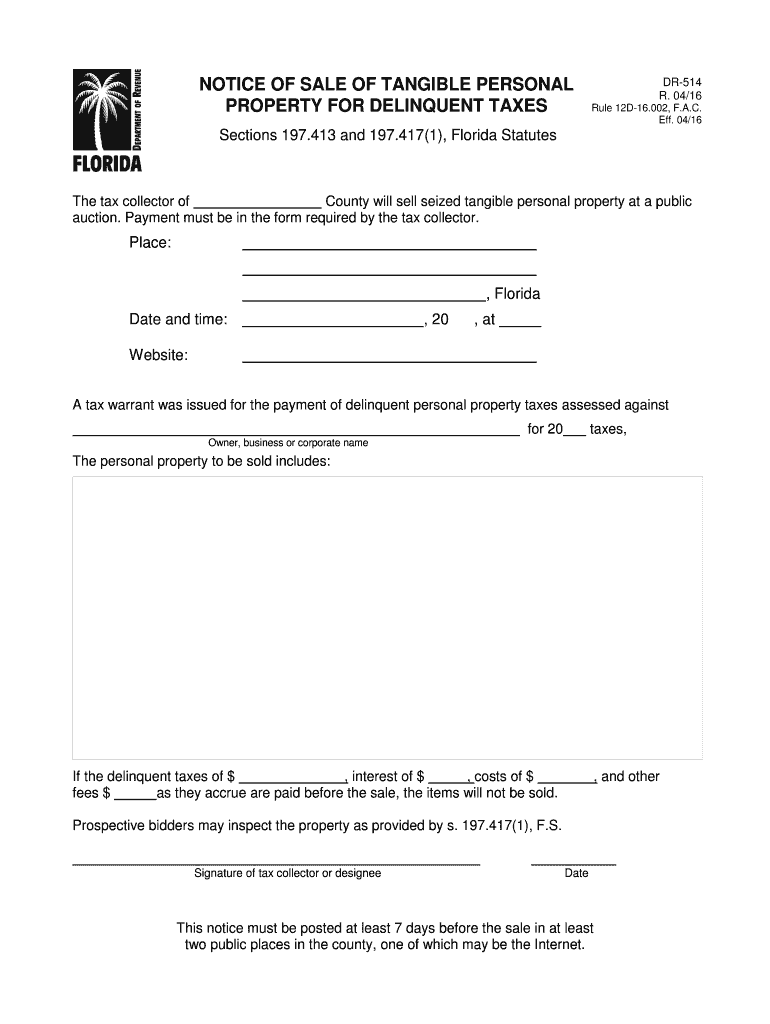

The Notice Of Sale Of Tangible Personal Property For Delinquent Taxes is a legal document that notifies individuals or entities about the impending sale of personal property due to unpaid taxes. This form is typically issued by local government authorities when taxpayers fail to meet their tax obligations. It serves as a formal warning that the property may be sold at auction to recover the owed amount. Understanding this notice is crucial for property owners to take appropriate action and avoid losing their assets.

Steps to complete the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

Completing the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information, including the property description, tax details, and the owner's information. Next, fill out the form accurately, ensuring that all sections are completed. It is important to review the document for errors before submission. Once completed, the notice must be filed with the appropriate local authority, and copies should be sent to the relevant parties involved.

Key elements of the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

Several key elements must be included in the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes to ensure its validity. These elements include:

- Property Description: A clear and detailed description of the tangible personal property being sold.

- Tax Amount: The total amount of delinquent taxes owed.

- Owner Information: The name and address of the property owner.

- Sale Date: The scheduled date and time for the auction.

- Legal Authority: The name of the governmental body issuing the notice.

Including these elements helps ensure that the notice is legally binding and provides all necessary information to the concerned parties.

Legal use of the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

The legal use of the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes is governed by state and local laws. This document must comply with specific regulations to be considered valid in court. It is essential that the notice is properly served to the property owner, allowing them the opportunity to respond or rectify the tax delinquency before the sale occurs. Failure to adhere to these legal requirements may result in the notice being deemed invalid, which can complicate the recovery of owed taxes.

How to use the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

Using the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes effectively requires understanding its purpose and the steps involved in the process. Property owners should first review the notice carefully to confirm the details are accurate. If the information is correct, the owner may need to take action, such as paying the delinquent taxes or seeking legal advice. Additionally, the notice serves as a reminder to maintain accurate tax records to prevent future issues related to property taxes.

State-specific rules for the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

State-specific rules regarding the Notice Of Sale Of Tangible Personal Property For Delinquent Taxes can vary significantly. Each state may have different requirements for how the notice must be formatted, the timeline for issuing the notice, and the procedures for conducting the sale. It is important for individuals to consult their local tax authority or legal counsel to understand the specific regulations that apply in their jurisdiction. Being aware of these rules ensures compliance and protects the rights of property owners.

Quick guide on how to complete notice of sale of tangible personal property for delinquent taxes

Complete Notice Of Sale Of Tangible Personal Property For Delinquent Taxes effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Notice Of Sale Of Tangible Personal Property For Delinquent Taxes on any device using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

The easiest way to modify and eSign Notice Of Sale Of Tangible Personal Property For Delinquent Taxes seamlessly

- Obtain Notice Of Sale Of Tangible Personal Property For Delinquent Taxes and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Notice Of Sale Of Tangible Personal Property For Delinquent Taxes to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice of sale of tangible personal property for delinquent taxes

Create this form in 5 minutes!

How to create an eSignature for the notice of sale of tangible personal property for delinquent taxes

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is a Notice Of Sale Of Tangible Personal Property For Delinquent Taxes?

A Notice Of Sale Of Tangible Personal Property For Delinquent Taxes is a legal document informing property owners about the sale of their assets due to unpaid taxes. This notice serves as a formal warning that the property may be sold if delinquent taxes remain unpaid. Understanding this process is crucial for property owners to avoid potential loss of assets.

-

How can airSlate SignNow assist with generating a Notice Of Sale Of Tangible Personal Property For Delinquent Taxes?

airSlate SignNow provides an easy-to-use platform that enables businesses to create and send a Notice Of Sale Of Tangible Personal Property For Delinquent Taxes electronically. With customizable templates and intuitive eSigning features, you can efficiently prepare legal documents without the hassle of paper-based processes. This streamlines your operations and ensures compliance.

-

What are the pricing options for using airSlate SignNow for Notices Of Sale?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including options for individuals, small businesses, and enterprises. Each plan allows you to create and manage Notices Of Sale Of Tangible Personal Property For Delinquent Taxes and other important documents. You can choose a plan that aligns with your volume of transactions and feature requirements.

-

Are there integrations available for airSlate SignNow that enhance document management?

Yes, airSlate SignNow integrates seamlessly with various popular applications, enhancing your document management processes. By connecting with tools like Google Drive, Dropbox, and CRM systems, you can easily store and access your Notices Of Sale Of Tangible Personal Property For Delinquent Taxes alongside your other important documents. This integration supports a more efficient workflow.

-

What features make airSlate SignNow a beneficial choice for handling Notices Of Sale?

airSlate SignNow offers features such as customizable templates, advanced eSignature capabilities, and secure document storage. These tools make it easier to prepare and send your Notice Of Sale Of Tangible Personal Property For Delinquent Taxes while ensuring that all documents meet legal standards. Additionally, the platform is user-friendly, allowing for a smooth experience even for first-time users.

-

How does airSlate SignNow ensure the security of my Notice Of Sale Of Tangible Personal Property For Delinquent Taxes?

Security is paramount at airSlate SignNow, which utilizes state-of-the-art encryption and secure data storage to protect your documents. Each Notice Of Sale Of Tangible Personal Property For Delinquent Taxes sent through our platform is safeguarded against unauthorized access. You can confidently manage sensitive information with compliance to industry regulations.

-

Can I track the status of my Notice Of Sale Of Tangible Personal Property For Delinquent Taxes?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your Notice Of Sale Of Tangible Personal Property For Delinquent Taxes in real-time. You'll receive notifications when documents are viewed or signed, ensuring you are always updated on the progress of your transactions. This transparency enhances communication with your clients or stakeholders.

Get more for Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

Find out other Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement