Employer Annual Reconciliation Form 541 2019-2026

What is the Employer Annual Reconciliation Form 541

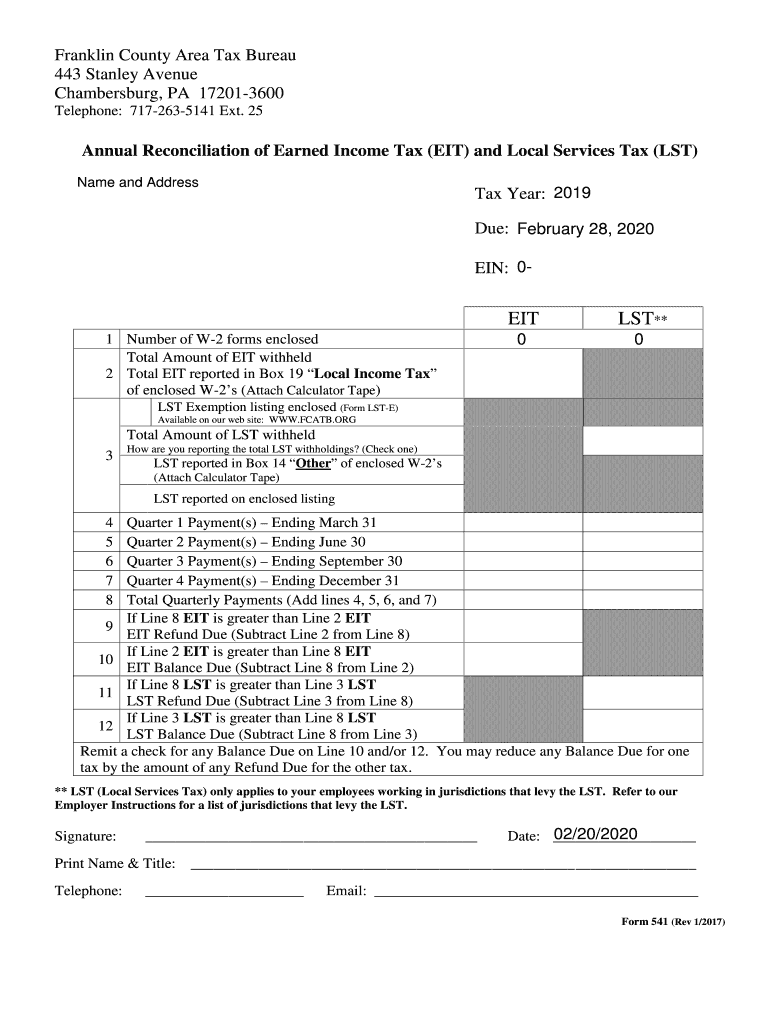

The Employer Annual Reconciliation Form 541 is a crucial document used by employers in Franklin County to report wages, taxes withheld, and other relevant information for the year. This form serves as a summary of all employee earnings and tax withholdings, ensuring compliance with local tax regulations. It is essential for accurate reporting to the Franklin County Area Tax Bureau, allowing for proper assessment of tax liabilities and ensuring that employees receive appropriate credit for taxes paid.

Steps to complete the Employer Annual Reconciliation Form 541

Completing the Employer Annual Reconciliation Form 541 involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the tax year, including employee wages and tax withholdings. Next, accurately fill out the form by entering total wages, the amount of local taxes withheld, and any other required information. It is important to double-check all entries for accuracy. Once completed, the form should be signed and dated by an authorized representative of the business. Finally, submit the form to the Franklin County Area Tax Bureau by the designated deadline.

Legal use of the Employer Annual Reconciliation Form 541

The legal use of the Employer Annual Reconciliation Form 541 is governed by local tax laws and regulations. This form must be completed accurately to ensure that the information reported is valid and can be used for tax assessment purposes. Failure to comply with the requirements may result in penalties or fines. Additionally, the form must be submitted by the established deadlines to avoid any legal repercussions. Using a trusted electronic signature solution can enhance the legal standing of the completed form, ensuring that it meets all necessary legal requirements.

Form Submission Methods

The Employer Annual Reconciliation Form 541 can be submitted through various methods to accommodate different preferences. Employers may choose to file the form online, which offers a convenient and efficient way to ensure timely submission. Alternatively, the form can be mailed directly to the Franklin County Area Tax Bureau. For those who prefer in-person interactions, submitting the form at the local tax office is also an option. Each method has its own advantages, and employers should choose the one that best fits their needs.

Filing Deadlines / Important Dates

Timely submission of the Employer Annual Reconciliation Form 541 is critical to avoid penalties. The specific filing deadline is typically set for January 31 of the year following the tax year being reported. Employers should be aware of any changes to deadlines announced by the Franklin County Area Tax Bureau. It is advisable to mark important dates on a calendar and set reminders to ensure that the form is submitted on time, thus maintaining compliance with local tax regulations.

Key elements of the Employer Annual Reconciliation Form 541

Several key elements must be included in the Employer Annual Reconciliation Form 541 to ensure it is complete and accurate. These elements include total wages paid to employees, the total amount of local taxes withheld, and the employer's identification information. Additionally, the form requires the signature of an authorized representative, affirming that the information provided is true and accurate. Including all necessary details helps prevent delays in processing and ensures compliance with tax laws.

How to obtain the Employer Annual Reconciliation Form 541

Employers can obtain the Employer Annual Reconciliation Form 541 through several channels. The form is typically available on the official website of the Franklin County Area Tax Bureau, where it can be downloaded in a printable format. Additionally, physical copies may be available at local tax offices or through designated distribution points. Employers should ensure they are using the most current version of the form to comply with any updates or changes in regulations.

Quick guide on how to complete employer annual reconciliation form 541

Complete Employer Annual Reconciliation Form 541 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files swiftly without delays. Manage Employer Annual Reconciliation Form 541 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Employer Annual Reconciliation Form 541 with ease

- Locate Employer Annual Reconciliation Form 541 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Employer Annual Reconciliation Form 541 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employer annual reconciliation form 541

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the annual lst pricing for airSlate SignNow?

The annual lst pricing for airSlate SignNow offers signNow savings compared to monthly plans. By opting for an annual subscription, you gain access to all essential features while managing your expenses more effectively. Consider the annual lst as a cost-effective solution for your document signing needs.

-

What features are included in the annual lst plan?

The annual lst plan includes a full range of features such as unlimited eSignatures, document templates, and advanced security options. Additionally, you can enjoy collaboration tools and integration with third-party applications. This comprehensive feature set makes the annual lst a powerful choice for any business.

-

How does the annual lst benefit my business?

Choosing the annual lst can signNowly streamline your document management process, boosting efficiency. With features designed to simplify eSigning and document flow, businesses can save time and reduce operational costs. The annual lst also supports compliance, ensuring that all signatories are appropriately verified.

-

Can I integrate airSlate SignNow with other software through the annual lst?

Yes, the annual lst of airSlate SignNow allows seamless integration with various software applications, enhancing your workflow. This capability means you can connect your existing tools, such as CRM and project management software, to optimize your document signing processes. Integrations included in the annual lst will support your broader business objectives.

-

Is there a free trial available for the annual lst plan?

While airSlate SignNow primarily offers subscriptions through the annual lst, potential customers can request a free trial to explore the features and benefits. This trial is a great way to assess whether the annual lst meets your needs without committing financially upfront. Take advantage of this opportunity to see how the annual lst can improve your document workflow.

-

How secure is the annual lst for document signing?

The annual lst of airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect your sensitive documents. It ensures that all data shared through the platform is secure and compliant with industry regulations. Investing in the annual lst means your document signing will be handled safely and efficiently.

-

What support is available for annual lst subscribers?

Subscribers of the annual lst can access comprehensive customer support, including live chat, email assistance, and a knowledge base. This level of support ensures that any questions or issues are promptly addressed, allowing for uninterrupted usage of airSlate SignNow. The annual lst includes this premium support to enhance your experience.

Get more for Employer Annual Reconciliation Form 541

Find out other Employer Annual Reconciliation Form 541

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors